SBA Communications (NASDAQ: SBAC) may have even surprised itself with its 2Q21 results. The company said that Q2 results were ahead of expectations and that growth rates are “going up!”

Site leasing revenues for the quarter came in at $524 million, up nearly nine percent from $482 million in 2Q20. Domestic site leasing revenues account for 80 percent of the SBAC’s total site leasing revenues and were up eight percent year-over-year to $419 million.

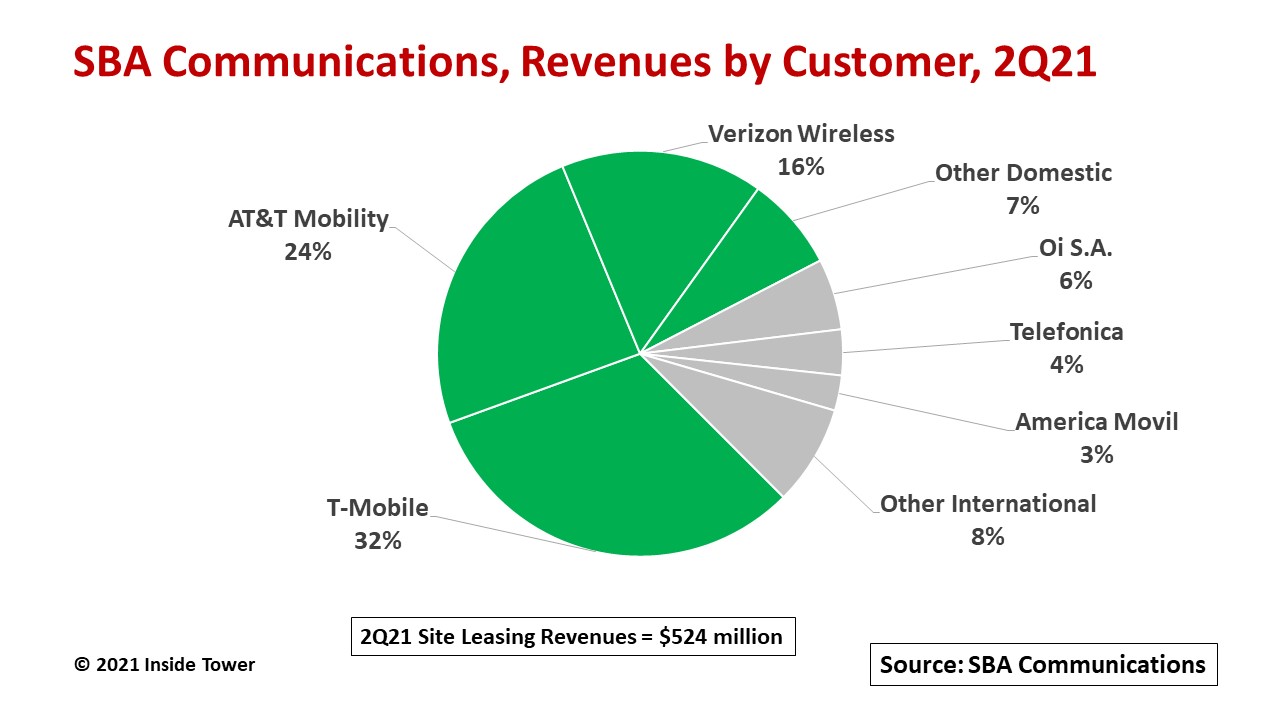

The company said its domestic customers were “extremely active” throughout the quarter with network build and upgrade activity. SBAC pointed out that the main drivers of new leasing activity come from the Big 3 U.S. mobile network operators that account for 72 percent of SBACs global revenues.

Activities included T-Mobile’s nationwide 2.5 GHz Extended Range 5G coverage, Verizon’s site preparations for its upcoming C-band deployments, AT&T’s continuing FirstNet expansion, DISH Network’s readying for its 5G rollout and general coverage expansion work across the board.

SBAC characterized new leasing activities from both DISH and Verizon as a “step function” as both MNOs ratchet up their 5G build plans. For Verizon along with T-Mobile and AT&T, leasing activity is mainly amendments to existing master lease agreements whereas activity with DISH is all new leases. SBAC signed DISH to an MLA in February. SBAC is receiving site development work from DISH but will not see leasing revenues until DISH activates its cell sites in late 2021.

With all this activity, SBAC noted that it signed more new leasing revenue in 2Q21 than it had in any quarter since 2014, creating a near record high backlog of lease and amendment applications. Roughly one-third of its domestic bookings were from amendments and two-thirds from new leases. DISH is driving the new lease volume.

SBAC suggests this backlog will translate into new revenues starting in 4Q21 and continuing into 2022 and beyond. Based on the overall increased activity across its markets, SBAC expects gross organic growth in the mid-to-high single digit range over the next several years.

With strong leasing performance in the quarter, the company raised its full-year 2021 site leasing revenue guidance to $2.08-2.10 billion, a seven percent mid-point increase from $1.95 billion in FY2020. With a growing top line, SBAC is guiding full year Adjusted EBITDA to $1.59-1.61 billion and AFFO to $1.15-1.19 billion.

This activity has pushed up SBAC’s 2Q21 site development revenues to over $51 million, a jump of 107 percent from $21 million in 2Q20. SBAC, like its peers, offers site development services to tenants to assist them in locating on a tower. Site development typically involves site acquisition and zoning in the early stages, then construction as tenant installations get underway.

In line with the increased backlog of leases, SBAC raised its guidance for FY2021 site development revenue to $180-200 million, up 47 percent mid-point increase over the $129 million billed in 2020.

International site leasing revenues grew by nearly 12 percent on a year-over-year basis with 55 percent from amendments and the 45 percent balance from new leases. Sequential leasing revenue improvements came mainly in Brazil and South Africa even as both countries still are dealing with COVID impacts.

Nonetheless, SBAC believes it is well-positioned to benefit from increased investment from mobile network operators in these markets as health and economic conditions improve and new spectrum is auctioned for 4G and 5G development.

SBAC acquired 57 communication sites for $67 million and built 98 towers during the quarter. At the end of June, SBAC owned or operated 33,854 communication sites, with 17,306 or 51 percent located in the United States and its territories, and 16,548 in international markets, mainly Latin America and South Africa.

Total 2Q21 capital expenditures were $108 million, comprising nearly $98 million of discretionary capex (new tower builds, tower augmentations, acquisitions, land and easement purchases).

Discretionary capex included almost $12 million to purchase land and easements, and for land lease renewals. At the end of the quarter, SBAC owned 71 percent of the land under its towers and on the remaining sites had land leases with terms averaging 37 years.

SBAC also spent over $10 million of non-discretionary capex (tower maintenance and general corporate). The company is guiding full-year 2021 discretionary capex, including acquisitions, of $1.45-1.47 billion.

Subsequent to 2Q21, SBAC purchased or agreed to purchase approximately 1,800 communication sites for an aggregate cash consideration of approximately $270 million. That tally includes roughly 400 sites in existing markets.

In a new country development, SBAC acquired approximately 1,400 towers in Tanzania from Airtel Tanzania for about $175 million in cash. The deal was handled through a joint venture with the U.K.-based Paradigm Infrastructure. SBAC expects these acquisitions to close by the end of 2Q22.

The Tanzanian towers have a tenancy ratio of under 1.5 tenants per tower including anchor tenant, Airtel Tanzania. Furthermore, the company has committed to a series of new build-to-suit towers to expand its portfolio in Tanzania over the next five years. SBAC expects these assets to achieve a 15 percent or better cash return on investment on these towers once a second tenant is added.

By John Celentano, Inside Towers Business Editor

Reader Interactions