The outlook for the wireless infrastructure business remains positive even as we all adjust to a new normal. Carrier networks have held up well since the pandemic hit, remaining on the air with no major reported outages while operating below peak traffic capacity thresholds.

In 1Q20 earning calls, carrier guidance for full-year 2020 varied from stay-the-course to revisions to outright withdrawal. Outdoor tower work continues albeit at a constrained pace mainly due to limited access to some sites and tower crews adjusting for safe working conditions.

Planned projects are proceeding along with short-term capacity augmentations in high traffic areas using loaned spectrum from other service providers.

By contrast, many in-building wireless deployments such as distributed antenna system (DAS) projects are deferred or rescheduled, simply because there is no access to buildings where the work is being done.

Still, carriers indicated that their respective 5G buildouts are progressing. The expectation is that capital expenditures (capex) will ramp through 2H20 and continue into 2021. Certainly, T-Mobile (NasdaqGS: TMUS), rejuvenated by the closing of its deal with Sprint, is charging ahead. The company is leveraging its deep spectrum holdings in low-, mid- and high-band frequencies to activate 5G in key target markets.

Verizon (NYSE: VZ) has millimeter wave (mmW) projects underway for 5G in both fixed wireless access and mobility applications in selected markets. AT&T (NYSE: T) is regrouping in the aftermath of its 5G Evolution marketing fiasco.

With current guidance, U.S. carrier 2020 capex is in the $27-30 billion range. (see, U.S. Tier 1 Wireless Carrier CapEx Reset)

The Big 3 tower companies (towercos), American Tower (NYSE: AMT), Crown Castle (NYSE: CCI) and SBA Communications (NasdaqGS: SBAC), are largely unphased even with COVID-19 adjustments. The main reason is that their site rental revenues are governed by master lease agreements (MLAs) that they each have in place with the four (now three) Tier 1 carriers that account for 75-80 percent of their tenant leases.

Annual rent escalators built into the MLAs are in the mid-to high-single digit percentage range. Carriers have sought ways to reduce those rents including relocating to new towers with lower lease charges.

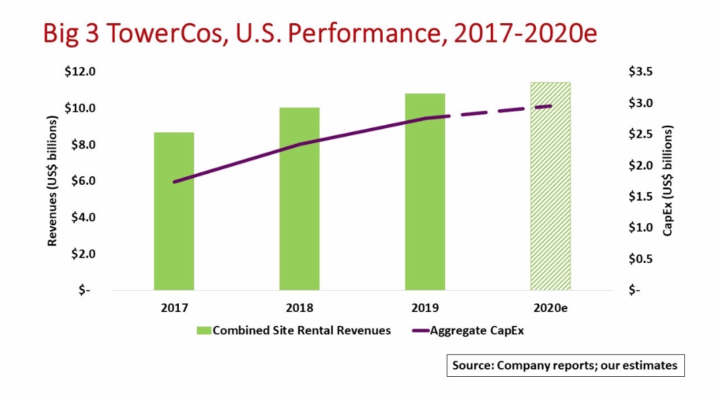

For the most part, the MLAs give the towercos predictable future revenue streams. Combined site rental revenues among the Big 3 towercos are expected to reach nearly $12 billion in 2020, growing about 10 percent a year over the past three years.

On the spend side, the Big 3 towerco aggregate capex for 2020 is projected at roughly $3 billion. With more than 50 percent of the U.S. base of communications towers, the Big 3 are the big spenders.

Towerco capex is grouped in two categories: discretionary and non-discretionary. Discretionary capex, typically 70-80 percent of the total budget, applies to new tower builds, tower augments and upgrades, and ground lease purchases. Non-discretionary capex goes to site maintenance and corporate systems.

Two key points about towerco capex. One, the Big 3 towercos are not building many new towers in the U.S. Their portfolio additions mainly derive from acquiring existing towers from other, smaller operators. This deal-driven capex is aside from ongoing network infrastructure investments.

Two, nearly half of the aggregate 2020 Big 3 towerco capex originates from CCI’s investments in small cells and fiber optic networks.

Here, CCI is the outlier. The company is working closely with major carriers such as VZ to rapidly deploy tens of thousands of small cells both for 4G LTE network densification and 5G in urban areas.

So expect growing demand for lots of wireless equipment and the skilled labor needed to install it.

By John Celentano, Inside Towers Business Editor

Reader Interactions