It’s been a busy 12 months for DISH Network (NASDAQ: DISH).

In the aftermath of the T-Mobile-Sprint merger a year ago, DISH shelved its plan to build a narrowband IoT network. With FCC approval, it entered the pre-paid retail wireless business, buying Boost Mobile prepaid from T-Mobile, then acquiring Ting Mobile and Republic Wireless, gaining about 9 million subscribers in the process.

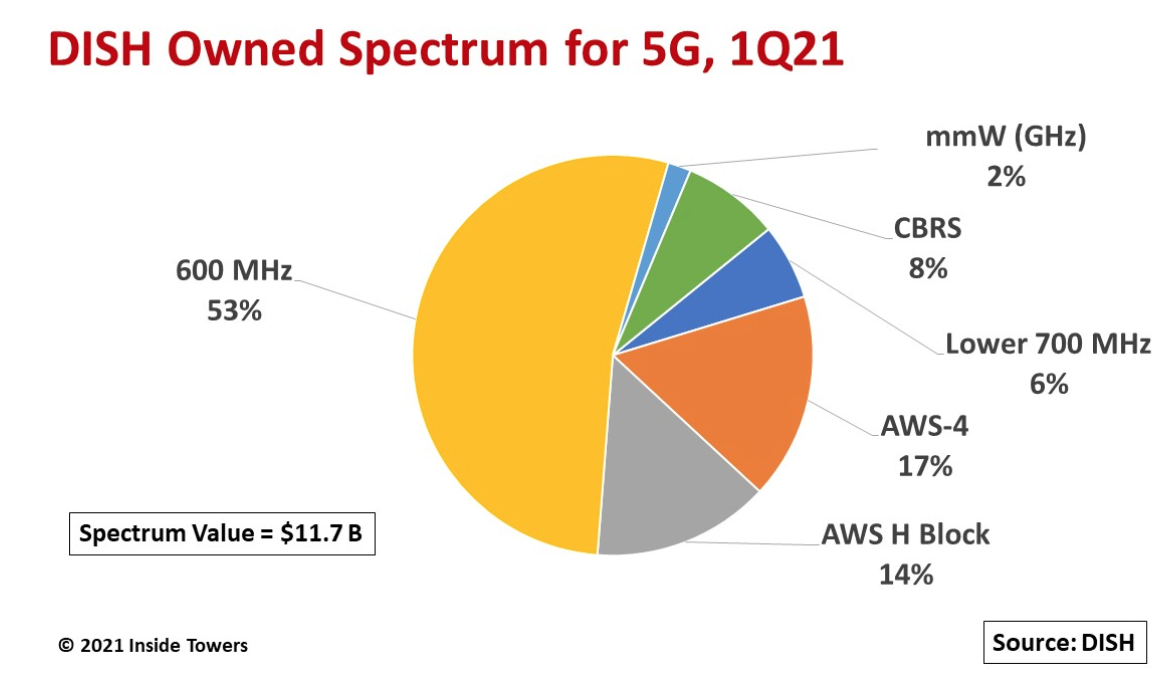

In addition, DISH paid nearly $1 billion for 3.5 GHz CBRS licenses in FCC Auction 105 to expand its already extensive spectrum holdings. All along, the company has formed long-term agreements with tower companies, radio equipment suppliers and cloud providers, notably, Amazon Web Services, to enable DISH to build its own competitive national 5G network. (see, DISH Network’s Allstar Vendor Lineup).

In its 1Q21 earnings call, the company expounded on how working with AWS gives its cloud-native 5G network a level of flexibility and robustness that DISH believes supersedes the capabilities of the established mobile network operators to serve a range of vertical market requirements.

In December, the company completed a successful field validation of its fully virtualized standalone 5G core network and what it claims is the industry’s first Open RAN compliant radio. During 2Q21, DISH began its first major market construction in Las Vegas, NV, and expects to offer live 5G service starting at the end of 3Q21.

DISH’s consolidated 1Q21 revenues were $4.5 billion, up 40 percent from $3.2 billion in 1Q20. Its Wireless segment accounted for $1.3 billion while the established Pay-TV was flat YoY as the company acknowledged subscriber declines. Operating income for the quarter was nearly $900 million compared to $141 million in 1Q20.

Growth in the Wireless segment primarily resulted from leasing a portion of its 600 MHz spectrum licenses to T-Mobile which began in September. That spectrum lease is for $56 million a year over a 42-month term.

DISH holds a lot of spectrum that it is now putting into play. In addition to its own $12 billion investments to acquire certain wireless spectrum licenses and related assets, the company made another $10 billion in non-controlling investments in Northstar Wireless and SNR Wireless for access to their AWS-3 spectrum.

DISH is standing by its previously stated $10 billion capital expenditures over seven years to build out its 5G network. The company reinforced the idea that the AWS collaboration will help keep its capex on that target. DISH acknowledged that the timing of the buildout could be impacted if COVID persists, and supply chain disruptions arise. The company’s overall 2021 capex will be a function of the 5G deployment rate as well as costs associated with subscriber premises equipment and maintenance of DISH TV services.

DISH holds a total national weighted average spectrum depth of around 1200 MHz. The 29 MHz of low-band 600 MHz portion accounts for 53 percent of DISH-owned spectrum investments. 600 MHz gives the company wide area coverage while mid-band AWS spectrum is better suited for dense market coverage. DISH said it expects to use CBRS in niche applications and Enterprise use cases.

In July 2019, DISH voluntarily committed to deploy a nationwide 5G broadband network and meet revised timelines for building out of its spectrum assets, subject to certain penalties.

With 600 MHz licenses, DISH must cover at least 75 percent of the population in each Partial Economic Area no later than June 14, 2025. With AWS-4, Lower 700 MHz E Block and AWS H Block licenses, the company must reach at least 20 percent of the U.S. population and have deployed a core network by June 14, 2022, and at least 70 percent of the U.S. population by June 14, 2023.

Failure to meet the various commitments would trigger FCC payments of up to $2.2 billion and could lead to forfeiture of certain AWS-4, Lower 700 MHz E Block, and AWS H Block licenses.

By John Celentano, Inside Towers Business Editor

Reader Interactions