Colony Capital (NYSE: CLNY) is fast becoming “the next great infrastructure platform.” Led by President and CEO Marc Ganzi, CLNY is “rotating” a complex diversified real estate investment trust (REIT) across many real estate verticals into a new focused digital REIT.

Through 2020, part of that rotation involved selling off legacy real estate assets in hotels and other financial holdings, then applying those funds to tower and data center investments, nearly doubling its assets under management (AUM) compared to the year before.

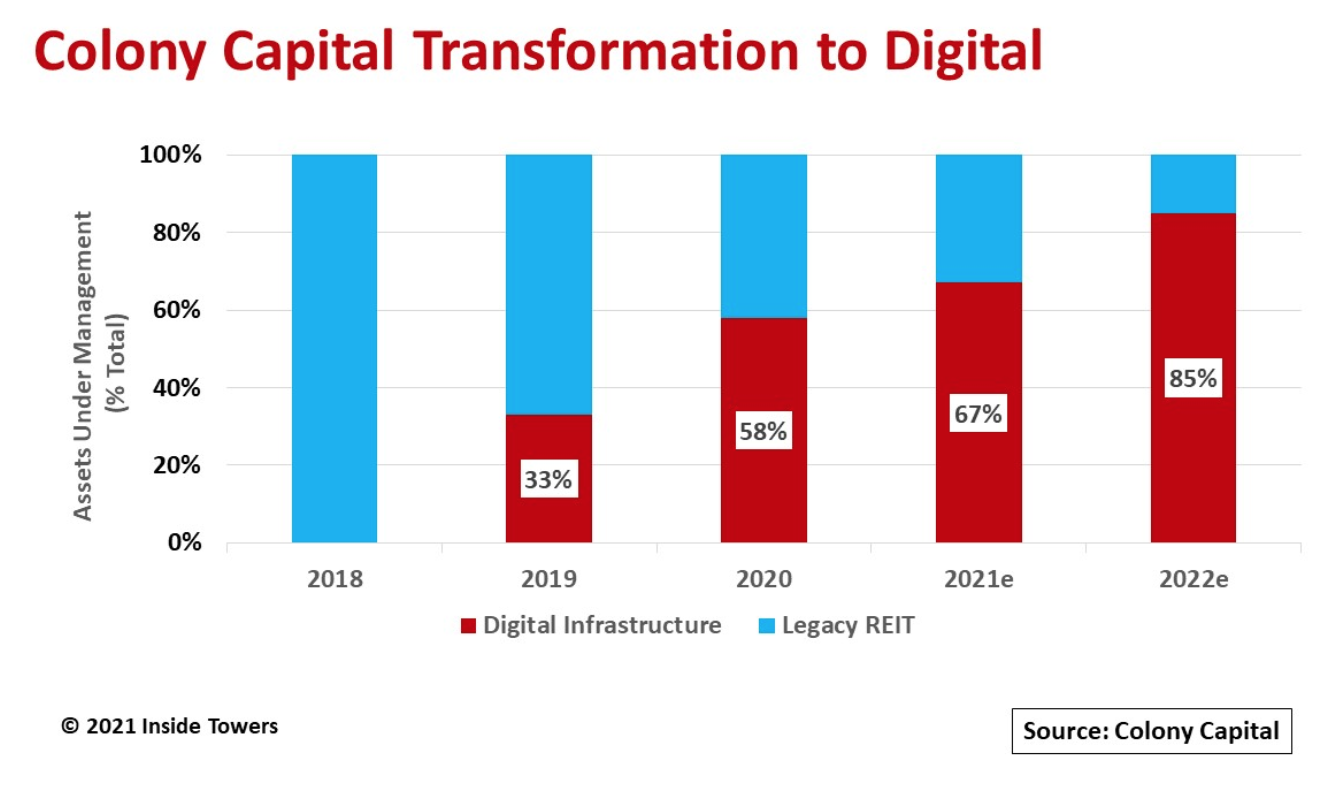

At year-end 2020, CLNY’s digital infrastructure holdings represented $30 billion or 58 percent of its total AUM and nearly $13 billion or 64 percent of fee earning equity under management (FEEUM).

The company expects its digital infrastructure investments to increase to 67 percent of AUM in 2021 as it accelerates its legacy hotel property asset and other equity and debt (OED) monetization and grows its FEEUM.

CLNY says it can add another 20 percent of rotated AUM through the end of 2021 once it jettisons legacy wellness properties (independent living, assisted living and skilled nursing facilities), and harvests its investments in Colony Credit Real Estate (NYSE: CLNC), a commercial real estate credit REIT.

CLNY makes its money two ways. It charges Investment Management fees for managing outside money invested in digital infrastructure companies, and it earns Digital Operating income from its share of revenues and profits generated by its portfolio companies.

The $30 billion in AUM represents an extensive array of digital infrastructure investment in 19 operating entities in North America, Latin America, and Europe. Totals assets comprise more than 360,000 tower and cell site locations (led by Vertical Bridge), over 38,000 small cells (mainly Extenet), 132,000 fiber route-miles (mainly Zayo) and 100 data centers (Databank and Vantage).

Management believes that its transition to digital is exactly aligned with market drivers for next generation networks needed to meet escalating 5G, IoT, cloud, and edge computing demand. It is expanding its digital infrastructure holdings to capture a large share of that demand.

CLNY was dealing big in 2020 with more than $22 billion in transaction value across all digital infrastructure sectors while adding over $5 billion in FEEUM.

On the investment management side, CLNY’s Digital Colony made several key moves with portfolio companies that included Vantage Europe data center expansion into five new European markets, taking fiber network provider Zayo private, launching a hyperscale data center platform in Latin America from Scala’s three data center campuses, and adding over 2,500 active towers to Highline by acquiring Phoenix Tower do Brasil.

Several moves with portfolio companies bolstered CLNY’s digital operating side. A CLNY-led investor group helped Vantage Stabilized Data Centers acquire a majority stake in 12 world class North American hyperscale data centers. Another CLNY-led deal helped DataBank acquire zColo with 44 co-location data centers along with a $30 million DataBank strategic investment in EdgePresence that operates multi-tenant, modular data centers in key U.S. markets.

In 2020, investment management annualized digital fee revenues increased to $125 million, and digital fee-related earnings grew to $66 million. Digital operating revenues were $124 million, and EBITDA came in at $56 million with the continued rotation of the company’s balance sheet.

For 2021, the company is targeting digital management fees revenues of $140-150 million and digital fee-related earnings of $80-85 million. Fees will grow with anticipated $3.5-4.0 billion of additional capital raised throughout 2021 for its Digital Colony Partners (DCP) II investment fund and expansion of CLNY’s other investment offerings.

For digital operating income, CLNY is targeting $125-135 million of revenue and $53-58 million of EBITDA, driven by “organic growth, bolt-on acquisitions, and our existing investments.” The guidance excludes new balance sheet investments that will be partially funded by an anticipated $400-600 million of legacy REIT monetization during 2021.

During the company’s 4Q20 earnings call, Ganzi summed up the company’s current situation, “We closed three new deals in 4Q20. We have three new deals in exclusivity right now that we anticipate entering into definitive documentation over the next 90 days. And we have a forward pipeline of over 40 new opportunities that we’re pursuing. … We deployed $22 billion of capital in 2020, putting over $5 billion of FEEUM to work. In 2021, we expect to grow FEEUM by at least another $3.5 billion to $4 billion. … The setup for us has never been better at Colony Capital.”

By John Celentano, Inside Towers Business Editor

Reader Interactions