READER OPINION DISCLAIMER:

This section allows others to contribute their opinions. The content does not necessarily represent the views of, or endorsement by Inside Towers.

By Ken Schmidt, President of Steel in the Air Reprinted with permission from Feb. 21st blog

Implications: T, S, ZAYO, CCI, AIRO, COMM, DY, ERIC, NOK (Disclosure- author holds position in ZAYO)

Looks like T’s finally cutting over to small-cell investment as S continues to under invest.

Looks like T’s finally cutting over to small-cell investment as S continues to under invest.

Carrier capex budgets for 2017 and forecasts for 2018 aren’t out yet, but our checks indicate that AT&T, which has to-date been a relative holdout on small cells, is finally shifting investment share in this direction.

Back in June, T highlighted that 90% of its next-5-year macrocell infrastructure was already in place, but only 5-10% of the small cell infrastructure for this same period had been built.

Checks now show that T is beginning to reassign real estate department personnel to work on small cells. Furthermore, some subcontractors are reporting increased requests from AT&T to do site walks for small cells.

Notably, we are not yet seeing increased municipal permitting/leasing. Given 9-12 month lead times, this suggests that small cell ramps will occur toward the middle of 2017 with a likely acceleration into 2018.

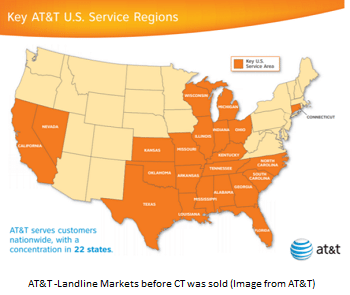

We anticipate that T will focus its small cell efforts in Wireline markets where the company already owns existing fiber and has access to Right-of-Ways and Franchise Agreements. T will best be able to control costs in these areas where it is already considered a wireline utility and has existing infrastructure in place. These markets include most of the Southeast and Midwest as well as a few markets in California.

Implications

We see this shift as an incremental positive for fiber providers and small cell operators like ZAYO, CCI and CSAL; although the effect is likely to be muted to the extent that their metro fiber overlaps with AT&T’s. It’s a likely positive for OEMs like AIRO and COMM that provide small cell equipment and antennas but don’t have exposure to the decline in macro cell equipment. Implications will likely be mixed for DY, NOK and ERIC. They should benefit from increased small cell work but are already seeing reduced capex allocated to macro cells.

Sprint Follow-up

Related to our past comments on Sprint, (see 10/26 – Sprint (S) still behind small cell 8-ball), we continue to see additional data points supporting our thesis.

Sprint confirmed during their last earnings call that last year’s Capex was lower than their previous guidance to the market by $2B ($2.3B actual vs $5B guidance). Sprint has been talking up its plans for years with relatively little to show for it, and recognition seems to be building throughout the marketplace, and the investor community, that the Mobilitie relationship has yielded far fewer small cells than were anticipated. Sprint is giving lip service to 2017 being a better year for permits and capex, but its hopes seem to be predicated on FCC leadership changes and possible rulemaking to remove impediments to small-cell deployment in right-of-ways. In fact, Mobilitie seems to have pinned a significant amount of hope on a Petition to the FCC for Relief.

We think Sprint’s capex will increase in 2017 off of an ultra-low 2016 number, but the service provider continues to struggle to deploy capex dollars. We wouldn’t be surprised to see major revisions to the strategy as well as Street expectations.

February 23, 2017

Looks like T’s finally cutting over to small-cell investment as S continues to under invest.

Looks like T’s finally cutting over to small-cell investment as S continues to under invest.