U.S. Cellular (NYSE: USM) is the quintessential regional wireless carrier. Headquartered in Chicago, USM is the fifth largest wireless carrier in the U.S. behind the four Tier 1 national carriers (T, VZ, TMUS, S). It provides high-quality network services in small town and rural America throughout states in the Midwest, the Pacific Northwest and northern California, the East and Northeast.

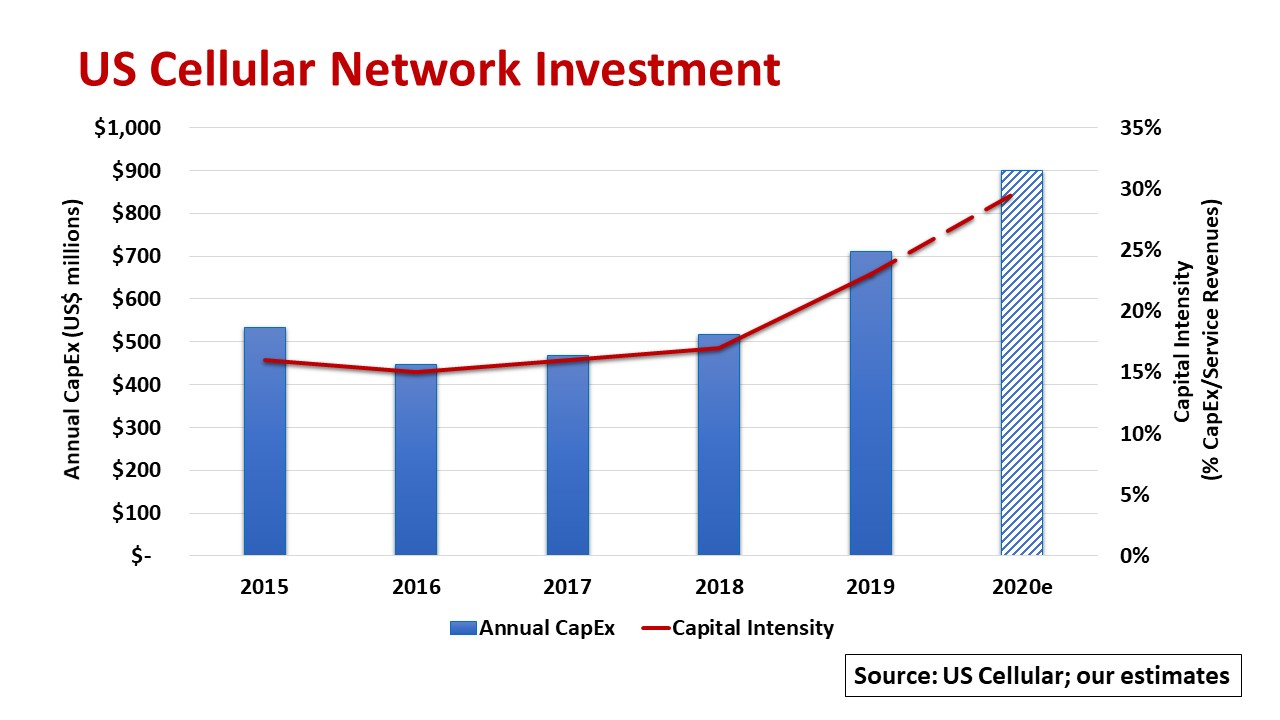

USM operates at roughly one-tenth the scale of the Tier 1 carriers covering a population of 31 million with nearly 6,600 cell sites and serving a customer base of more than 4.9 million connections. Service revenues are $3 billion with annual capital expenditures under $1 billion, typically $500-600 million.

USM is often the only game in town even with competition in every market. It relies on network modernization and outstanding customer care to differentiate itself in providing high-quality pre- and post-paid wireless services to its consumer, business and government accounts.

That is not to say that USM’s network is a laggard. On the contrary, USM’s network is state-of-the art and fully compatible with the Tier 1 networks. USM relies on Ericsson and Nokia for its radio access network (RAN) and Core switching systems, and recently added Samsung to supply next generation radios. These are the same wireless equipment vendors used by the Tier 1 carriers. With agreements across the board, USM facilitates seamless cross-network roaming capabilities.

USM already has substantial spectrum holdings in low-band (600/700/800 MHz), mid-band (1900 MHz, AWS [1700/2100 MHz]) and high-band (24/28 GHz mmW) frequencies. It plans to acquire more high-band mmW spectrum to give it the latitude to meet an expanding suite of high-value 5G services.

USM maintains significant network investments. Annual capex hovered around $500 million between 2015 and 2018, with capital intensity at or above the 15 percent threshold for network modernization and growth. In 2019, USM’s capex jumped to $710 million as the company expanded its 4G LTE network services and began its 5G build. The company again has raised its 2020 capex guidance to $850-950 million, a 32 percent CAGR since 2018. With service revenues remaining flat, capital intensity spikes up to 30 percent in 2020, indicating substantial network expansion.

USM expects to launch commercial 5G services in selected markets in 2020. The company points out that wherever 5G is deployed, its customers on the existing 4G LTE network will experience faster network speeds due to the network modernization efforts.

About one-third of the company’s 2019 capex went to 5G deployments at 600 MHz. Another estimated 12 percent went towards implementing Voice over LTE (VoLTE) technology with the balance for enhanced network capacity, network operations and back office systems. USM sees VoLTE enabling customers on its 4G LTE network with enhanced voice and data services. USM now offers VoLTE to nearly 70 percent of its customers with deployments in additional operating markets expected in 2020 and 2021. USM’s 5G capex for 2020 is expected to account for 40 percent of the overall guidance, with the bulk for 600 MHz wide area deployments and about a quarter of the total 5G allocation towards new mmW installations for both mobility and fixed wireless applications.

USM has a lot going on for a regional carrier. More to come, that’s a for sure!

By John Celentano, Inside Towers Business Editor

Reader Interactions