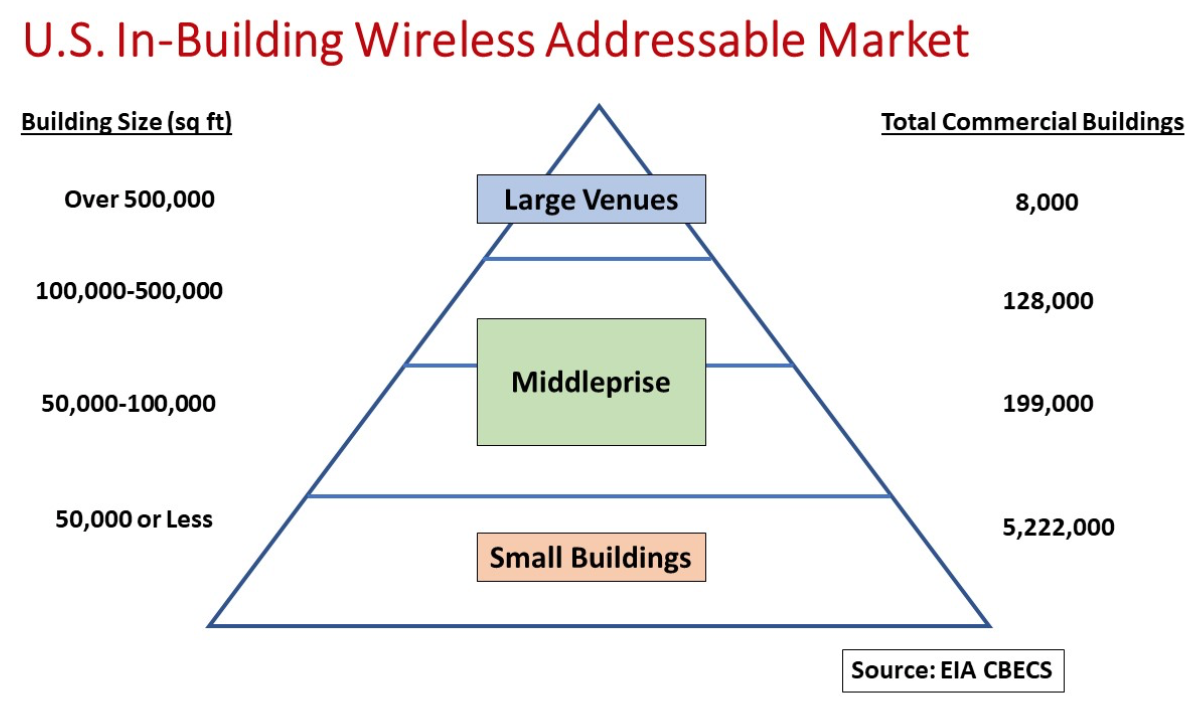

There are nearly 5.6 million commercial buildings in the U.S., according to the DoE Energy Information Administration’s Commercial Buildings Energy Consumption Survey. From a wireless perspective, an oft-cited statistic is that some 80 percent of all mobile calls originate or terminate inside buildings.

People making calls from inside a building typically connect to nearby outdoor macrocells. Yet building materials are not wireless-friendly. Steel, concrete and energy saving glass windows attenuate or block outside RF transmissions. Elevator shafts and interior walls also obstruct or degrade two-way wireless connections.

The solution is an in-building wireless system that transmits the same outdoor cellular carrier signals inside. IBW systems include distributed antenna systems, small cells and bi-directional amplifiers or signal boosters. The type of IBW system selected is determined by many factors – building size and structure, number of devices served, traffic patterns, single or multiple carrier signals and more.

The cellular carriers themselves have deployed, or are planning to deploy, DAS equipment at most of the country’s 8,000 large venues that average 885,000 square feet. Attractive sites with high mobile communications traffic concentrations include airports, stadiums, arenas, and convention centers.

On the other end of the scale, most of the 5.2 million small buildings averaging 16,000 sf do not need an IBW system, instead relying on outside connections. If better reception is required, affordable signal boosters usually remedy the situation.

A second tier of buildings, dubbed the Middleprise, is the prime target for IBW suppliers. The Middleprise is a mix of high-rise office and residential buildings, educational campuses, healthcare facilities (hospitals/medical centers), shopping malls and warehouses comprising 327,000 buildings in the 50,000-500,000-sf range.

The cellular carriers have articulated that they cannot afford to install IBW systems in that many buildings. Rather, the onus is on the building owners or property managers to seek their own solutions to improving indoor mobile communications even though they must coordinate with carriers to use their frequencies.

The good news is that neutral host operators and systems integrators are assisting building owners in navigating the technical complexity to deploy IBW systems.

Who pays and how much? Available funding mechanisms from neutral host leasebacks to vendor financing help lower the total cost of ownership for building owners.

There are downward pressures on that cost. Technical advances such as CBRS 3.5 GHz spectrum is available for Middleprise establishments to create their own private LTE networks without being dependent on carrier frequencies. (see, Strategies for Securing CBRS 3.5 GHz Spectrum)

New Open RAN concepts can change the economics of campus deployments where multiple buildings can be served from a central core. Equipment costs come down over time through manufacturer cost-reductions and competitive pressures.

What is the total addressable market value for the Middleprise? Factoring in the number of buildings, square footages, price per square foot for different IBW systems, equipment price declines and considering that not every building will be equipped, a $50 billion estimate may be in the ballpark.

A timeframe over which Middleprise IBW deployments play out remains to be seen, however. A 10-year or longer window is not unrealistic. Low double-digit IBW penetration has already been achieved.

Certainly 2020 is an off year. To date, the pandemic has slowed much IBW installation activity because access to many buildings is restricted. The hope is that activity ramps up into 2021 but target sectors like hospitality, healthcare and education may take a different tact post-COVID-19.

Public safety communications systems are not included in these figures although the growth trajectory is similar. (see, Programmable RF Systems Advance Public Safety Communications)

With sizable market potential, IBW system vendors have opportunities to address building owner issues, needs and wants while educating these customers on the amenity benefits that reliable IBW systems deliver.

By John Celentano, Inside Towers Business Editor

Reader Interactions