Cellnex Telecom (IBEX35: CLNX), the Barcelona, Spain-based tower company, is arising as Europe’s leading telecommunications infrastructure service provider. In its biggest deal to date, the company in November acquired nearly 30,000 telecommunication sites across six European markets from Hong Kong-based mobile network operator CK Hutchison.

These six acquisitions strengthen Cellnex’ foothold in Italy, the UK and Ireland while adding Austria, Sweden, and Denmark as new markets. For $12 billion, Cellnex bought roughly 24,600 existing sites and is earmarking $1.7 billion for another 5,250 build-to-suit sites over the next eight years, along with small cells and DAS initiatives.

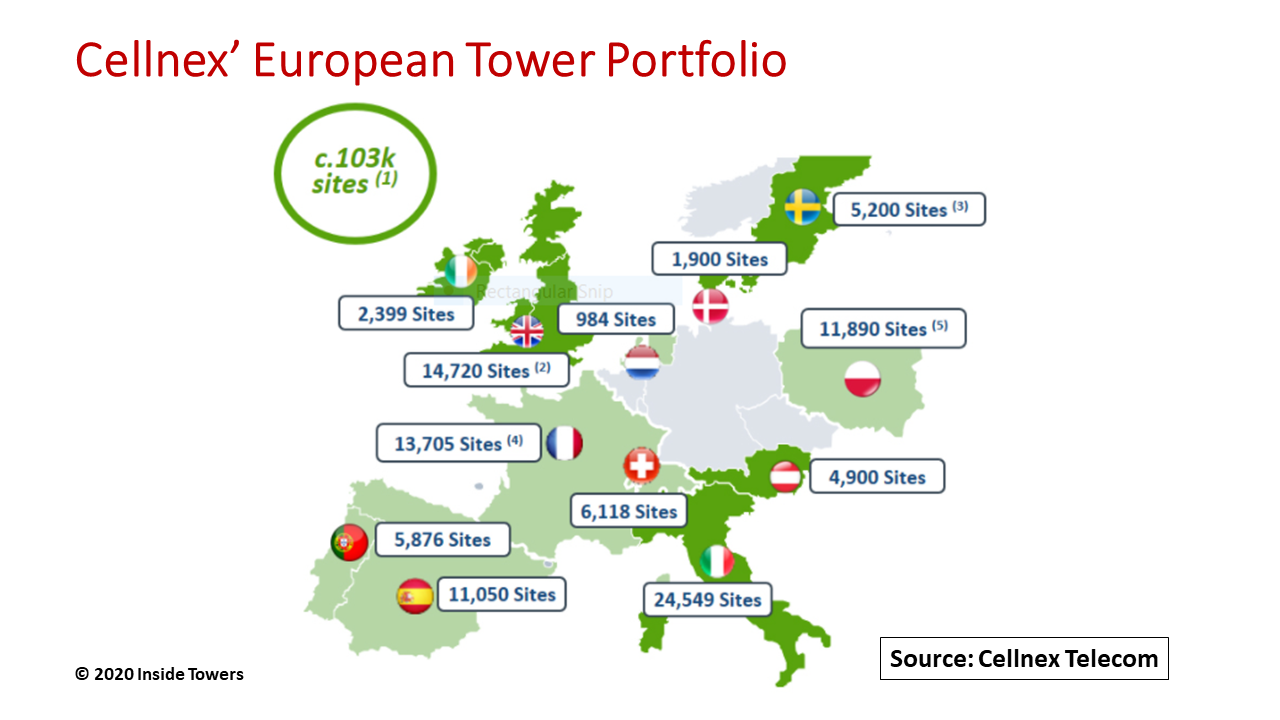

By 2028, Cellnex will operate over 103,000 towers and telecommunications sites in 12 European markets, making it the leading towerco in Europe, ahead of Vantage Towers. (see, Vodafone Launches Vantage Towers).

Cellnex gains an inflation-linked Master Service Agreement with CK Hutchison for an initial term of 15 years, to be extended for a 15-year additional period and subsequent five year periods (on an all-or-nothing basis).

The deal raises Cellnex’ future site leasing revenue bookings for the 15-year period by $40 billion to over $104 billion. A significant proportion of that backlog is from CK Hutchison, the established anchor tenant, and strong geographical diversification.

Though based in Spain, Cellnex generates most of its revenues outside the country. Through nine months of 2020, the company generated $1.4 billion in total operating revenues. Telecom tower rentals accounted for 78 percent with the balance in broadcast tower rentals and network services. Of Cellnex’ telecom tower rentals, only 17 percent comes from Spain. Italy is its largest market outside of Spain accounting for 28 percent while the rest of Europe accounted for the 56 percent balance.

Cellnex models itself after U.S.-based towercos such as American Tower (NYSE: AMT) that had 178,000 towers worldwide at the end of 3Q20. AMT and Cellnex have little overlap. Only 3 percent of AMT’s portfolio is in Europe with over 4,700 towers in France, Germany, and Poland.

In that light, the company is transforming its current 60,000 site network with investments intended to boost its service capabilities and internationalization drive.

Beyond providing MNOs with reliable infrastructure, Cellnex is developing municipal ‘smart city’ projects, creating an intelligent connectivity ecosystem for IoT applications, and supporting public safety and emergency communications facilities called ‘Public Protection and Disaster Relief’ networks.

Since the beginning of 2020, and despite the pandemic, Cellnex has executed a series of rapid-fire M&A moves to enter new markets and consolidate its position in key markets. Through 3Q20, Cellnex’ tower expansion and BTS capital expenditures reached $485 million and its M&A capex has totaled $3.7 billion.

In Portugal, Cellnex purchased in January the towerco OMTEL for $960 million. With OMTEL’s 3,000 sites, the company will build 400 new sites over four years, with potential for another 350 sites, amounting to $170 million in site construction capex.

Cellnex and France’s Bouygues Telecom announced a strategic agreement in February to roll out and operate a 31,500 km fiber optic network to support and accelerate 5G rollouts. The $1.2 billion planned investment through 2027 will interconnect the towers that serve Bouygues Telecom (5,000 of which belong to Cellnex) with the network of “central” and “metropolitan” mobile edge computing centers. The agreement envisages up to 90 new “metropolitan” centers through 2027 in addition to the 150 centers already built for Bouygues Telecom.

In April, Cellnex acquired NOS Towering from Portuguese MNO NOS. The nearly $455 million transaction, which closed in September, involves about 2,000 sites and up to $212 million for 400 new sites over the next six years.

The company completed the acquisition of Arqiva’s telecommunications division in the UK in July for $2.7 billion. The project adds about 7,400 sites to Cellnex’ portfolio and includes the marketing rights of another 900 sites across the UK.

In another July deal, Cellnex acquired Finnish start-up Edzcom that specializes in edge connectivity solutions for private LTE networks.

In Spain, in October, Cellnex finalized the purchase of 60 percent Metrocall from Indra, the neutral host operator that operates the telecommunications infrastructure and services in the Madrid underground system.

Also, in October, the company reached an agreement with French MNO Iliad SA to acquire 7,000-sites from Play, the Polish MNO taken over by Iliad. Cellnex will invest nearly $970 million for a 60 percent controlling stake in the towerco that will manage the Polish sites along with an additional $1.6 billion for up to 5,000 new BTS sites over the next 10 years. The deal is expected to close in 2Q21.

By John Celentano, Inside Towers Business Editor

Reader Interactions