Comcast (NASADQ: CMCSA) has wireless in its future. The Philadelphia, PA-based media and technology conglomerate was among the top five winning bidders in the FCC’s recent Auction 105 of 3.5 GHz Citizens Broadband Radio Service (CBRS) Priority Access Licenses (PALs).

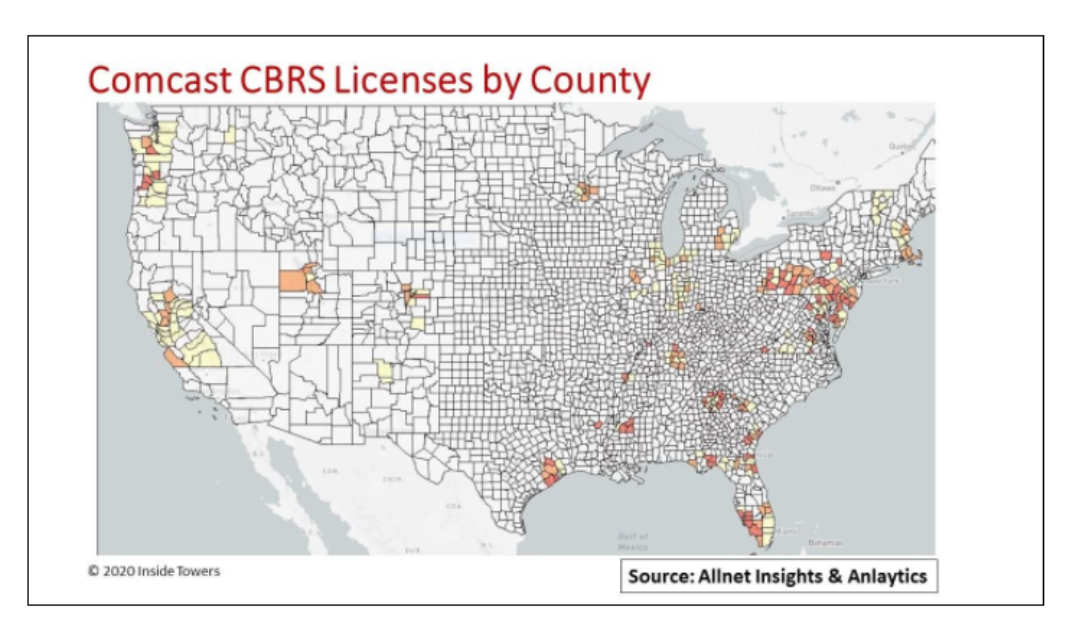

Comcast, bidding under the XF Wireless Investment moniker, paid $459 million for 830 PALs in 306 counties. Depending on the county, spectrum depth varies from 10 to 40 MHz.

These licenses overlay Comcast’s cable network operations in 40 states mainly on the heavily-populated east coast, in the southeast and along the west coast as well as key markets in the Midwest, Southwest and Mountain states.

The PALs cover 108 million POPs. By comparison, Comcast Cable passed 59.3 million homes and businesses, and reported 32.1 million customer relationships at the end of 2Q20.

The 3.5 GHz win complements the $1.7 billion that the company spent in the 2016 600 MHz auction. Those licenses were awarded by Partial Economic Area (PEA) basis versus by county. With PEAs, Comcast’s 600 MHz licenses cover its cable franchise areas and extend into the surrounding areas.

The 600 MHz licenses averaged 10 MHz in each PEA and cumulatively cover 155 million POPs.

Comcast is sitting on a large swath of prime low-band and upper mid-band spectrum that covers roughly 47 percent of the U.S. population. More important, it must activate those licenses relatively soon.

So, what is the plan?

At a recent investment conference, Comcast CEO Brian Roberts commented on what he referred to as the company’s “three-tiered” wireless strategy.

In the first tier, the company offers wireless services under the Xfinity Mobile brand which operates as a Verizon (NYSE: VZ) mobile virtual network operator. Comcast cable customers can buy Xfinity Mobile cell phones and prepaid monthly services that are handled over Verizon’s network.

Roberts is happy with the MVNO relationship. He pointed out that his customers receive the same wireless network features and benefits as do Verizon’s own customers.

Comcast reported its wireless subscriber base grew 51 percent on a year-to-year basis to 2.4 million at the end of 2Q20. (see, Cableco’s Growing Wireless Play)

The second tier is what Roberts touts as Comcast’s own “world-class WiFi network.” At the end of 2Q20, Comcast had almost 30 million high-speed internet residential and business connections, virtually all of which are handled via on-premise WiFi access points.

Comcast offers its Xfinity Mobile customers the ability to seamlessly transition back and forth between the mobile network and WiFi access points. Roberts considers this capability a value-added benefit that enhances the customers’ wireless experience and reduces churn rates.

Tier three involves deploying the spectrum that Comcast now owns. Roberts and his team have no illusions about creating another national wireless network. Even with its valued 600 MHz and 3.5 GHz licenses, Comcast does not have the coverage to operate on that level.

Rather, Comcast could become a strong regional player serving its customers within and around its cable franchises in dense metro areas like New York, Miami, Chicago, Los Angeles and San Francisco. This regional mode of operation compares to how US Cellular (NYSE: USM) operates in small towns and rural markets with out-of-territory roaming agreements with the national carriers.

Roberts believes that Comcast can lower its wireless operating costs by operating its own network in dense urban markets rather than paying MVNO wholesale rates to Verizon.

Moreover, he says that Comcast’s proprietary wireless network would “supplement” its Verizon MVNO that would still be offered in smaller markets.

Certainly, Comcast would have to incur capital expenditures to build out its spectrum licenses.

The company invests about $7 billion a year in expanding and upgrading its cable infrastructure. Wireless capex would be incremental to that amount.

Comcast conceivably could build its wireless network cost-effectively by deploying line-powered small cells and strand-mounted cells along its existing cable rights-of-ways while taking advantage of available street furniture and using its own cable network for backhaul.

By John Celentano, Inside Towers Business Editor

Reader Interactions