Cincinnati Bell (NYSE: CBB) will soon be under new management.

In March, CBB entered into a merger agreement with Macquarie Infrastructure Partners (MIP) to be acquired for $2.9 billion in a deal that is expected to close in early 2021.

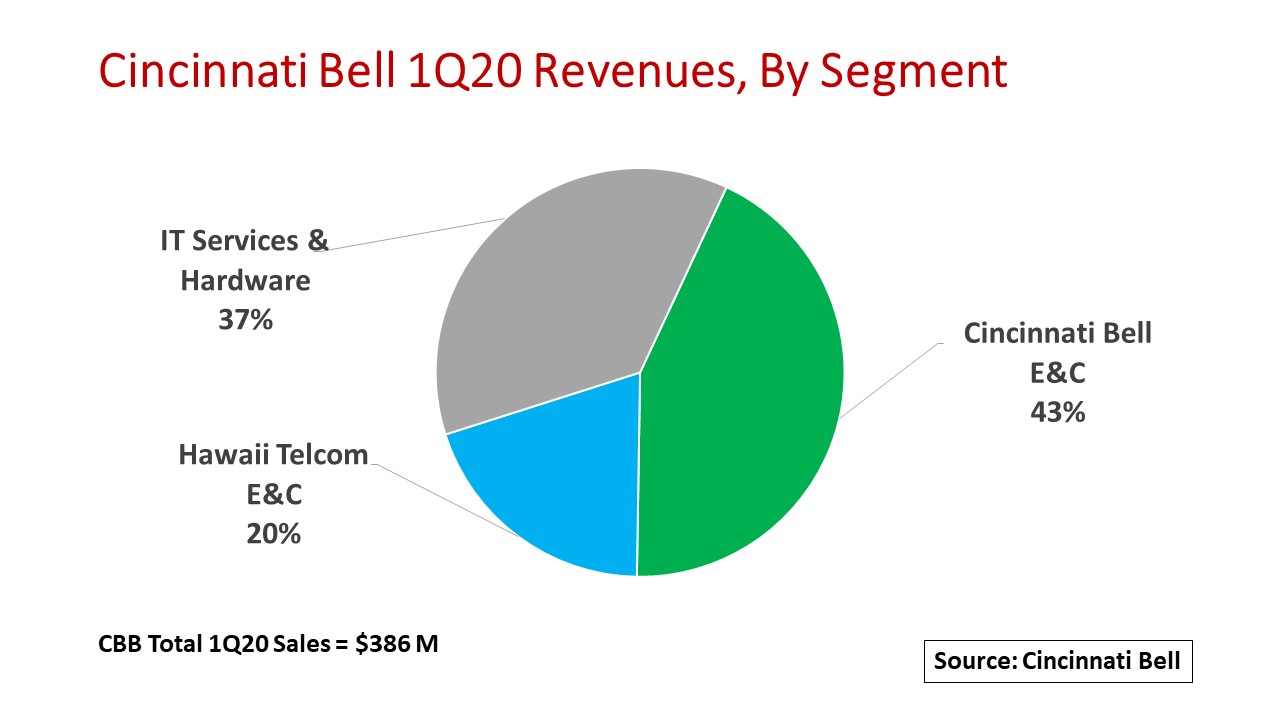

In the interim, it is business as usual. The company reported 1Q20 consolidated revenues of $380 million, flat on a year-to-year (YtY) basis with 1Q19. CBB recorded a small operating profit of $5 million that was offset by the payout of a $25 million break-up fee paid in connection with the termination of a previously announced merger agreement. Total Adjusted EBITDA increased 4 percent YtY to $102 million.

CBB has two main operating units: Entertainment and Communications (E&C), and IT Services and Hardware (IT).

E&C is the company’s wireline business that encompasses the original Cincinnati Bell Telephone (CBT) incumbent local exchange carrier (ILEC) and Hawaii Telcom (HT), the largest ILEC in Hawaii, that CBB acquired in 2018. Note that CBB sold its wireless business to Verizon in 2015.

The two E&C entities operate both legacy copper telephone voice and data lines and fiber-to-the-premise (FTTP) fiber optic networks that deliver internet, video and voice services. FTTP is marketed as “Fioptics” in Cincinnati or “Consumer/SMB Fiber” in Hawaii. At the end of 1Q20, CBB operated 281,000 FTTP connections, 80 percent of which were in the CBT operations.

The number of FTTP “Homes Connected” represents a 42 percent penetration of the “Homes Passed” by the FTTP network facilities. Internet access is the primary FTTP service that customers take with video and voice services added to about 50 percent of those connections.

CBT and HT still manage 487,000 legacy copper-based telephone lines and low-speed data services. The E&C segment 1Q20 revenues totaled $244 million and generated Adjusted EBITDA of $91 million. CBB capital expenditures (capex) in the E&C operations are about $200 million a year.

The IT segment provides Enterprise customers under its CBTS and OnX Canada brands with a range of Cloud, Communications and Consulting services along with major branded telecom and IT hardware. IT’s services and products are offered through CBB subsidiaries in the United States, Canada and Europe. As needed, IT leverages strategic connections through CBB’s fiber and copper networks. IT revenue totaled $142 million, up 4 percent YtY, generating Adjusted EBITDA of $13 million. IT accounted for 37 percent of CBB’s total revenue mix for the quarter.

With the pending MIP merger, CBB neither provided financial guidance for the balance of 2020, nor scheduled a quarterly earnings call.

By John Celentano, Inside Towers Business Editor

Reader Interactions