Frontier Communications (NASDAQ: FYBR) has emerged from bankruptcy with a new lease on its corporate life. The company is transforming its wireline network from mainly copper lines to fiber-to-the-premise (FTTP) deployments.

The transformation will allow Frontier to deliver gigabit speed broadband services to consumers and businesses throughout its operating territory. In the process, it expects to drive new revenues and profits.

Frontier’s wireline network today passes 15 million premises. This means that Frontier’s copper and fiber facilities pass by that many residences and businesses but only generate service revenues when they connect to those premises.

The company has a total of 3.5 million consumer and business customer connections across 25 states, in three regional clusters in the West and Southwest, Midwest and Northeast, and the Southeast.

Frontier points out that these regions have large populations that are among the fastest growing in the country and have high favorable broadband demand characteristics. At the end of 2Q21, its broadband-capable facilities passed 3.6 million premises, and 2.8 million broadband connections with 49 percent on fiber.

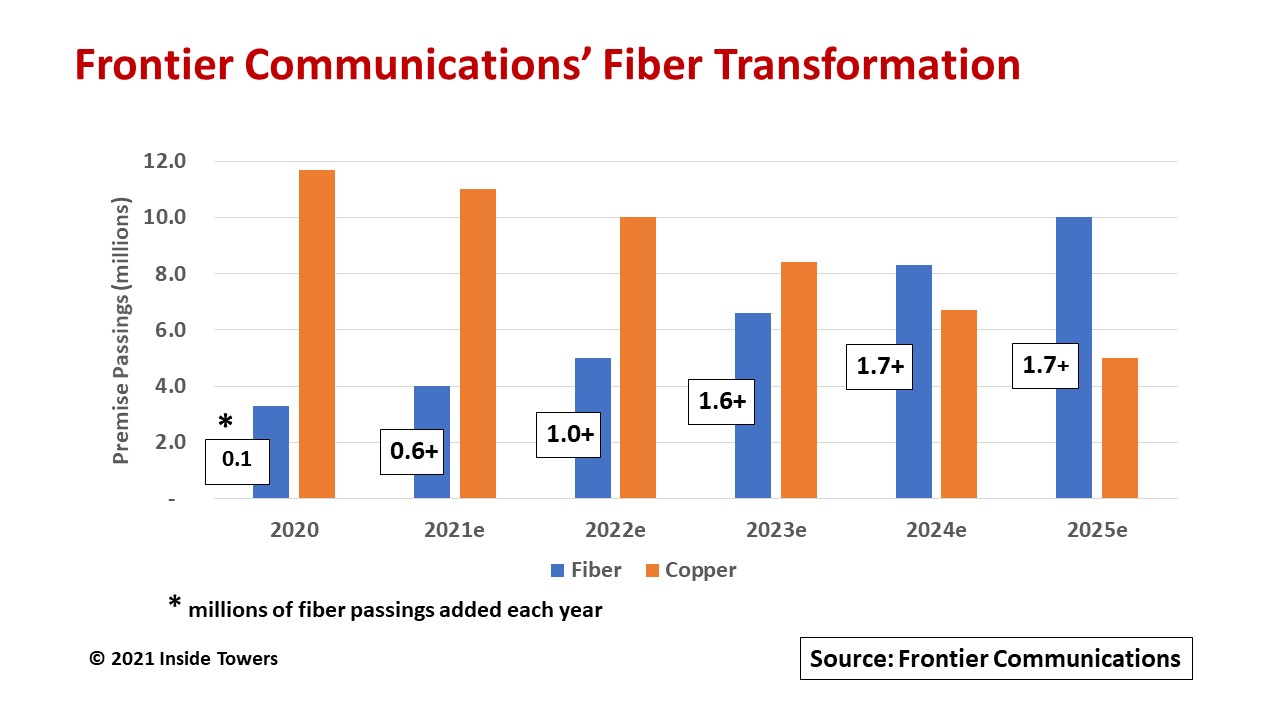

Of the 15 million passings, the company expects to upgrade four million passings to fiber by the end of 2021, and more than 10 million by 2025.

Frontier reported revenues for 2Q21 of $1.62 billion, down nearly four percent from $1.68 billion in 1Q21 on roughly flat sequential data revenue but lower voice revenue. Of that 2Q21 total, $1.53 billion was generated from consumer, business and wholesale customers for data, internet, voice, and video services. Adjusted EBITDA was $633 million, down over five percent sequentially as fiber growth was offset by copper decline.

Frontier made significant progress toward its 10 million fiber passings objective in 2Q21, building fiber to approximately 157,000 new locations. Frontier now expects to reach 600,000 new locations in full-year 2021, up from its original estimate of 495,000 new passings, to get to the four million fiber passings target by year-end 2021.

Nick Jeffery, Frontier President and CEO, comments, “The acceleration of our fiber network expansion is clear evidence that Frontier’s transformation is taking hold.” Accordingly, the company raised its capital expenditure guidance for 2021 to $1.8 billion, from its earlier $1.5 billion estimate, up from $1.2 billion spent in 2020.

A Little History.

The company started in 1935 as Citizens Utilities, a rural local exchange carrier (RLEC) in Minnesota. It expanded rapidly over the past three decades by acquiring smaller RLECs, and larger wireline operations from portions of the former GTE, several Baby Bells including USWest and Verizon, and AT&T’s wireline operations in Connecticut. Frontier divested its non-telephone operations in the late 1990s and early 2000s. In 2009, the Citizens Utilities renamed itself Frontier Communications, headquartered in Stamford, CT, and trading as FTR.

By early 2018, Frontier’s revenues were declining nearly 10 percent a year even as it attempted to cut costs across its patchwork network. The company sold its operations in the Northwest in 2019 to focus on the three high potential regional clusters.

In April 2020, Frontier filed for bankruptcy to reduce its debt and to reorganize its operations. With new capitalization, the company reemerged in May 2021, trading as FYBR.

Three Fiber Waves

In its recent Investor Day presentation, the company articulated its objective to upgrade and expand more than 10 million lines to fiber by 2025.

The roll outs will occur in three waves. Wave 1 targets lower cost locations where the company thinks it can quickly penetrate and prove its efficient build methodology to the 2021 four million fiber passings target.

Wave 2 will add another six million fiber passings in the 2022-2025 period. Frontier sees deployments accelerating as it becomes more efficient particularly in the larger communities that it already serves and where there is little or no cable competition.

Wave 3 will target the remaining 5 million predominantly rural copper passings. Frontier says it will assess upgrading those lines to fiber opportunistically although it sees “significant upside” as it qualifies for from government funding programs aimed at closing the digital divide and the bipartisan infrastructure bill aligns with the company’s mission of delivering gigabit speed internet connections to underserved or unserved parts of the country.

Since Frontier is the incumbent RLEC in many markets, it can achieve economies of scale and installation efficiencies by overbuilding existing copper infrastructure for fiber. For instance, it can “overlash” fiber cables to aerial copper lines and share long haul fiber transport facilities that it already owns. Frontier can also utilize existing fiber feeder routes and only replace existing distribution legacy copper that connects to customer premises. And it can utilize existing conduit capacity.

The company believes that by leveraging what is already in place, it can build out its fiber footprint at rapid pace while still realizing an estimated cost advantage of roughly 20 percent compared to a greenfield build.

by John Celentano, Inside Towers Business Editor

Reader Interactions