Africa is an attractive market for independent tower operators for several reasons. First, there is a big and growing demand for wireless communications. The population of sub-Saharan Africa is big, estimated by the UN at around 1.2 billion people, growing at 2-3 percent a year. Yet, wireless penetration is only around 25 percent, according to recent MNO subscriber tallies.

Second, post-pandemic, mobile connectivity is becoming increasingly important for personal, commercial, and public safety communications, especially in rural areas outside the major cities where wireline networks do not reach. Moreover, smartphone usage proportionally is still low but is growing rapidly with the demand for digital services such as mobile financial transactions. For instance, Vodacom M-pesa and Airtel Mobile Money financial services generate billions of wireless transactions in micro-loans and money transfers each year. For the quarter ending September 30, Africa’s largest multinational mobile network operators – Airtel, MTN, and Vodacom – all showed year-over-year service revenue growth in mid-single to low double-digit percentage range.

Third, MNOs are jettisoning their passive infrastructure to focus on expanding and upgrading their networks to 4G and 5G to handle the increased voice and data traffic demand.

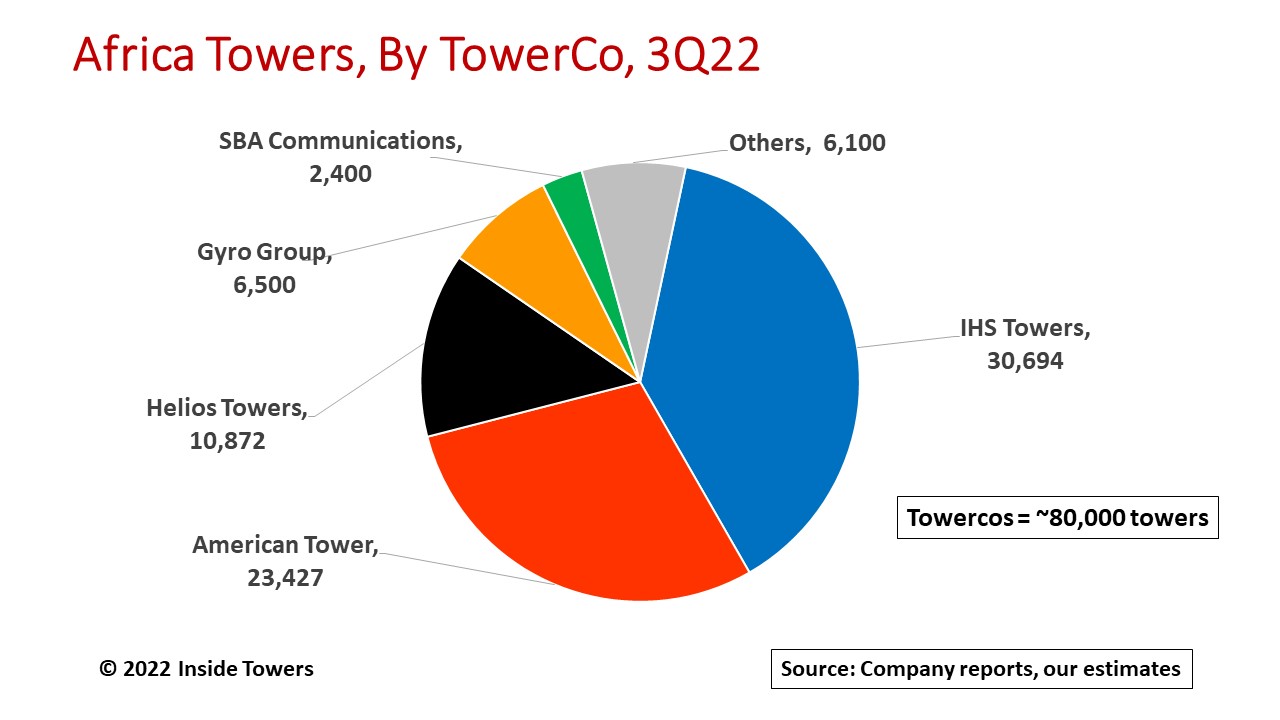

As a consequence, the independent tower business has grown dramatically in Africa in just the past five years and the outlook is positive. We estimate that there are around 80,000 active towers in sub-Saharan Africa today. Even with modest economic growth for the region projected by the IMF, these markets will see increased investment in wireless networks and more infrastructure offloads. Tower companies expect their African portfolio to grow significantly in the next five years.

IHS Towers, the operating unit of London-headquartered IHS Holdings (NYSE: IHS), is the leading towerco in Africa. At the end of 3Q22, the company had nearly 31,000 towers in six African countries (Nigeria, Côte d’Ivoire, Cameroon, Zambia, Rwanda, South Africa).

American Tower (NYSE: AMT), the world’s largest independent towerco, in 2019 acquired Eaton Towers with 5,700 towers in five African countries. AMT, the second largest towerco in Africa serving the big three MNOs, has continued expanding through acquisitions and an active built-to-suit program, including 1,940 towers built in the past year alone, and now has over 23,000 towers in seven countries. Its largest holdings are in Nigeria and Ghana.

Helios Towers (OTC: HTWSF), also London-based, the third largest towerco on the continent, has operations in eight countries, predominantly in Tanzania and DRC. In its 3Q22 results, the company reported that total sites increased by 2,107 year-over-year to 10,872 sites, reflecting 894 new builds and the acquisition of 1,213 sites in Malawi and Madagascar.

Gyro Group, based outside Johannesburg, manages 6,500 towers for parent company Telkom SA SOC Ltd. U.S.-based SBA Communications (NASDAQ: SBAC) operates 1,000 towers in South Africa and in January, acquired 1,400 towers from Airtel Tanzania, Inside Towers reported.

Smaller African towercos include Africa Mobile Networks with roughly 2,000 towers in 10 countries, Pan African Towers with 1,300 towers mainly in Nigeria and Ghana, Infratel with 1,200 sites in Zambia and TowerCo of Madagascar with 1,500 towers.

The tower business in Africa has considerable upside. African MNOs still own nearly 60 percent of Africa’s telecom towers. Comparatively, Inside Towers estimates that independent towercos own over 90 percent of towers in the U.S. With growing demand for internet coverage, African MNOs are focusing on their core wireless and digital services. So towercos in Africa will see growth through both organic tower builds and acquisitions.

Moreover, African towercos generate revenue by offering power-as-a-service. The electric grid in many countries is either not reliable or non-existent in rural areas. Towercos are utilizing more renewable energy sources like solar and reducing dependency on diesel generators, Inside Towers reported. These power costs are passed through to the MNOs.

By John Celentano, Inside Towers Business Editor

Reader Interactions