American Tower (NYSE: AMT) is showing financial and asset growth across its global footprint. More importantly, the company is upbeat about its future.

AMT reported strong results for the nine months through the end of 3Q20, showing revenue increases, improving margins and solid underlying global growth.

Consolidated tenant revenues came in at nearly $5.9 billion, up 5 percent from the same period in 2019. Adjusted EBITDA grew over 7 percent to $3.8 billion from $3.6 billion a year earlier. Consolidated AFFO reached $2.9 billion, up 7 percent over $2.7 billion at the end of 3Q19.

Several factors are driving AMT’s growth and positive outlook.

Certainly, the biggest development was the strategic Master Lease Agreement inked with T-Mobile (NASDAQ: TMUS) on September 15. The MLA includes annual rent escalators of 3.0-3.5 percent as well as incremental user fees that allow TMUS to place equipment on AMT towers up to specified tower loadings without AMT being involved. The user fee escalator will be adjusted annually and will decline over the MLA term as TMUS reaches its network build milestones.

AMT says the TMUS MLA creates a backlog of $23 billion committed contractual revenues over the 15-year term. With such agreements, AMT estimates that it garners about 50 percent of the U.S. tower leasing business.

AMT expanded its tower global tower portfolio even as some of its key international markets such as Latin America, Africa and India were dealing with the impact of COVID-19 and weak economies. In 3Q20, AMT’s global tower base grew to 179,391 with 589 net additions.

That net figure comprises a record 1,455 new tower builds in the quarter with 979 new towers in India, 467 in Africa and Latin America and single digit builds in the U.S, and Europe. AMT also acquired 305 towers including 202 in Europe, 91 in Latin America and 12 in the U.S. At the same time, the company sold or decommissioned a total of 1,171 towers, mostly in India.

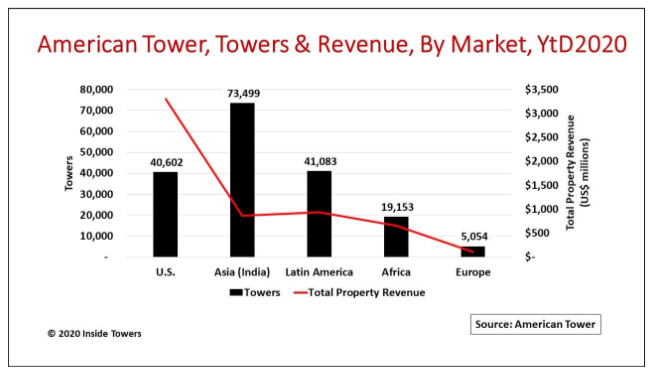

It is important to note that AMT derives 56 percent of its total property revenues in the U.S. even though the U.S. accounts for 40,602 towers, just 23 percent of its global tower count.

By contrast, India and Latin America together tally 114,552 towers or 64 percent of the portfolio but generate only 31 percent of property revenues. Africa and Europe together make up the 13-14 percent balance of revenues and towers.

This wide variance between the U.S. and international markets stems from different occupancy and rental rates. AMT’s U.S. tower occupancy ranges 1.8-2.4 tenants per tower at monthly rents of $1,800-2,700 per tenant. These figures are significantly higher than in international markets where occupancy ranges 1.4-1.8 tenants per tower and monthly tenant rents of $1,200-1,800.

AMT believes it is well-positioned for long term growth. It sees activity among its U.S. carrier customers accelerating into 2021 as they build out 5G in multiple frequency bands especially mid-band 2.5 GHz where TMUS is strong. AMT expects new activity with upcoming C-band and 3.5 GHz CBRS deployments and DISH Network (NasdaqGS: DISH) build activity in 2H21.

AMT also sees demand for its tower infrastructure in international markets as carriers in those markets improve wireless connectivity for their customers, especially in countries where both wireline and electrical grid infrastructure are unreliable or lacking.

Despite its tower-only business model and like its peers, AMT is pursuing opportunities by expanding its core tower infrastructure platform into profitable new infrastructure offerings.

The company is testing and evaluating about two key expansion areas: edge computing, and power-as-a-service.

In the U.S., AMT has unveiled an edge data center that is a compact shelter placed at the base of a tower. This shelter houses servers for processing mobile data traffic at the tower site. AMT believes that such capabilities will be attractive to carriers and Enterprises alike for high-speed, low latency applications cost effectively using AMT’s infrastructure.

In international markets such as Africa and India, AMT is testing a power-as-a-service model at towers where the electrical grid is unreliable. The company is exploring use of cost-effective and energy-efficient solar power generation along with lithium-ion batteries as backup to replace widely used, fuel-consuming diesel generators.

Reader Interactions