Lumen Technologies (NYSE: LUMN) is a high-performance fiber phoenix arising from a legacy telephone company.

A little history. Since its 1968 origins as CenturyTel, a rural local exchange carrier, based in Monroe, LA, the company grew by acquiring other RLECs. By 2008, CenturyTel had become one of the largest U.S. RLECs.

It acquired Embarq Communications (formerly United Tel, then Sprint’s wireline operations) in mid-2009, and renamed the merged company, CenturyLink.

In 2011, CenturyLink acquired Qwest Communications (formerly US West, itself a former Bell Telephone company, Mountain Bell, that operated in 14 western and midwest states) to become the third largest wireline company behind Verizon and AT&T. In late 2017, CenturyLink absorbed Level 3 Communications, a global fiber network operator.

All these acquisitions substantially reshaped the company’s customer base, geographic footprint, business strategies and mix of products and services. To articulate its new profile, CenturyLink rebranded itself in 2020, as Lumen Technologies, still based in Monroe, LA.

The company holds a formidable array of assets from which to deliver high-speed, low latency connectivity services for a range of evolving customer data-centric applications. Lumen operates about 450,000 fiber route-miles around the world ranking it among the largest providers of communications services to domestic and global Enterprise customers.

Its terrestrial and subsea fiber long-haul network throughout North America, Europe, Latin America, and Asia Pacific connects to in-country metropolitan fiber networks that the company operates.

Lumen’s global fiber network connects over 180,000 on-net buildings, more than 2,200 public data centers and over 100 edge computing nodes with another 60 planned.

The Lumen platform enables application designs with latency of 5 milliseconds or less between the workload and the endpoint device. The company believes it can reach over 98 percent of U.S. Enterprise customers with that capability.

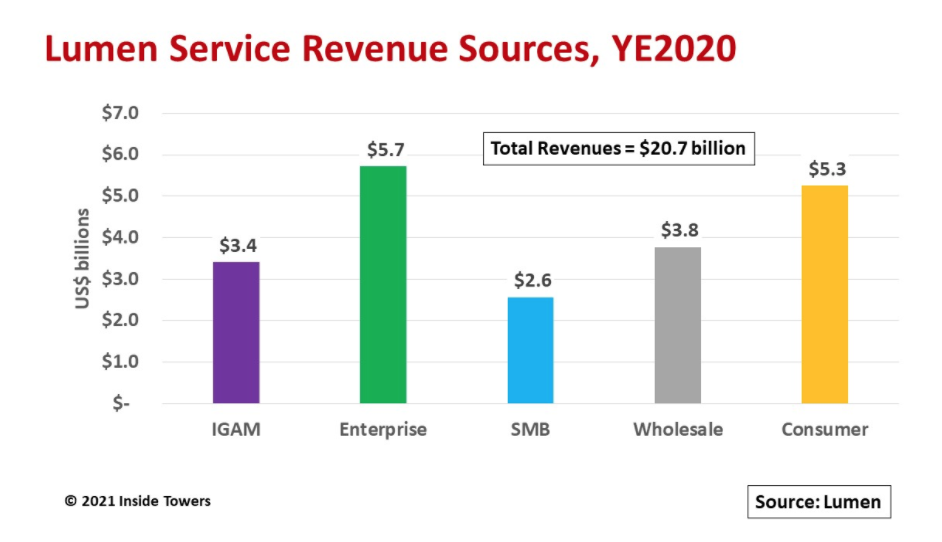

Lumen provides services in over 60 countries, with the bulk of its revenue derived in the U.S. Revenues in 2020 were $20.7 billion, down 3 percent year-over-year as COVID-19 impacted new business and legacy wireline service revenues eroded. Capital expenditures for the year were $3.7 billion.

That revenue total breaks down several ways.

International and Global Accounts Management (IGAM) revenues were $3.4 billion or 16 percent of the total for products and services sold to approximately 200 global Enterprise customers in Europe Middle East and Africa, Latin America, and Asia Pacific.

The Enterprise segment, with $5.7 billion or 28 percent of the full-year total, serves large and regional domestic and global Enterprises as well as the public sector including the U.S. federal government, state and local governments along with research and education institutions.

SMB segment sells to small and medium businesses directly and indirectly through our channel partners, contributing $2.6 billion or 12 percent of revenues.

Wholesale involves selling to other communication service providers in the wireline, wireless, cable, voice, and data center sectors. Wholesale customers range from large global telecom providers to small regional providers which together accounted for $3.8 billion or 18 percent of 2020 revenues.

The Consumer segment serving residential customers contributed $5.3 billion or 25 percent of the 2020 total. This segment includes certain state support payments, Connect America Fund federal support revenue, and other revenue from leasing and subleasing.

At the end of 2020, Lumen had 4.5 million consumer broadband subscribers and roughly 675,000 customers using its Quantum fiber services.

For 2021, Lumen is combining Consumer and SMB segments into a new Mass Markets category. At the same time, it is grouping IGAM, large and mid-market Enterprises, and wholesale customers into a broader Business category.

The company suggests that these changes reflect a better way to deal with customers based on their buying behavior and customer service needs. On a pro forma basis, 4Q20 results comprised 72 percent from the Business category with Mass Markets accounting for the 28 percent balance.

Under the new reporting format, Business products comprise:

- Compute & Application consists of edge cloud services, data center, content delivery network and security services. The company recently signed a deal with T-Mobile for edge computing services. (see, T-Mobile and Lumen Become Edge Partners)

- IP & Data include adaptive networking, hybrid networking, VPN, SDN-based services, and dynamic connections

- Fiber Infrastructure includes dark fiber and optical services, and

- Voice & Other comprise TDM voice and other legacy services.

The company believes it is well-positioned for next generation applications that require highly distributed computing, high performance networking, multi-cloud orchestration and connectivity, and embedded security.

For 2021, Lumen is projecting adjusted EBITDA and free cash flow on par with 2020, and capex in the $3.5-3.8 billion range.

By John Celentano, Inside Towers Business Editor

Reader Interactions