By many measures, the U.S. Big 3 tower companies – American Tower (NYSE: AMT), Crown Castle (NYSE: CCI) and SBA Communications (NASDAQ: SBAC) – are performing well after nine months into 2020 despite the pandemic. More importantly, with their carrier customers’ 5G deployments underway and a couple of major deal signings, the long-term prospects for these towercos look bright.

AMT is a leading independent tower company worldwide. At the end of 3Q20, AMT had 179,391 towers between the U.S. and 19 other countries across Latin America, Africa, Europe, and India, its largest market with 73,499 towers. AMT ranks third overall behind Chinese state-owned China Tower that has 2,015,000 towers, and Indus Towers of India with 201,121 sites.

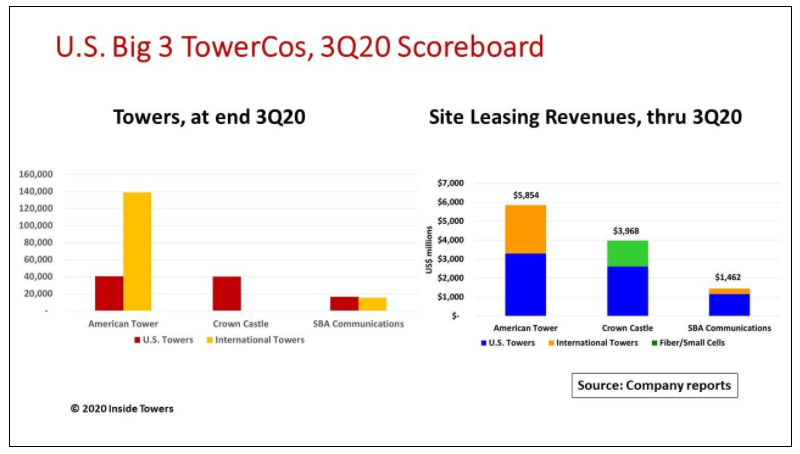

As the largest U.S. towerco, AMT has 40,602 towers in the U.S. or 23 percent of its total portfolio, that generates 56 percent of its overall site leasing or property revenues.

Through nine months, its U.S. property revenues were $3.3 billion, up 7 percent from $3.1 billion year-to-year. International property revenues grew 4 percent to $2.6 billion on 77 percent of the tower base.

Since the beginning of 2020, AMT has been active across its markets constructing nearly 3,000 new towers, acquiring another 848 and selling or decommissioning almost 2,200 sites. Of the new builds, 1,800 were in India and 855 in Africa with only nominal activity in the U.S.

The company projects a record 5,500 new tower builds for 2020, up from 4,414 built in 2019. AMT expects 2020 global capital expenditures of $1.1 billion with one-third going to new builds.

In 3Q20, AMT raised guidance for full-year property revenue to $7.9 billion, up 6 percent over 2019. The company expects to recognize straight-line revenue of over $100 million in 4Q20 from the blockbuster 15-year deal with T-Mobile on September 15.

Adjusted EBITDA guidance increased to $5.1 billion, up 8 percent over 2019. AMT’s AFFO outlook is $3.7 billion, up 6 percent year-to-year.

The second largest U.S. towerco, CCI has 40,128 towers, all in the U.S., along 80,000 route-miles of fiber and over 70,000 small cells.

CCI believes its diversified infrastructure portfolio is well-suited to its wireless carrier customer needs as networks become denser, and macrocells and small cells alike rely on fiber connectivity.

Certainly, CCI thinks its infrastructure asset mix was instrumental in landing the breakthrough multi-year, anchor tenant deal with DISH Network, announced on November 16.

CCI will support DISH’s virtualized 5G network build starting in major metro markets with a mix of macrocells and small cells all connected by fiber. DISH said it expects deployments to commence in 2H21.

Through 3Q20, CCI reported total site rental revenues of nearly $4.0 billion, up 5 percent from the comparable 2019 level. Towers accounted for $2.6 billion or two-thirds of CCI’s site leasing revenues while fiber/small cells made up the $1.4 billion balance.

In 3Q20, CCI offered full-year 2021 guidance with site rental revenues growing 4 percent to $5.5 billion up from $5.3 billion in 2020. Adjusted EBITDA is projected up 5 percent to $3.6 billion while AFFO is expected to jump 12 percent to $2.9 billion from $2.6 billion in 2020.

Year-to-date capex was $1.2 billion, down 20 percent year-to-year mainly due to a slower uptake of tower activity expected after the T-Mobile-Sprint merger earlier in the year. Fiber construction, which accounts for nearly 75 percent of total capex, is down as CCI strives to co-locate more small cells on its existing fiber facilities. Full-year 2020 capex is expected to be $1.5 billion.

SBAC is a smaller pure-play U.S. towerco with 32,724 towers at the end of 3Q20. Of these, 16,495 are in the U.S. and 16,229 in international markets including Latin America, Canada, and South Africa.

Over 80 percent of its site leasing revenues are from the U.S. market even though its tower portfolio is split nearly 50/50 between the U.S. and international markets. Year to date site leasing revenues were $1.2 billion in the U.S and $0.3 billion from offshore markets.

SBAC’s U.S. site leasing revenues are highly concentrated with T-Mobile, AT&T, and Verizon accounting for 91 percent of the total. T-Mobile alone accounted for $466 million or 40 percent of domestic site leasing revenues through 3Q20.

SBAC’s full-year 2020 guidance projects site leasing revenues of $1.9 billion, up 5 percent from 2019, adjusted EBITDA up by 10 percent to $1.5 billion and AFFO increasing by 26 percent to $1.1 billion. SBAC expects a full-year 2020 capex of $360 million.

Each towerco expects demand for its communications real estate to remain high. These companies enjoy predictable site leasing revenue growth of 4-5 percent a year under long-term master lease agreements.

Their combined annual site leasing revenues are about $15 billion with aggregate new construction and maintenance capex around $2.5 billion a year.

By John Celentano, Inside Towers Business Editor

Reader Interactions