For T-Mobile (NASDAQ: TMUS), the end of 2Q20, June 30, was Day 1. Since it closed its merger deal with Sprint on April 1, TMUS reported its first full quarter of operation as the integrated company. The results were impressive.

TMUS is now the second largest wireless carrier in the U.S. Its combined base of branded post-paid and pre-paid customers reached 98.3 million connections at the end of 2Q20. Total 2Q20 net customer additions were 1.3 million, bringing total customers to 98.3 million. That tally surpasses AT&T (NYSE: T) with 92.9 million and is second only to Verizon (NYSE: VZ) that leads with 119.9 million connections. The company expects to add another 1.7 to 1.9 million customers in 2H20.

TMUS’s 2Q20 wireless service revenues of $13.2 billion were up 50 percent from $8.8 billion in 1Q20 and up 55 percent from $8.5 billion in 2Q19. Both prior periods represent TMUS-only pre-merger levels.

TMUS’s 5G network buildout and its integration with the Sprint network are the big stories here. Certainly, the company believes that as a pure-play wireless service provider, its network quality and robustness allows it to offer its customers a rich suite of wireless services at a good value.

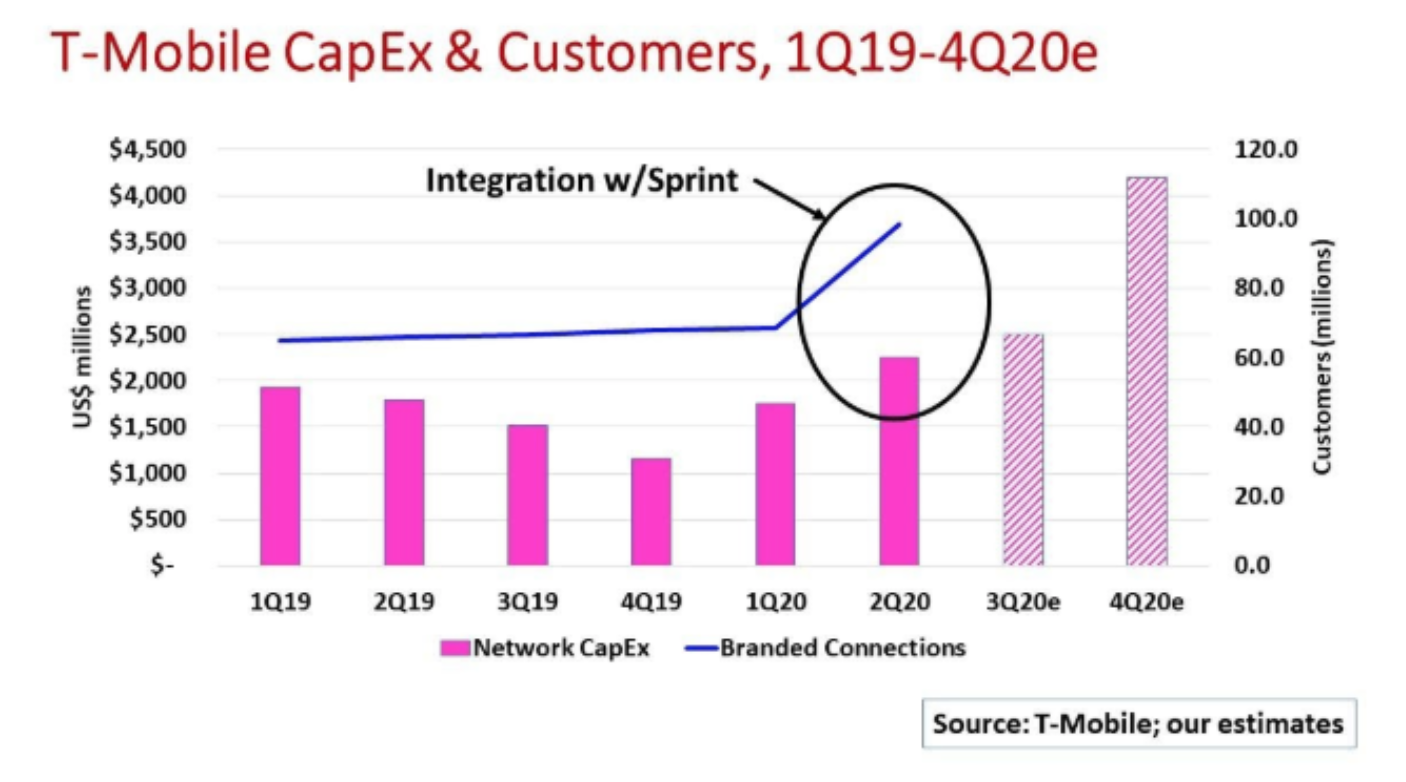

TMUS’s full-year 2019 capital expenditures were $6.4 billion. Spending for the year started at a high point in 1Q19 then declined each quarter as the company slowed network activity in anticipation of approval for its merger with Sprint.

This slowdown created much consternation among TMUS’s equipment vendors and the major tower companies of which TMUS is a leading tenant.

Capex levels in 1Q20 shot up by 52 percent over 4Q19 levels and then jumped another 29 percent in 2Q20. Cumulatively, TMUS invested $4.0 billion in the first six months of 2020, up 8 percent over the $3.7 billion spent in 1H19.

With the merger complete, TMUS is accelerating the pace of its nationwide 5G buildout and network integration. The company provided 2H20 capex guidance of $6.5 to 6.9 billion. Capex in 3Q20 is expected to be “similar” to 2Q followed by a big ramp in 4Q20.

Taking the midpoint guidance, TMUS’s overall capex for 2020 will be around $10.7 billion, ahead of its peers.

With Sprint, TMUS gained a significant spectrum position to deploy 5G across multiple spectrum bands, the so-called “layer cake” of low, mid, and high bands that facilitate high-performance coverage and capacity.

TMUS launched 5G in mid-2019 using millimeter wave spectrum. Since December 2019, the company has been building a nationwide 5G network on low-band 600 MHz in tier two markets such as Norfolk, Richmond, Topeka, and Buffalo.

At the same time, TMUS uses mid-band 2.5 GHz for 5G in major metro markets such as New York, Philadelphia, Chicago, Houston, Los Angeles, Washington D.C., Atlanta, and Dallas.

TMUS says its 5G network now is live in all 50 states and Puerto Rico, covering more than 250 million POPs or more than 75 percent of the U.S. population in over 7,500 cities and towns.

The company addressed tower companies’ “misinformation” remarks suggesting their own 1H20 performance was off because of delays associated with TMUS’s network integration. TMUS countered that it was moving “full speed ahead,” leveraging synergies with existing infrastructure that allowed for “site avoidance” and associated costs.

When the Sprint deal closed, TMUS expected full integration of the two networks to take about three years and $15 billion to complete. With permitting, building, and network deployment processes well underway, TMUS is on track to combine the network assets of both companies.

The company reiterated its network integration strategy: deploy the Sprint spectrum on the new T-Mobile anchor network; migrate Sprint customers onto the new T-Mobile network; and, decommission legacy Sprint network sites.

TMUS made clear that there is a lot of work to be done to achieve the significant operating and financial synergies that the merger promises. Equipment vendors, tower companies and contractors all have a significant role.

The company expects merger-related costs in 2H20 to be $800 million to $1 billion before taxes.

By John Celentano, Inside Towers Business Editor

Reader Interactions