Verizon (NYSE: VZ) presented a positive outlook for revenues and earnings through year-end 2020 and into 2021. Its 3Q20 operating metrics improved even as COVID-19 impacts persisted.

In its second full quarter under COVID-19, nearly all its retail stores have reopened albeit with slower foot traffic and protective safety measures in place. Mobile device and equipment sales have picked up. Service revenues rebounded from a dip in 2Q20 as the economy started opening and more customers upgraded to Unlimited Premium and bundled service plans.

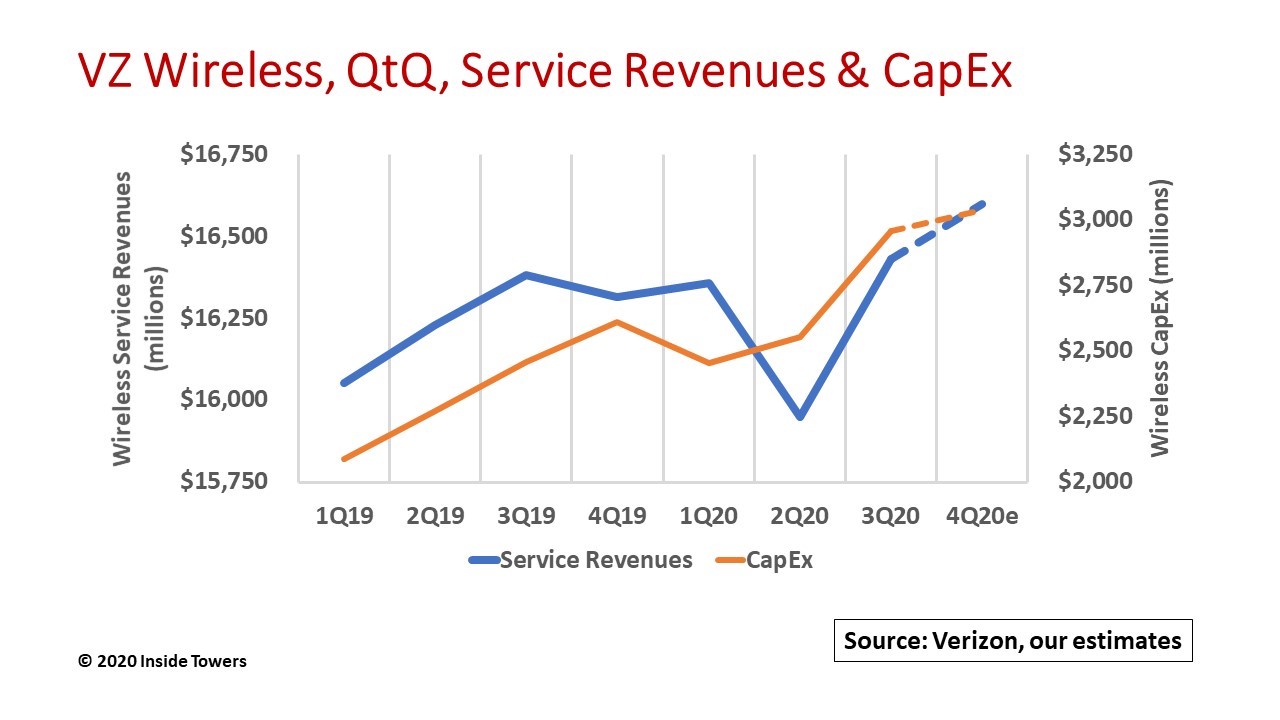

Wireless service revenues in 3Q20 were $16.4 billion, up 3 percent from $16.0 billion in 2Q20 but flat with 3Q19.

We estimate that VZ’s wireless capital expenditures for 3Q20 were roughly $3 billion, up 16 percent sequentially over 2Q20 and up 20 percent over $2.5 billion in 3Q19.

Total retail connections increased nearly two percent to 120.3 million. Postpaid retail connections account for 97 percent of the total with prepaid connections making up the balance. The acquired Tracfone accounts will not be added to the prepaid tally until that deal closes in mid-2021. (See, Puzzling Over Verizon’s Tracfone Deal)

VZ’s current network build initiatives are intended to fuel its growth over the next three to five years. The company is executing on what it refers to as its ‘Network as a Service’ strategy that encompasses several key elements.

First and foremost, VZ continues to build out its 4G LTE network. It is augmenting the 4G LTE network using the 34 MHz of 3.5 GHz CBRS spectrum for which it spent $1.9 billion in FCC Auction 105 for 557 Priority Access Licenses covering 140 million POPs.

VZ recently turned up its 5G Nationwide service that rides on the 4G LTE frequencies utilizing Dynamic Spectrum Sharing and the 4G Core. 5G Nationwide currently covers more than 200 million POPs in over 1,800 towns and cities across the country. The company will move to Standalone 5G in late 2021.

VZ has installed millimeter 5G Ultrawideband small cells for mobility in 55 cities and 5G Home fixed wireless access service in eight cities to date. 5G UWB is also installed in 43 stadiums and arenas, and at seven airports.

For now, the company is not saying how many small cells it is installing other than it is on pace to deploy “five times” more small cells in 2020 compared to 2019. (See, Verizon 5G Rollout Gains Traction)

The introduction of four iPhone 12 models that operate on mmW frequencies are key 5G ecosystem elements. With attractive purchase incentives, VZ expects iPhone 12 to drive 5G adoption.

The company is leveraging its One Fiber deployment plan for 4G and 5G backhaul and fiber-to-the-premise applications outside its base operating territory in Northeast states.

In addition, VZ is offering mobile edge computing capabilities in partnership with Microsoft Azure and Amazon Web Services to select vertical markets such as healthcare and education. The company has five MEC centers active now, going to 10 by year-end 2020.

All this network infrastructure requires sustained, high level capex. The company upped its full year 2020 capex guidance suggesting that network investment would come in at the high end of its $17.5-18.5 billion guidance range.

Of that total, we estimate that Wireless will account for about $11 billion. Given the spending to date, 4Q20 capex likely will be around $3 billion. Capital intensity is running 17-18 percent as the company is in this rapid expansion mode.

In its 3Q20 earnings call, CEO Hans Vestberg emphasized that he is pushing his engineering and technical staff to move as quickly as possible to get the 4G, 5G and fiber network elements in place so that the company can begin monetizing that infrastructure.

VZ expects to realize revenues from 5G mobility services in 2021, and 5G and MEC combined applications by 2022.

By John Celentano, Inside Towers Business Editor

Reader Interactions