The new Ericsson Mobility Report is here! This highly regarded and oft-cited annual analysis quantifies and forecasts a myriad aspects of the global wireless business. The June 2022 issue presents 2021 baseline data with an outlook to 2027.

Two major variables drive the need for wireless infrastructure: coverage and capacity. These variables are a function of 1) the number of devices connecting to the network (that’s the coverage part), and 2) the amount of data traffic that each device uses (the capacity part). The product of these two variables is the total traffic demand on the network. This figure tells network planners how, where and when they must expand and upgrade the network to meet that demand.

By extension, that figure determines the type and quantity of infrastructure needed to carry and route that volume of traffic. And it affects everything – RAN (radios and antennas), towers, fiber, Core equipment (servers and routers) in data centers and at the edge, small cells, power, operations support systems and billing systems.

Here’s where the Report proves its worth.

One of the global key figure categories is mobile subscriptions, which indicates the number of devices attached to the network. Again, that’s the coverage part. Worldwide mobile subscriptions of all types are expected to grow from 8.2 billion in 2021, to about 9.1 billion by 2027, at a 2 percent CAGR. Below that top line are a lot of moving parts, however.

From an infrastructure perspective, mobile subscriptions are broken out by the different air interface technologies. For instance, 2G/3G mobile subscriptions tallied 2.7 billion in 2021 but will decline at a negative 13 percent CAGR to 1.2 billion by 2027. 4G LTE mobile subscriptions are on the decline as well but at a slower rate. From 4.9 billion in 2021, 4G LTE subscriptions will drop to about 3.5 billion by 2027, at a negative 6 percent CAGR.

The uptake in 5G mobile subscriptions will be at a much faster pace because of starting from a small base. 5G mobile subscriptions are projected to grow at a 41 percent CAGR from 550 million in 2021, to nearly 4.4 billion by 2027. 5G will account for 48 percent of worldwide mobile subscriptions by 2027.

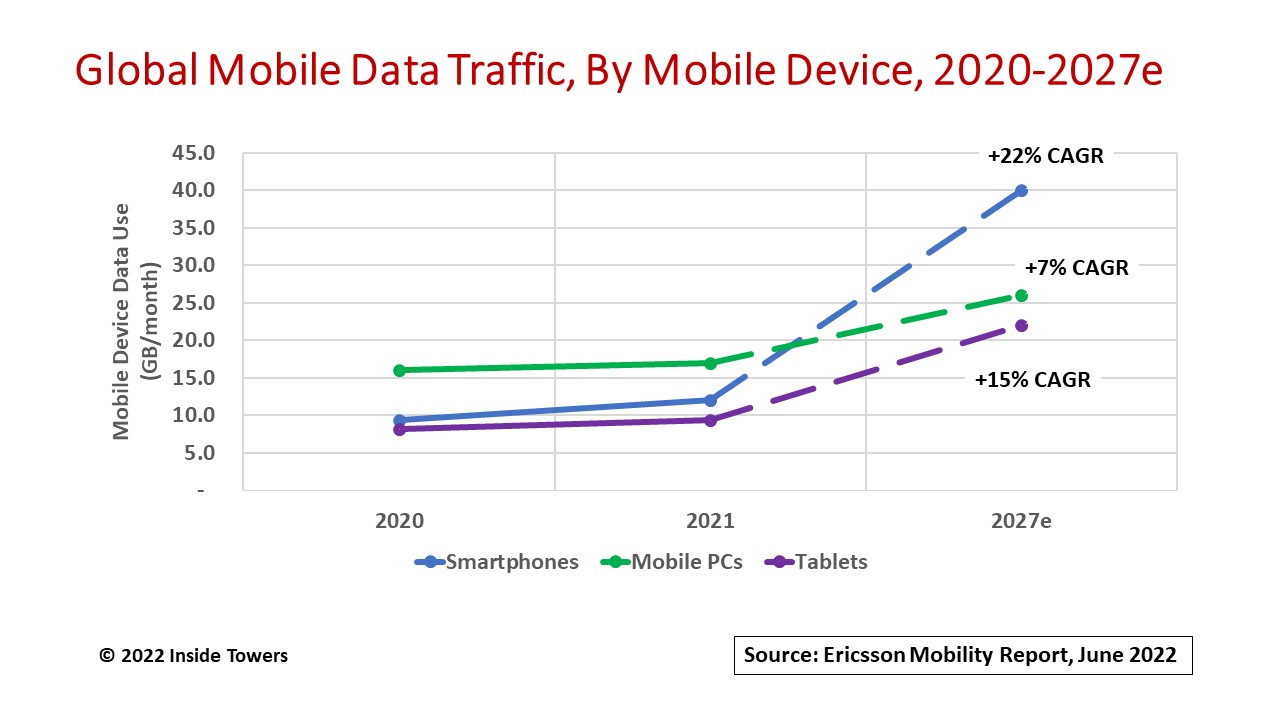

The capacity part has subsets as well. By type of the device, personal computers and laptops with mobile connections used 17 gigabits per month in 2021. That figure is projected to grow to 26 Gb per month by 2027, at a 7 percent CAGR. Use of tablets is expected to more than double at a 15 percent CAGR from 9.5 Gb per month in 2021, to 22 GB per month in 2027.

Not surprisingly, smartphone use will grow dramatically from 12 Gb per month in 2021, to 40 Gb per month in 2027, at a 22 percent CAGR. Clearly, we all are using our smartphones every day for text and video communications, consuming social media and streaming services, checking our health, doing our banking, and more. Plus, smartphones are getting smarter, letting us do even more while on the go.

Multiplying mobile subscriptions by mobile data usage per device determines the full load on the network. Total worldwide mobile data traffic will grow from 67 exabytes per month in 2021, to 282 Eb per month by 2027, at a 27 CAGR. Adding prospective fixed wireless access growth shows the total mobile network traffic reaching 368 Eb per month by 2027, representing a 29 percent CAGR from 2021.

All of this means that mobile network operators cannot slow down their capital investments in their networks. We estimate that the U.S. wireless capex will jump by 25 percent in 2022, to over $45 billion then settle down to $30-35 billion a year over the next 3-4 years as the MNOs step up to meet that escalating traffic demand.

By John Celentano, Inside Towers Business Editor

Reader Interactions