Let’s keep it in context. Independent mobile virtual network operators (MVNOs) in the U.S. are not a direct competitive threat to their mobile network operator hosts. That said, MVNOs can still siphon off customers from MNO networks at a time when adding new customers means the MNOs must incent wireless users to switch from a competitor’s network.

Compare the numbers.

At the end of 3Q21, MNOs — including national carriers AT&T, T-Mobile, Verizon, and regional and rural wireless carriers led by UScellular — together served around 293 million postpaid and prepaid customers. Recognized MNO-branded prepaid services are AT&T’s Cricket Wireless, Metro by T-Mobile and Verizon’s recently acquired TracFone and its brands like StraightTalk Wireless.

Roughly 55 MVNOs serve an estimated 25-30 million subscribers. MVNOs do not have their own wireless infrastructure. Instead, they buy mobile voice and data services from MNOs at wholesale rates and resell these services along with branded cellphones at retail rates to consumers and small businesses. Some MVNOs use more than one MNO network.

MVNOs fill an important void in the wireless business by selling to the “value” segment comprising low-income or fixed-income subscribers. An example is Consumer Cellular with about 4 million subscribers across the country. Other MVNOs serve specific vertical or geographic markets or affiliations, such as AAA’s offering of Affinity Cellular to its members.

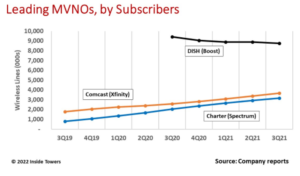

It’s important to watch the big MVNOs. DISH Network’s Boost Mobile is the largest MVNO with 8.4 million customers at the end of 3Q21. DISH acquired Boost from T-Mobile in 2020. DISH’s subscriber count has declined nearly two percent per quarter since acquiring Boost (see, DISH Still Finding Its (Wireless) Sea Legs). Nonetheless, Boost customers provide DISH with needed wireless revenues as DISH constructs its standalone 5G network. Boost uses both the T-Mobile and AT&T Mobility networks.

Similarly, the big cablecos, Comcast and Charter Communications, offer MVNO mobile services under their own brand names. Comcast’s Xfinity Mobile and Charter’s Spectrum Mobile both use the Verizon Wireless network. At the end of 3Q21, Comcast reported 3.7 million Xfinity customers and Charter had 3.2 million Spectrum customers. Over the past two years, Xfinity and Spectrum have grown at nearly 10 percent and 20 percent, per quarter, respectively.

Herein lies the quandary.

Most of this cableco MVNO growth has come from bundling their branded mobile services with their wired broadband services (internet, TV, voice). Comcast and Charter are getting their broadband customers who are also AT&T, Verizon, or T-Mobile customers to switch to the cableco’s mobile service.

This switching is recognized by the MNOs. At a recent investor conference, T-Mobile CEO Mike Sievert acknowledged that cable companies consistently are capturing about 10 percent of wireless gross adds each quarter.

This switching is disconcerting to the MNOs because the rate of new adds is slowing as the domestic wireless market nears saturation. So, losing 10 percent each quarter is significant. This means to add new customers, the MNOs must pirate subscribers from each other or figure out ways to retain their existing customers.

Longer term, DISH and the big cablecos could make a bigger dent in the MNO customer base and associated revenues as these operators develop their own wireless infrastructure.

Once DISH gets its 5G network up and running, it likely will migrate a portion of its Boost MVNO customers to 5G retail customers. At the same time, the major cablecos have acquired spectrum with the idea of building their own wireless networks. In FCC Auction 105, eight cable companies including Comcast, Charter, Cox, Mediacom and Cable One spent $1.2 billion for 3,218 3.5 GHz CBRS priority access licenses (PALs) in 1,100 counties covering their respective operating areas around the U.S. These cablecos collectively served over 75 million broadband subscribers at the end of 3Q21 with branded wireless penetration over 9 percent of that base.

The cablecos only will deploy wireless infrastructure in their cable operating footprints. However, this is sufficient to attract enough of their broadband subscribers to their proprietary wireless services through bundling. At that point, these customers no longer use the MNO network, and MNOs lose those customers and associated revenues.

How much and how fast this may happen remains to be seen.

By John Celentano, Inside Towers Business Editor

Reader Interactions