AT&T (NYSE: T) may be seriously underinvesting in its wireless and fiber networks even as it adds subscribers.

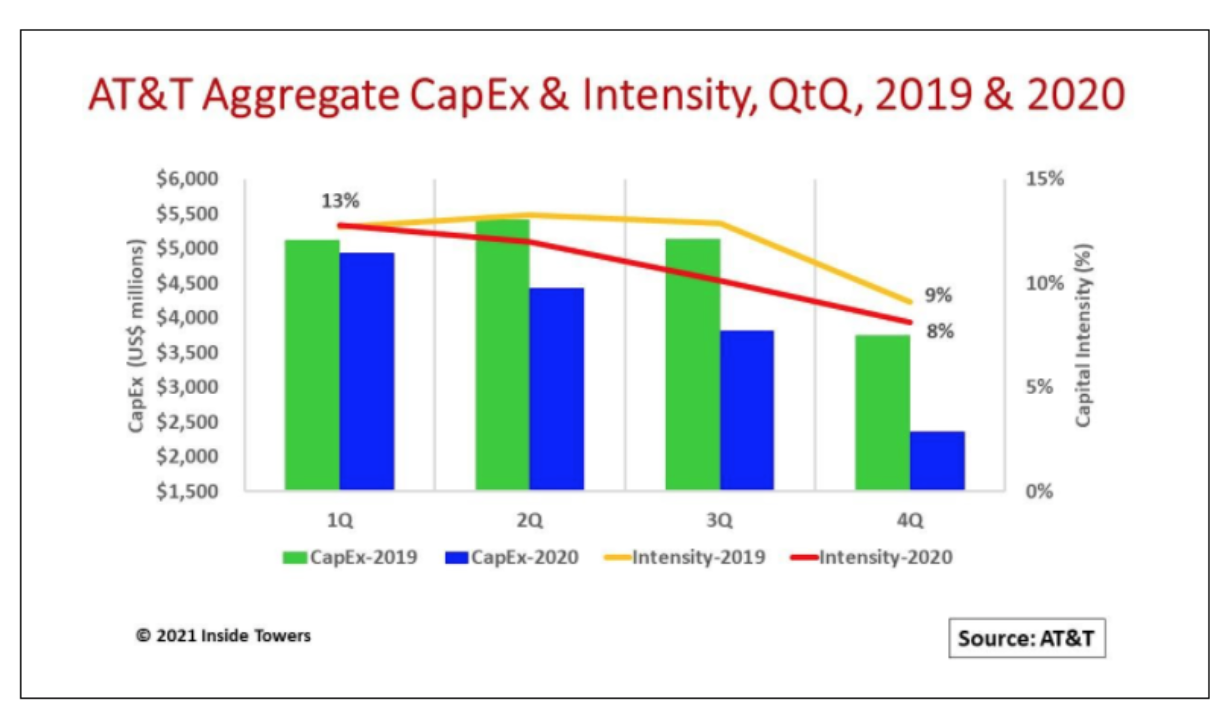

Big picture, the company reported net 2020 consolidated capital expenditures for purchases of property and equipment of $15.7 billion, down 20 percent from $19.6 billion in 2019.

Quarterly capex declined steadily throughout the year. In 2020, AT&T started with 1Q20 investments of roughly $5 billion but dropped to less than half of that in 4Q20.

Note that these levels represent AT&T’s net capex and exclude vendor financing (Ericsson and others) of $3 billion and another $1 billion in reimbursements from FirstNet in each year. These supplementary payments help offset AT&T’s need to fund all network infrastructure expansion from its own coffers.

The key metric is capital intensity, that is, the ratio of capex to service revenues. The demarcation is 15 percent. Any figure above that level indicates network expansion, while figures below 15 percent represent a maintenance mode.

In 2019, AT&T’s consolidated capital intensity (total capex divided by total service revenues) was 12 percent. In 2020, that figure dropped to 10 percent.

On a quarterly basis, the company’s capital intensity started out in 1Q of both years at 13 percent, then nosedived to 9 percent in 4Q19 and 8 percent in 4Q20.

Although AT&T’s results took a COVID-19 hit, the company maintained wireless and fiber connectivity for its residential and business customers. More important, AT&T expanded its customers’ relationships with HBO Max, its new video streaming service where it invested substantial capex. As John Stankey, AT&T CEO puts it, “Our biggest and single most bet … is HBO Max.”

By infrastructure, the Communications segment including Mobility, Broadband, Video and Business Wireline, accounts for 80 percent of both AT&T’s consolidated revenues and EBITDA.

Mobility is the high runner with roughly 50 percent of the Communications’ service revenues and around 70 percent of EBITDA. Wireless service revenues and EBITDA grew less than 1 percent on a year-over-year basis, coming in at $55.5 billion and $30.5 billion, respectively.

The company grew retail postpaid and prepaid connections by nearly 2.3 million to 95.3 million with attractive phone and service package offerings. Connected devices grew by nearly 15 million to 80.8 million. These additions are keeping wireless revenues buoyant and generate substantial cash flows.

AT&T does not break out its capex allocations. However, a proportional analysis and a weighting towards wireless suggests that the company spent roughly $7 billion in wireless network capex in 2020. That figure is down about 7 percent from an estimated $7.3 billion in 2019 and is the lowest level in the past five years. Capital intensity was 11 percent.

Comparatively, Verizon and T-Mobile are investing around $10 billion a year in their wireless networks, at capital intensity levels above 15 percent.

5G is AT&T’s big-ticket item. AT&T keeps it capex down by using dynamic spectrum sharing on its low band 4G LTE network for its 5G nationwide service. With about 1,000 MHz of millimeter wave spectrum in 24 and 39 GHz bands. AT&T currently offers its 5G Plus mmW service, available selectively in 38 cities in 17 states.

Mid-band spectrum remains a gap. AT&T did not bid in the 3.5 GHz CBRS auction but is expected to garner C-band licenses though the final price tag is to be determined.

The company is facing some tough choices when it comes to managing its cash. The elephant in the room is its long-term debt of nearly $154 billion. AT&T generated $43 billion in cash flow in 2020 and had $27 billion in free cash flow after capex. The company will use that FCF to pay dividends first, then pay down debt.

The company guided 2021 capex to $18 billion, net of vendor financing and FirstNet contributions, up almost 15 percent over 2020. Note that it offered similar capex guidance a year ago.

Wireless service revenues are projected to grow 2 percent in 2021. If guidance holds, then expect wireless capex to reach $9-11 billion with capital intensity above 15 percent.

Fiber is the other infrastructure growth area, mainly for broadband connections to residences. Overall broadband connections were flat YoY at 14 million. Within that total, fiber connections jumped 27 percent to almost 5 million as legacy broadband services were displaced.

The company has committed to another 2 million homes passed with fiber in 2021, that will cost nearly $4 billion to deploy.

by John Celentano, Inside Towers Business Editor

Reader Interactions