There is an old adage in this business: ‘It takes a lot of wires to make wireless work!’

Actually, the only wireless part is between a mobile device and the nearest antenna. After that, signals are carried through the cellular carrier’s network on the ground over “wires” which these days are fiber optic cables.

When we think of wireless infrastructure, towers first come to mind. The wireless carriers have long jettisoned ownership of their own structures to specialized tower companies (towercos) whose business model is to build and maintain a tower then lease space on that tower to one or more carriers.

Among the leading towercos, Crown Castle (NYSE: CCI) has taken the notion of wireless infrastructure well beyond towers. CCI bills itself as a “leading provider of shared communications infrastructure in the U.S.”

The company’s communications infrastructure comprises an extensive array of assets across the U.S. Consider the metrics. CCI operates 40,000 cell towers and other structures such as rooftops of which over 70 percent are located in the top 100 U.S. basic trading areas (BTAs), geographic area designations originally used to determine where mobile service providers could operate. Each metropolitan trading area (MTA) consists of several BTAs.

CCI’s tower base grew through acquisitions of towers from carriers and smaller towercos along with new site builds. Over 40 percent of CCI’s towers are located on land that CCI owns; the company buys ground leases wherever it can. CCI’s fiber network totals more than 80,000 route-miles amassed through a series of acquisitions over several years of key fiber cable operators such as Lightower, FPL FiberNet and Sunesys. These networks together added to CCI’s network over 55,000 route-miles in major cities across the country. More important, that extensive fiber cable network connects roughly 70,000 small cells that are already on on-air or under contract in every major U.S. market.

5G networks are being built to meet ever-increasing mobile data demand. The way to deliver 5G’s ultrafast data speed and low latency over the air is to move antennas closer to customers. This means greater network densification using small cells for coverage and capacity where macrocells cannot reach effectively. To meet the demand projections, today’s installed base of about 350,000 cell sites in the U.S. could grow two-to-three times that size in the next three-to-four years.

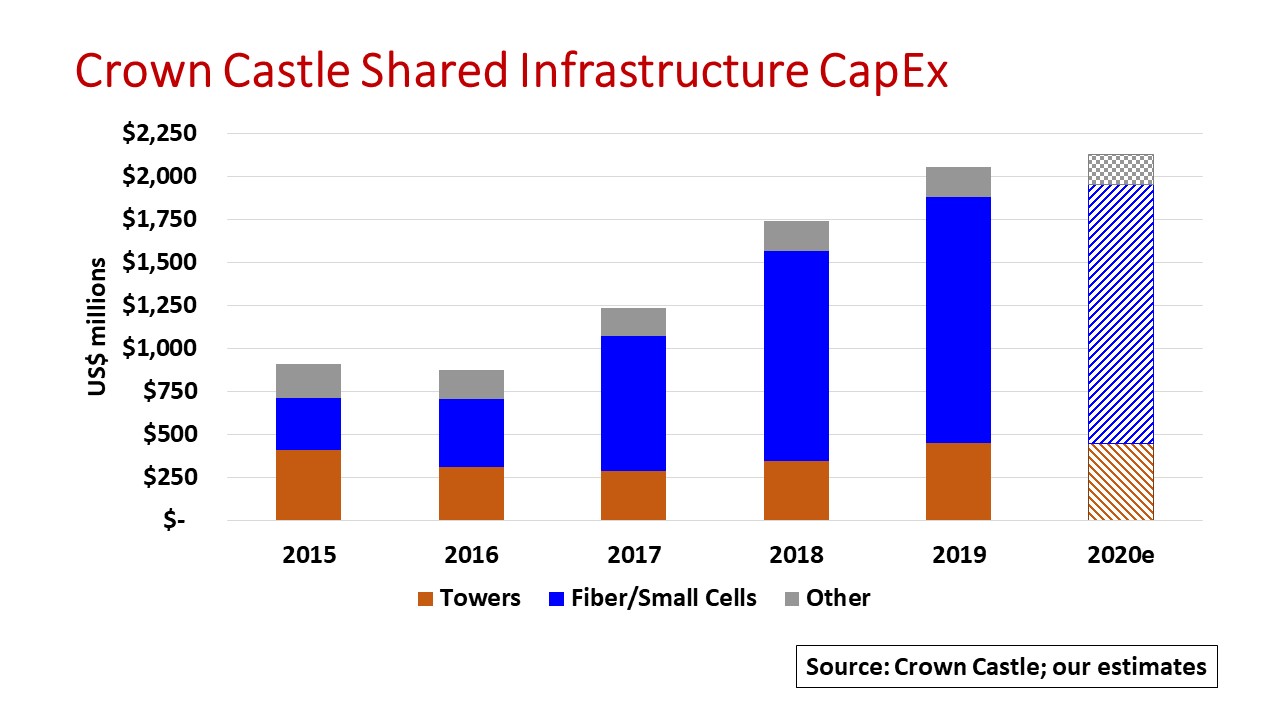

In positioning to meet that infrastructure growth, CCI has ramped up dramatically its capital expenditures (capex) in its fiber/small cell business segment beginning with its fiber acquisitions in 2017. Capex grew at a 24 percent CAGR from $874 million In 2016 to $2.1 billion in 2019 with the fiber/small cell portion accounting for 69 percent of the 2019 total, 22 percent for towers and the balance for ground lease purchases, tower maintenance and network integration activities. CCI’s outlook for 2020e capex is on par with 2019, say, $2.0-2.2 billion. That figure is roughly double CCI’s closest competitor, American Tower that operates a tower base of more than four times CCI’s.

These network investments are significant for CCI’s size but are clearly for the long term. In 2019, CCI still derived 59 percent of its $5.8 billion revenues from tower site rentals. Of that, 75 percent comes from the big four national carriers. The fiber/small cell segment generated another 30 percent of revenues with the balance from network services involving site acquisition, development and construction for its customers.

As the small cell count grows, CCI expects to garner a greater proportion of revenues from its ‘wired’ business, with less dependency on ‘wireless’ tower leases.

By John Celentano, Inside Towers Business Editor

Reader Interactions