UScellular (NYSE: USM) has strategic initiatives and priorities underway that position the company to compete in its operating area while driving long-term growth.

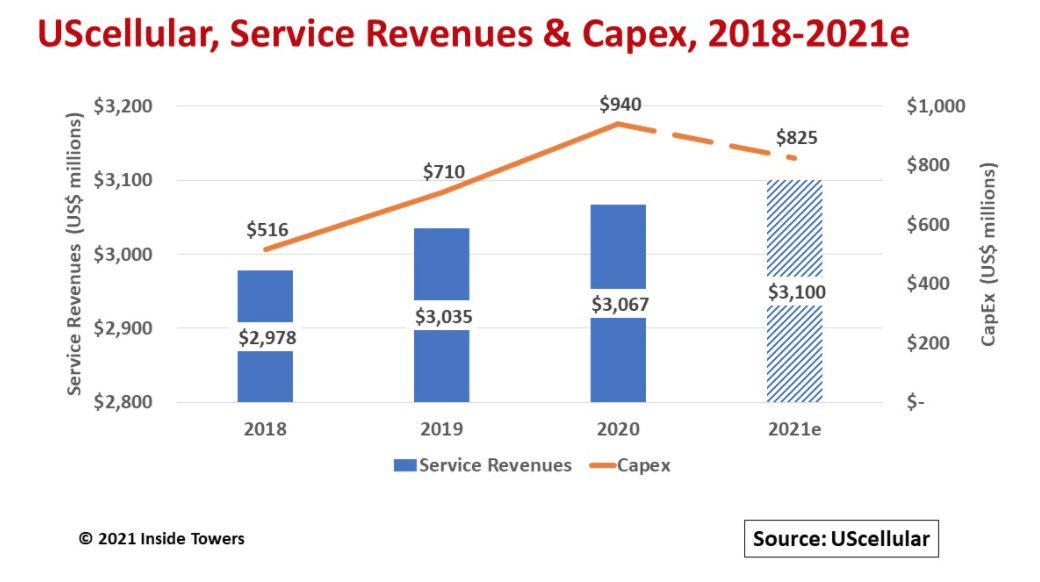

The company reported 1Q21 wireless service revenues of $771 million, up 1 percent from $762 million in 1Q20. Adjusted EBITDA for the quarter was $302 million, up 8 percent on a year-over-year basis. USM is guiding 2021 mid-point service revenues and adjusted EBITDA to $3.1 billion and $1.8 billion, respectively.

Capital expenditures of $125 million in 1Q21 were down nearly 50 percent from $236 million in 1Q20. USM’s for full-year 2020 reached $940 million, the highest in its history, for 5G and network modernization.

The company expects to invest another $825 million in 2021, down 12 percent YoY. Of that total, USM is allocating over 60 percent of 2021 capex to 5G and capacity expansion as it competes with the Tier 1 mobile network operators in its major markets.

The company’s initial 5G coverage layer uses “clean” low-band spectrum. This means USM is initially deploying 5G only on low-band 600 MHz spectrum that is not used for other purposes such as 4G LTE. With 600 MHz, USM’s 5G now is available “to some degree” in 18 states of its 21-state operating area.

The company is trialing 5G in millimeter wave spectrum for fixed wireless access applications. USM holds 425 MHz of 28 GHz spectrum along with 100 MHz in both 24 and 39 GHz.

Three FWA test markets are showing promising results. Tests to date have achieved average download speeds of close to 1 Gbps speeds over a 4-mile line-of-sight hop. USM expects to launch service pilots in those markets by 3Q21.

USM added significantly to its current mid-band AWS (1.7/2.1 GHz) and PCS (1900 MHz) spectrum holdings with gains in both the FCC C-band (3.7 GHz) and CBRS (3.5 GHz) auctions. With CBRS, the company spent $13.5 million for 243 10 MHz Priority Access Licenses in 80 counties, mainly in its 21-state operating area.

As the fourth highest C-band auction bidder behind the Tier 1 MNOs, USM invested $1.2 billion for 254 20 MHz licenses in 99 partial economic areas, again mostly in its 21-state operating footprint. USM will have an average of nearly 60 MHz in each PEA where it won licenses.

Note that these licenses are all in the C-block (C2, C3, C4) which will not be cleared before December 5, 2023. USM will commence 5G deployments using C-band in 2024. The company notes that when C-band is combined with CBRS, it will have 5G mid-band spectrum across nearly all its operating footprint.

Towers are another area in which USM is competing. As one of the few MNOs that still owns towers, USM operated 4,270 towers at the end of 1Q21.

USM considers its towers as a strategic asset that it could monetize at some point if it needed to raise capital. For now, towers are a revenue source. For 1Q21, the company reported 1,917 colocation tenants and site leasing revenues of $20.3 million, up from $18.7 million YoY. Tower occupancy averages 1.45 tenants per tower.

The company relies on its towers to control or reduce its own operating costs since there is no review and approval process to install new radios and antennas or make modifications.

At the same time, the company is making co-location on its towers more appealing to prospective tenants. For instance, it is reducing the RAD center space it occupies for its equipment to make more tower space available to tenants.

USM has also streamlined the permitting and licensing process for both new installations and future tenant equipment adds, moves, and changes.

At the same time, the company is willing to share infrastructure assets at towers to attract new tenants, helping them with both installation capex and operating costs. Infrastructure assets available for sharing include equipment shelters, backup diesel generators, and backhaul facilities.

In April, USM signed a long-term tower master lease agreement with DISH Network. The company does not expect the deal to yield site leasing revenues before 2022. While details were not disclosed, USM suggests that its infrastructure sharing proposition is attractive to tenants like DISH.

By John Celentano, Inside Towers Business Editor

Reader Interactions