Uniti Group (NASDAQ: UNIT) is a pure play fiber company after selling off Uniti Towers and jettisoning Talk America, the consumer CLEC business it gained from Windstream.

UNIT, based in Little Rock, AR, is a real estate investment trust that is one of the largest independent fiber providers in the country with a national network 124,000 route-miles and 6.7 million strand-miles of fiber, 2,400 small cell locations and other communications real estate across 42 states.

UNIT’s growth strategy utilizes an operating company/property company model. Typically, when a business puts its real estate and other infrastructure assets into an OpCo/PropCo structure, the OpCo becomes the tenant, making rental payments on the real estate assets to the PropCo, which acts as the landlord and leases the spun-off assets back to the OpCo in a sale-leaseback transaction.

UNIT manages its business under its Uniti Leasing and Uniti Fiber divisions.

Uniti Leasing owns, acquires, constructs and leases shared communications real estate assets including fiber, coax cable and copper networks to communication service providers. The division leverages the sales-leaseback model by leasing communications real estate back to the CSPs in both exclusive and non-exclusive shared tenant arrangements.

By virtue of the fiber assets transferred with the bankruptcy settlement, Windstream is Uniti Leasing’s largest customer with most of the leased fiber assets located in the Midwest and southern states. Uniti Leasing also offers fiber transport capacity on its coast-to-coast long-haul routes.

Uniti Fiber offers a variety of network connectivity options to businesses in small community and rural markets where it is hard to find reliable, scalable, and affordable fiber solutions.

The division’s fiber infrastructure solutions and services include cell site backhaul and small cell connectivity for wireless carriers, and Ethernet, wavelengths and dark fiber for wireline carriers, Enterprises, educational institutions, and government agencies.

With a combined focus on dense urban and metro areas along with Tier 2 and Tier 3 markets, Uniti Fiber is developing network solutions across the country. To date, Uniti Fiber’s growing infrastructure spans 1.3 million fiber-strand miles, connecting over 16,300 customer locations with local access to 2,600 municipalities and dozens of utilities.

Through 3Q20, UNIT reported consolidated revenues of $792 million, flat compared to results over the same period in 2019.

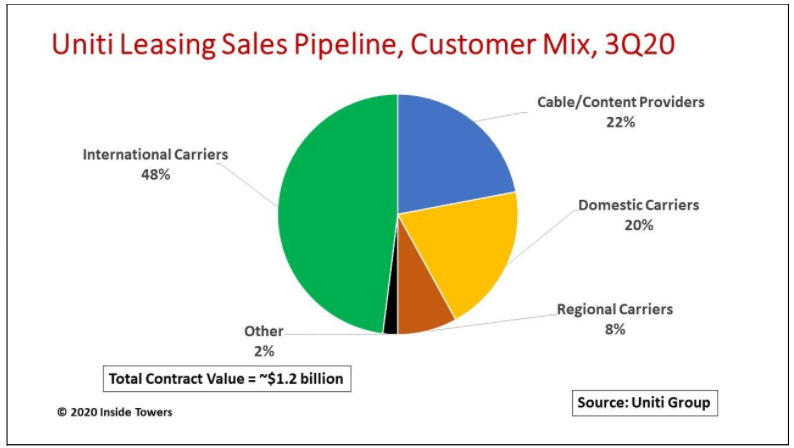

Uniti Leasing accounted for $552 million or 70 percent of the total and is growing 4 percent year-to-year. At the end of 3Q20, Uniti Leasing reported a sales pipeline worth nearly $1.2 billion comprising close to 130 opportunities from various CSPs.

Uniti Fiber came in at $233 million or 29 percent of the total, down 1 percent compared to 2019, in part reflecting some impacts from COVID-19 on carrier customer activity.

Uniti Group CEO Kenny Gunderman commented, “We continue to see strong demand for our wireless and non-wireless service offerings at Uniti Fiber while focusing on meaningful lease-up of our major wireless anchor builds. At Uniti Leasing, we’re also driving incremental lease-up on our national fiber network of 124,000 route miles.”

The company no longer reports revenue from its tower and consumer CLEC businesses.

In November, Uniti entered into a strategic OpCo/PropCo agreement with Cleveland, OH-based fiber network operator Everstream for $135 million upfront. The deal includes fees of about $3 million a year with a 2 percent annual escalator over the initial 20-year term of the indefensible right of use (IRU) lease agreements.

UNIT also will establish two 20-year IRU agreements to lease Everstream 220,000 strand miles of UNIT-owned fiber across 10,000 route miles in eight states within the Northeast and Midwest, including 165,000 strand miles of fiber that UNIT acquired as part of the Windstream bankruptcy settlement.

Furthermore, UNIT agreed to sell Everstream a portion of Uniti Fiber’s Northeast operations and certain dark fiber IRU contracts also gained from Windstream.

Gunderman adds, “… we’re replacing actively managed lit services revenue with passively managed dark fiber revenue. This not only extends the average contract term from approximately four years to 20 years but also improves the average margins from 73 percent to 100 percent and virtually eliminates any churn risk.”

By John Celentano, Inside Towers Business Editor

Reader Interactions