No one said tower company CEOs have it easy. In the past 20 years, demand for wireless infrastructure capacity has expanded dramatically as smartphones have proliferated and mobile data demand has grown exponentially.

The Big 3 U.S. towerco CEOs must meet that demand to keep their prime wireless carrier tenants happy.

At the same time, they must run their publicly held businesses profitably and deliver solid returns to expectant shareholders. When goals are met, they are compensated very well.

James Taiclet of American Tower (NYSE: AMT) is a notable story. Mr. Taiclet became AMT’s President and CEO in 2001 and ran the company until June of this year when he left for Lockheed Martin. Thomas Bartlett, AMT CFO is the new CEO.

When Mr. Taiclet became CEO, AMT operated only in the U.S. and had a market capitalization of $2 billion.

In the nearly 20 years under his leadership, AMT grew to become the largest independent tower company in the world, owning and operating 180,000 towers in 19 countries.

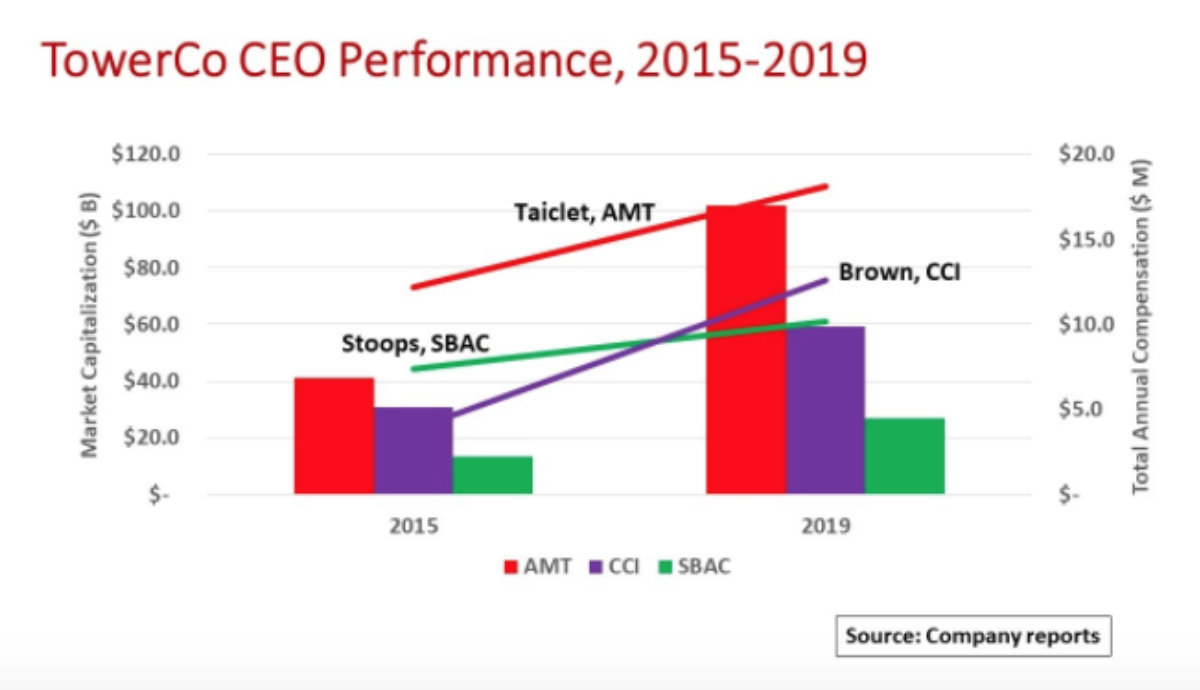

Significantly, AMT’s market cap topped $100 billion by the end of 2019.

Since 2015, AMT’s revenues and adjusted EBITDA grew at a 12 percent CAGR to $7.6 billion and $4.7 billion, respectively. Adjusted funds from operations (AFFO) grew by 65 percent or a 13 percent CAGR to $3.5 billion.

These metrics make AMT the leading tower company in the U.S. and ahead of its global peers.

Mr. Taiclet’s annual compensation grew at a 10 percent CAGR since 2015, reaching $18.1 million in his last year at the company. His annual compensation package comprised a $1.1 million base salary along with substantial stock awards and non-equity incentives for achieving specified goals.

High performance is rewarded. Mr. Taiclet left the company with accumulated AMT stock holdings valued at $120 million.

Jay Brown joined Crown Castle (NYSE: CCI) in 2000. Having held numerous corporate positions, he was promoted from CFO to President and CEO in mid-2016.

Under Mr. Brown’s watch, CCI’s revenues and adjusted EBITDA each grew by more than 55 percent to $5.8 billion and $3.3 billion, respectively, at a 12 percent CAGR by 2019. AFFO grew by 64 percent to $2.4 billion. CCI’s market cap has more than doubled to over $59 billion.

Mr. Brown’s annual compensation grew proportionally faster than the company’s overall performance since mid-2016. According to the company’s SEC DEF 14A filings, his base salary grew from $638,000 to $986,000.

With stock awards, non-equity incentives and other benefits, his total annual compensation grew to $12.6 million in 2019, a 71 percent increase from mid-2016.

Mr. Brown’s current CCI stock holdings are valued at around $43 million.

The CCI management team has taken heat lately from Elliott Management, an activist investor that claims the company is underperforming. (see, Crown Castle’s Fiber Strategy Under Fire – Fair or Not?)

SBA Communications’ (NASDAQ: SBAC) President and CEO, Jeffrey Stoops has headed the company since 2002.

The smallest of the Big 3, SBAC’s revenues, adjusted EBITDA and AFFO grew at a modest mid-single digit CAGR pace since 2015, reaching $2 billion, $1.4 billion, and $972 million, respectively in 2019.

Under Mr. Stoops’ guidance, SBAC’s market cap doubled to $27 billion in the 2015-2019 period. Over that same interval, Mr. Stoops’ base salary grew from $750,000 to $980,000. With stock awards, options awards, non-equity incentives and other benefits, his 2019 salary totaled $10.2 million, up 38 percent from $7.4 million in 2015.

With his long tenure, Mr. Stoops’ has accumulated SBAC stock holdings valued at $203 million.

It’s a tough job but somebody has to do it. Still, it is hard to gauge appropriate compensation.

Note that for every $100 invested in 2015, AMT returned $256 while CCI and SBAC both returned roughly $218 in 2019.

If shareholders are satisfied with the returns that these CEOs are delivering, then it’s a fair deal.

By John Celentano, Inside Towers Business Editor

Reader Interactions