UPDATE FCC Auction 105, starting on July 23, will serve as a key benchmark for the future of wireless network use in the U.S. for years to come. This auction has drawn interest from an eclectic mix of bidders who see using the Priority Access Licenses (PALs) for a wide range of public and private wireless networks uses.

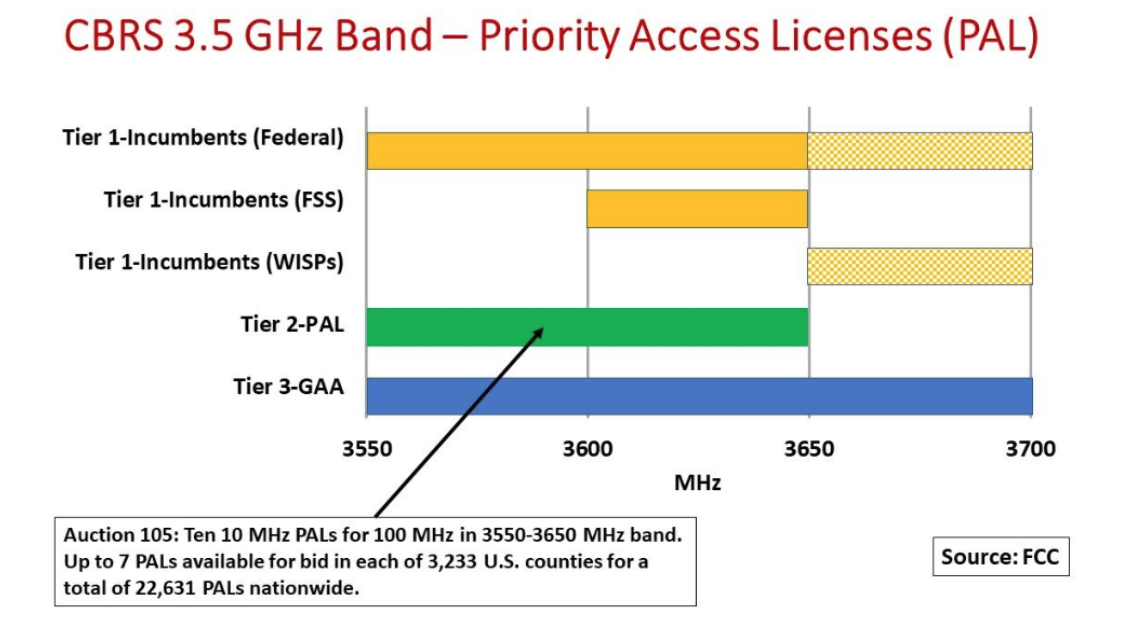

To recap, Auction 105 is making available ten 10 MHz Priority Access Licenses for a total of 100 MHz in the 3550-3650 MHz portion of the Citizens Broadband Radio Service (CBRS) 3.5 GHz band. Seven PALs will be available in each of 3,233 U.S. counties nationwide for a total of 22,631 PALs up for bid. A licensee can hold up to four of the seven PALs in any license area at any given time.

PAL licensees must submit requests to a Spectrum Access System (SAS), one of four certified frequency coordinators – CommScope, Federated Wireless, Google, and Sony – for channel assignments on a dynamic basis. SASs ensure no interference with Tier 1 Incumbent Access users or Tier 3 General Availability Access (GAA) users. The SAS may dynamically reassign a PAL to a different channel to accommodate higher priority Incumbents.

Each PAL licensee must register its Citizens Broadband Radio Service Devices (CBSDs) with a SAS before operating those devices in the band. CBSDs are FCC Part 96-complaint CBRS base stations that operate on either a PAL or GAA basis.

PALs are authorized for 10 years. PAL licensees must provide substantial service in their license area by the end of the initial license term or forfeit the license renewal.

Certainly, AT&T, Verizon and T-Mobile are bidding. AT&T and Verizon both need mid-band spectrum to complement their millimeter wave (mmW) holdings for 5G deployments, especially in markets outside of dense urban areas. T-Mobile already is deploying 5G in mid-band 2.5 GHz spectrum acquired from Sprint but could use 3.5 GHz PALs to serve vertical market applications.

Regional wireless carriers including U.S. Cellular, Bluegrass Cellular, Carolina West Wireless and VT Wireless are seeking PALs to expand their high-speed wireless offerings to their small market and rural customer base. (See Inside Towers story ‘Bidders Line Up for CBRS Auction’)

Wireless internet service providers (WISPs) such as Airlink Internet Services, Bee Wireless and Rio Broadband see CBRS as a cost-effective way to supplant their generally unlicensed connectivity offerings with LTE-grade service to their commercial and residential customers. WISPs using 3.5 GHz on an interim basis are bidding for PALs to give them stable licensed operation along with GAA licenses they may obtain. (See, Strategies for Securing CBRS 3.5 GHz Spectrum).

Local telephone companies CenturyLink, Cincinnati Bell, Frontier, Windstream and Puerto Rico Tel along with cable companies Charter and Cox are seeking PALs to overlay their wireline networks and to add to their bundled service offerings.

Some companies want to deploy wireless infrastructure for their own mobile service that they now operate as a mobile virtual network operator (MVNO) on a Tier 1 carrier network. DISH Networks wants to increase its mid-band spectrum holdings as it readies its 5G rollout.

PALs enhance the potential to establish private LTE/CBRS networks in vertical markets. Oil and gas companies such as Chevron and Oxy USA are in the mix; Chevron already operates its own private LTE network in the Gulf of Mexico on 700 MHz licenses it acquired in Auction 73.

Electric utilities such as Exelon, Southern California Edison and many rural electric cooperatives have submitted applications; a private LTE network enhances remote control of their power transmission and distribution facilities. Deere & Co is another industrial applicant with potential to expand high-speed wireless links that support autonomous farming operations.

Healthcare, hospitality and education bidders include Duke University and Healthcare system, Starwood Holdings, Virginia Tech Foundation and the University of Kentucky. Here, PALs could be used in campus applications for both outdoor and indoor wireless coverage.

Expect the big players to spend heavily for large blocks of PALs across the country. Still, there are enough PALs nationwide to satisfy a myriad of next generation wireless services.

By John Celentano, Inside Towers Business Editor

Reader Interactions