Vodafone Group PLC (NasdaqGS: VOD) in its FY1Q21 earnings call, formally introduced Vantage Towers, the standalone company that Vodafone formed to take over and manage Vodafone’s tower assets across its European markets. (see, Vodafone Creates Europe’s Largest Tower Company)

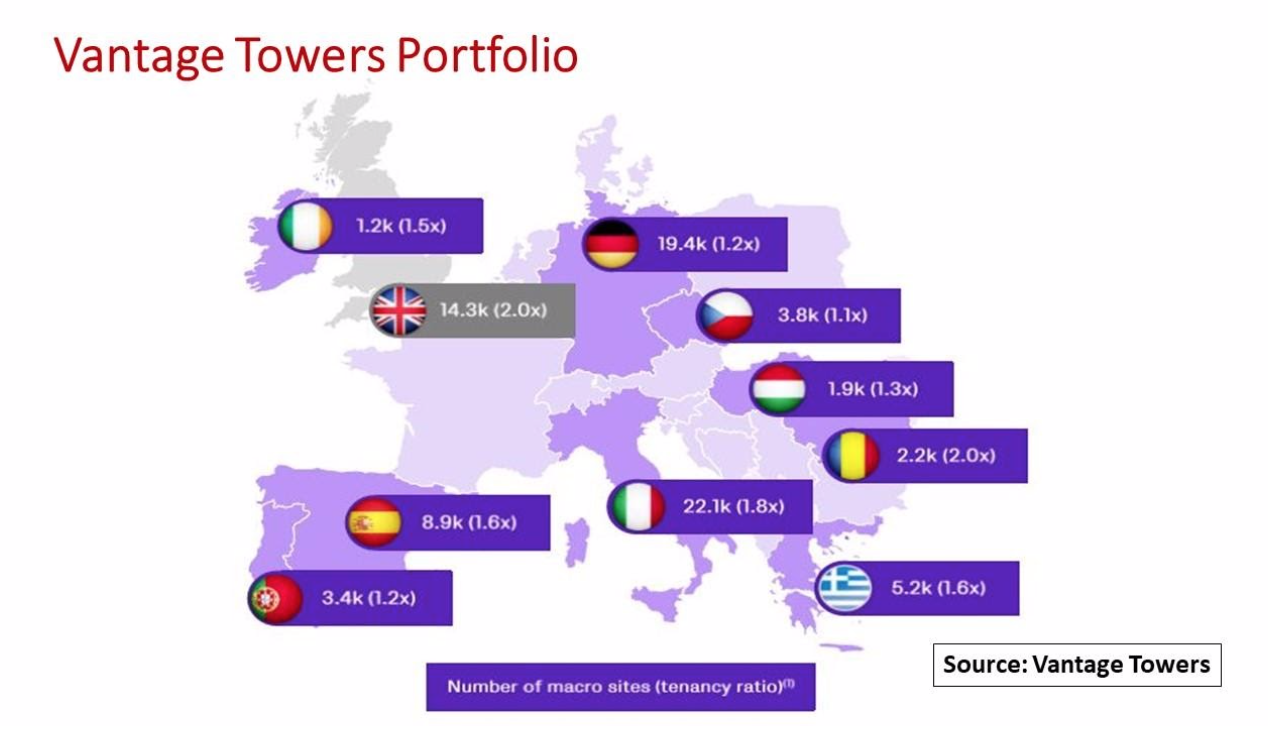

Vantage Towers, based in Dűsseldorf, Germany, becomes Europe’s largest and most geographically diverse tower company with a portfolio of over 68,000 macro towers across nine countries. In almost all these countries, the company holds either a #1 or #2 market position, as measured by the number of towers.

Vantage Towers has controlling interest in its tower assets in eight markets: Germany, Spain, Greece, Portugal, Czech Republic, Romania, Hungary, and Ireland. Referred to as ‘Consolidated Vantage Tower,’ this group accounts for 46,000 towers of which Germany is the largest market with 19,400 sites.

In one transaction, Vantage Towers Greece becomes the largest tower company in Greece with a combined portfolio of 5,200 macro towers with a 1.6 tenancy factor contributed by wireless carriers, Vodafone Greece and Wind Hellas. Each carrier committed to a new long-term Master Lease Agreement under which Vantage Towers Greece will be their preferred supplier of built-to-suit towers. Each carrier will be an anchor tenant on 250 new sites (500 in total) that Vantage Towers Greece will construct over a five-year period ending in January 2026.

Vantage Towers also owns a 33.2 percent equity stake in Infrastrutture Wireless Italiane S.p.A (INWIT) in Italy. Telecom Italia owns the balance. The two carriers have co-controlling rights in INWIT. Adding INWIT’s 22,100 towers brings Vantage Towers’ portfolio to 68,100 towers.

To gauge its operating performance, Vantage Towers presented selected pro forma financial results as though it had been operating for the full fiscal year 2020 which ended on March 31.

Consolidated Vantage Towers revenue was €950 million (US$1.1 billion) and adjusted EBITDA of €523 million (US$609 million). The group’s adjusted Operating Free Cash Flow (adjusted EBITDA less maintenance capital expenditure) was €494 million (US$575 million), on maintenance capex of €29 million (US$34 million) or 3 percent of revenue.

Maintenance capex is applied to maintain and operate existing towers and other passive site infrastructure. It is distinct from discretionary capex that is invested for new site developments or other growth initiatives.

In another potential deal, the company could add the 14,300 sites managed by UK-based Cornerstone Telecommunications Infrastructure Limited (CTIL) in which Vodafone has a 50% equity stake. Incorporating CTIL assets would bring Vantage Towers’ total base to 83,400 towers.

Vantage Towers believes it has an attractive operating model. The company enjoys secure, predictable cash flows assured through long-term, inflation-linked MLAs with highly rated tenants.

Vodafone, as Vantage Towers’ anchor tenant, represents about 90 percent of the company’s FY20 pro forma revenue. Vantage Towers benefits from a solid customer base with an average of 1.5 tenants per tower across the portfolio, including INWIT.

In all markets, Vantage Towers sees compelling structural growth opportunities being driven from several aspects: wide-area coverage obligations by its wireless carrier tenants, new cell sites that increase network density to meet escalating mobile data demand, and the rollout of 5G across Europe.

Furthermore, the company recognizes the potential to offer more services to its tenants such as wholesaling fiber optic access for backhaul and standby power generators.

Where acquisition opportunities arise, Vantage Towers will consider expanding its portfolio albeit from a “disciplined M&A” approach.

By John Celentano, Inside Towers Business Editor

Reader Interactions