DISH Network (NASDAQ: DISH) is advancing its 5G network build plans. It just does not want to keep talking about it.

In its 2Q20 earnings call, DISH Chairman Charlie Ergen commented, “There is nothing that stops us from building the best network in the [U.S.]. There’s no law of physics, no technology that really has to change – it’s really execution risk for us and our vendors to make that happen. … We don’t spend a lot of time talking about it externally because everyone is going to be skeptical up until we light it up and then people will have their opinion about it. So that’s what we’re going to do.”

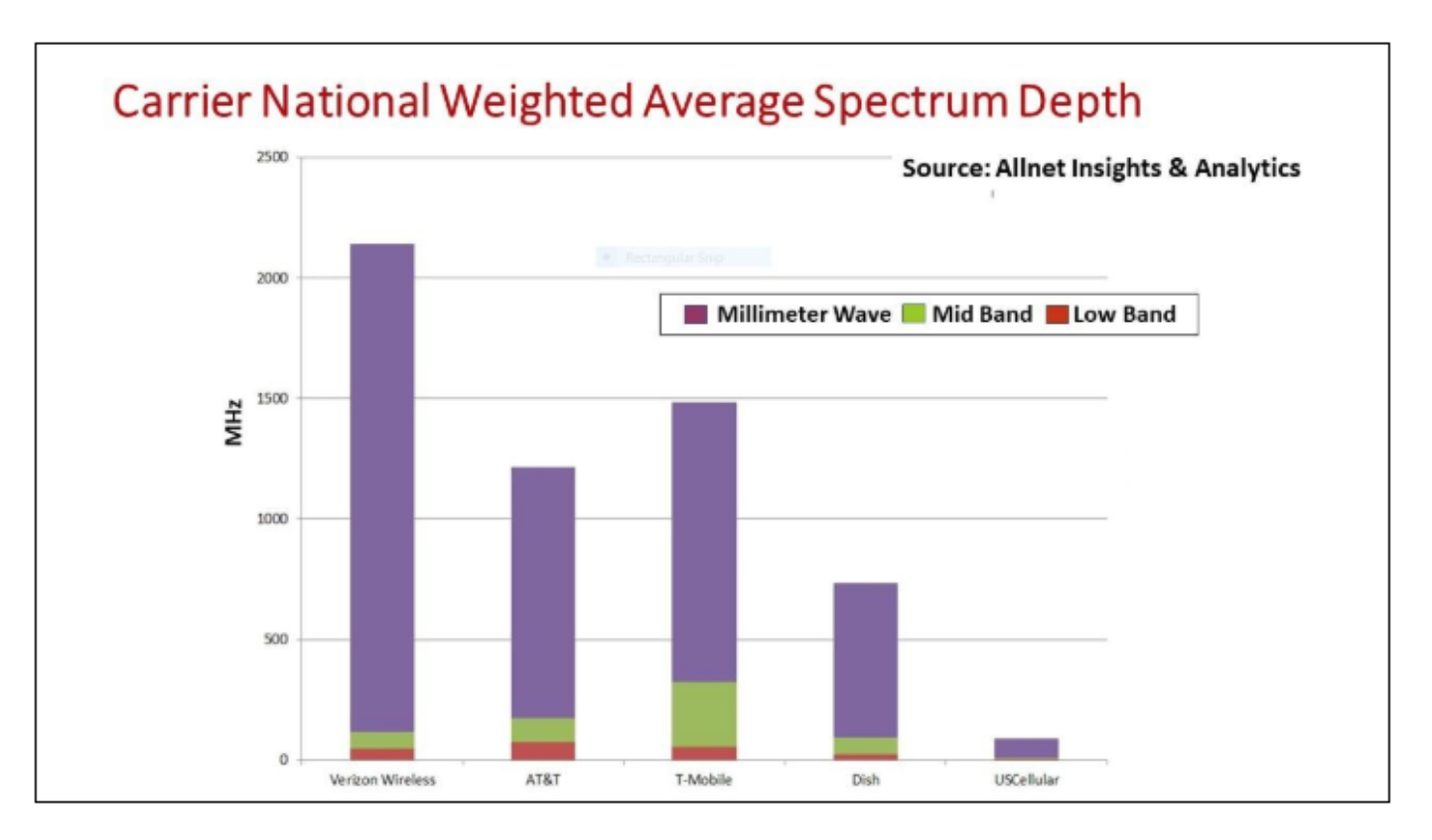

DISH controls about 100 MHz of national weighted average spectrum in low- and mid-band frequencies. These include low-band 600 MHz with up to seven 5+5 MHz paired blocks and 6 MHz of Lower 700 MHz E Block. Both bands are suited well for wide area coverage.

Its mid-band AWS spectrum works better in denser markets: AWS H Block with paired 5 MHz channels at 1.9 GHz, AWS-3 with paired 25 MHz channels at 1/7/2.1 GHz and AWS-4 with 20 MHz at 2.0 GHz.

DISH will deploy 5G in those bands in “certain population coverage targets” around the country. The company gave no indication of using its millimeter wave spectrum for 5G.

Timing is a big risk, however.

DISH has significant build out commitments to the FCC. It faces a ‘use it or lose it’ scenario for certain licenses in AWS-4, Lower 700 MHz E Block and AWS H Block along with a $2.2 billion voluntary default payment to the FCC.

The 600 MHz band is the big one. DISH must have 600 MHz operational for at least 70 percent of the population covered by those licenses and a core network deployed by June 14, 2023. It must offer 5G broadband service to at least 75 percent of the population in each Partial Economic Area by June 14, 2025.

Similarly, the company must build out AWS-4, Lower 700 MHz E Block and AWS H Block to at least 20 percent of the population covered by those licenses and deploy a core network by June 14, 2022, growing to 70 percent by June 14, 2023.

Equipment supply is another risk.

DISH is committed to Open RAN architecture. It believes O-RAN gives it the best opportunity to deploy a nationwide 5G network in the specified timeline and at lower capital expenditures than proprietary architectures used by incumbent wireless service providers.

DISH rationalizes its approach several ways: no legacy wireless installed base to support; O-RAN radios are cheaper than proprietary designs; lower capex and faster deployments with compact radios, antennas and cabling; and, lower operating expense with smaller RAD center occupancy on towers.

DISH selected Japan’s Fujitsu as its O-RAN radio manufacturer. Fujitsu will supply its new Low Band Tri-Band RU and Mid Band Dual-Band RU across DISH’s spectrum portfolio. Fujitsu also will deliver to DISH integrated radios and antennas through its high-caliber supply chain. This is important. DISH said it must start receiving RUs by 2H21 to be able to meet its mid-2022 deployment commitments.

Fujitsu will manage Distribution Unit/RU hardware validation between vendors, including Altiostar and Mavenir, that are delivering cloud-native 5G radio software to DISH. With Altiostar’s software, DISH can dynamically scale its network to the type of 5G applications and services needed by consumers and businesses. DISH also retained VMWare to help stitch together various cloud-based, software-defined services.

DISH said it will rely on terrestrial facilities for backhaul where low latency is stipulated. Otherwise it could opt for satellite backhaul in certain areas.

Financing is another concern. DISH’s 2020 wireless capex guidance was $250 to $500 million. It now expects to come in at the low end of that range. The company stood by its $10 billion capex estimate for a nationwide 5G network build.

The company issued over 100 RFIs/RFPs seeking vendors and partners to share investments needed for research and development, network infrastructure builds, testing and commercialization.

DISH may acquire additional wireless spectrum licenses including CBRS and C-band if needed to deliver new services that compete with other wireless service providers.

Ergen concluded: “DISH is a unique company. We technically understand most [of the issues]. We’re pretty good at satellite, we’re pretty good at video and we’re getting really good at 5G open architecture wireless.”

Reader Interactions