The Big 3 U.S. wireless carriers – AT&T (NYSE: T), T-Mobile (NASDAQ: TMUS) and Verizon (NYSE: VZ) – are throwing competitive barbs at each other, making muddled 5G claims, calculating some fuzzy math and offering only selective transparency. Makes you wonder, ‘Who’s on first?’

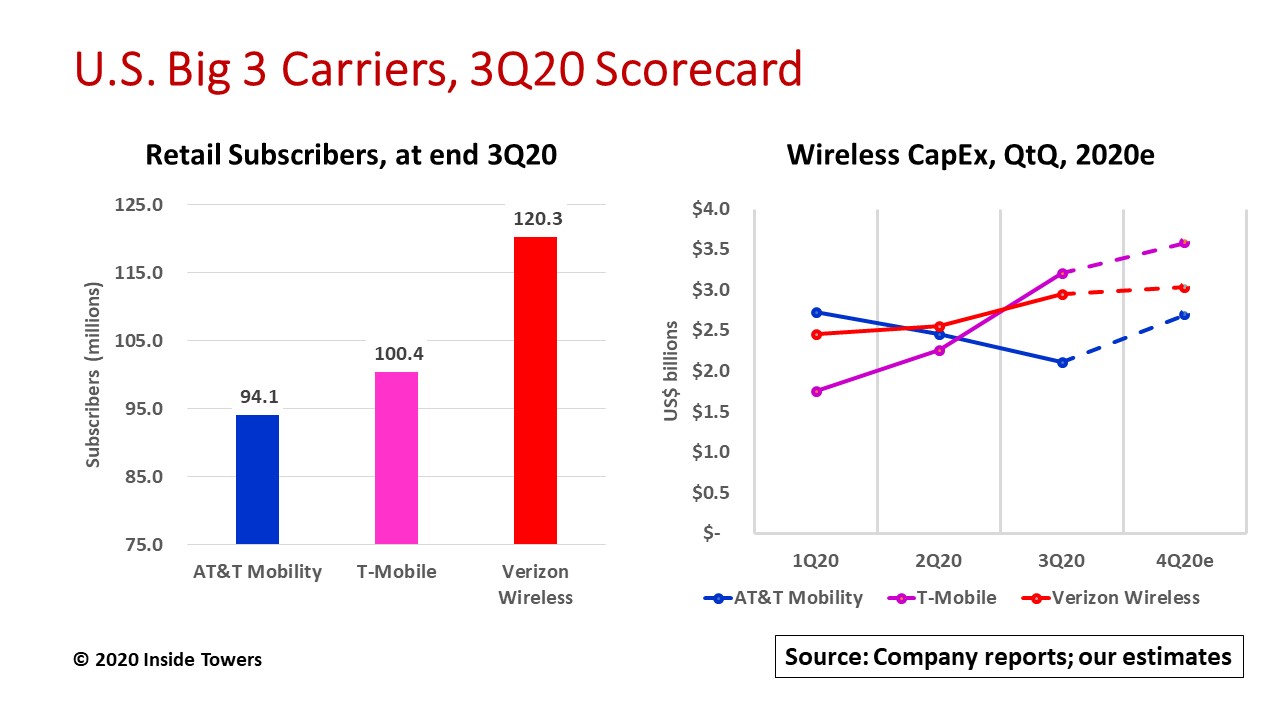

AT&T Mobility reported 94.1 million postpaid and prepaid subscribers at the end of 3Q20, ranking it third behind VZ and TMUS. The company delivered an unexpected gain of over one million postpaid subscriber net additions in 3Q20. That retail subscriber count does not include nearly 7 million reseller connections and 76 million connected IoT devices.

Mobility accounts for roughly half of T’s overall $20 billion capital expenditures in 2020 with most of that for 5G.

Even though T does not break out capex by business unit, we estimate that Mobility’s quarterly capex declined throughout the pandemic to $2.1 billion by 3Q20. Expect a big uptick in 4Q20 to nearly $2.7 billion at a capital intensity of 18-19 percent, indicating expansion mode.

The company offers several flavors of 5G. Nationwide 5G rides on the company’s 4G LTE network at low-band 700 MHz frequencies using dynamic spectrum sharing technology.

Standalone 5G mobile services on low- and mid-band frequencies are expected in 2021. Today, Nationwide 5G is available to more than 200 million people.

Alternatively, 5G+ takes advantage of more than 1,000 MHz of millimeter wave spectrum for high-speed, low latency connections. 5G+ is available in 36 cities mainly in downtown core or high traffic venues.

The company has a big stake in fiber with a three-pronged approach: cell site backhaul, core transport for businesses, and connecting homes. Fiber-to-the-home is a big opportunity since T currently passes only 25 percent of the households in its 21-state operating footprint. Expect continued fiber investments to support both wireless and wireline applications.

VZ Wireless leads the U.S. market with 120.3 million retail connections, 97 percent of which are postpaid.

VZ also does not break out its wireless capex. We estimate its 2020 wireless capex at around $11 billion. VZW has steadily increased its quarterly capex since 1Q20. Expect a 4Q20 flourish of $3 billion, at a 16-17 percent capital intensity.

VZW is betting big on its vast 2,000 MHz mmW spectrum holdings for its 5G Ultra wideband mobility service targeted to high-traffic metro core areas. The company has deployed 5G UWB small cells in parts of 55 cities, in 43 stadiums/arenas, and at seven airports.

For now, VZW is not saying how many UWB small cells it is installing other than it plans to deploy “five times” more small cells in 2020 than in 2019.

Its 5G Home fixed wireless access service is available in eight cities so far.

VZW’s 5G Nationwide service rides on the 4G LTE network utilizing DSS and the 4G Core, currently covering more than 200 million POPs.

The company is adding capacity to its 4G LTE network with mid-band 3.5 GHz CBRS spectrum acquired in FCC Auction 105. Moreover, VZ is expected to be the high roller in the upcoming C-band (3.7-3.98 GHz) Auction 107.

Since April 1 when the merger with Sprint closed, TMUS has been on a roll. TMUS reached 100.4 million postpaid and prepaid customers in 3Q20, second to VZW.

TMUS is running its 5G deployments ahead of schedule by using existing sites. Its Layer Cake spectrum deployment strategy starts with low-band 600 MHz as the coverage foundation, moves into high-capacity, high-speed performance in mid-band 2.5 GHz, then targets vertical market use cases with high-band mmW spectrum.

At the end of 3Q20, the company deployed its low-band 600 MHz 5G in 8,300 cities and towns across the country covering 270 million people. TMUS expects to cover 300 million POPs by year-end 2021.

At the same time, TMUS has turned up its mid-band 2.5 GHz 5G network in over 400 cities and towns covering 30 million POPs. The company is projecting mid-band 5G deployments to more than 1,000 municipalities covering 100 million POPs by year-end 2020 and 200 million by year-end 2021.

TMUS expects to invest $10-11 billion for full-year 2020. Capital intensity is 22 percent at current run rates. The company’s 2020 capex started at a low point but has ramped up sharply each quarter. With revised guidance, expect TMUS’ 4Q20 capex of around $3.6 billion.

TMUS’s combined T-Mobile-Sprint 4G LTE and 5G networks currently comprise 108,000 macrocell sites with the goal of reducing that number to 82,000-83,000 sites in 3-5 years.

The company is testing its Home Internet service, a fixed wireless access broadband offering over its 4G LTE network for unserved or underserved markets. TMUS did not provide availability dates.

In the end, the Big 3 face the same challenges. They need all available frequencies to address myriad 5G use cases. Their 5G uptake rate will be a function of device availability and attractive marketing offers. And each is striving to get the biggest bang for their wireless capex bucks.

By John Celentano, Inside Towers Business Editor

Reader Interactions