The FCC has yet to approve the stock and cash deal between Time Warner and AT&T, but expectations for success are high on both sides. While Time Warner stock has experienced almost a six percent increase since the agreement was made public, AT&T anticipates the addition of the media company’s premium television channels to its over-the-top video streaming service, DirecTV Now, will attract even more wireless customers.

Analysts indicate the expectations should be no surprise. Although other video streaming companies, such as Netflix and Amazon, make up nearly 75 percent of the over-the-top subscribers, AT&T would have an edge in the business as it transitions from distributing media, to distributing and creating it. Media outlets give AT&T a means to diversify its wireless business. Market Realist reports, “AT&T’s Entertainment business is becoming increasingly important for the company as indicated in the company’s recent 3Q16 results. It had revenues of $12.7 billion in fiscal 3Q16 with video or ad sales making up 71.0 percent of the segment’s revenues.”

According to a recent publication, Market Realist cited reports announcing mobile data traffic is expected to increase around 40 percent annually over the next four years, while the number of households paying for television subscriptions is predicted to decline. While the full effects remain to be seen, AT&T hopes these homes increase the data usage on its wireless network as they switch to on demand video streaming, even to the point of requiring further infrastructure.

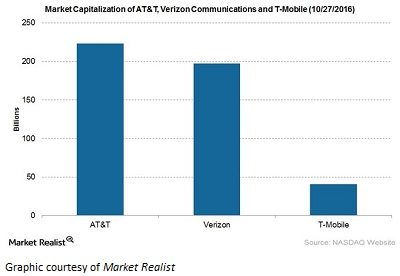

Despite potential changes, stock prices have remained steady for AT&T. Steady 3Q16 reports are in line with last year’s numbers and this year’s estimates have increased share value. As of October 27, AT&T’s market capitalization was significantly higher than its major wireless competitors, Verizon Communications and T-Mobile. Its $223.1 billion easily surpasses Verizon’s $197 billion and T-Mobile’s $40.8 billion. However, AT&T is trading at this year’s price-to-earnings multiple of ~12.8x, which is higher than Verizon’s ~12.4x.

November 3, 2016

Reader Interactions