Network investment uncertainty hangs over the U.S. wireless industry as the Tier 1 carriers come down the Q4-2019 stretch. 5G is the big driver for network modernization and expansion but questions remain. What will an approved T-Mobile U.S.-Sprint merger mean for its customers and competitors? Rattled by shareholder activism challenging the wisdom of its media expansion plans, how will AT&T invest in its wireless network going forward? Given the financial squeeze it has put on its contractors and suppliers, does Verizon have the liquidity to ramp up its 5G build out?

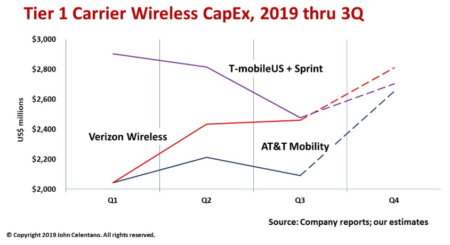

The chart shows a combined T-Mobile U.S.-Sprint quarterly capex (as if’ the merger was finalized) and compares the sum of what the two companies have each reported up to now with AT&T and Verizon. Until the deal is done, all bets are off.

Out of the gate, T-Mobile U.S. charged ahead, committing to $5.8-6.1 billion for the year and moving quickly to deploy new sites in its 600 MHz band as it readies its network for 5G. The company spent nearly $2 billion in Q1 or roughly 30 percent of its full-year budget. With Sprint apace, the two companies together spent nearly $3 billion in Q1. More conservative Sprint invests roughly $1 billion a quarter as it readies its network for 5G to take advantage of its significant 2.5 GHz spectrum holdings while awaiting merger approval. Sprint’s larger problem is that is it has lost one percent of its connection base since the end of 2018 while T-Mobile U.S. added customers by two percent in the same period. Sprint has a greater sense of urgency to get the deal done albeit for its mere survival.

At the half-way point, T-Mobile U.S. spent a full 58 percent of its capex budget and quickly reined in its deployment pace, throwing off a lot of contractors. Spending dropped 15 percent sequentially to $1.5 billion in Q3 as the company eased to a trot awaiting merger approval, even as it raised its full-year capex guidance to $6.35-6.45 billion.

AT&T and Verizon both took a measured pace from the start, following a more historic pattern of network investment, starting slow then picking up the pace through mid-year, slowing in Q3 then sprinting to finish Q4.

AT&T Mobility invests around $2 billion a quarter, with 71 percent of its budget spent through Q3. With its full-year guidance, expect a capex increase to about $2.7 billion in Q4. AT&T’s predicament is that while connections grew over two percent from a year ago, mainly on the strength of connected devices such as (IoT sensors, vehicles), there was no postpaid subscriber growth. Consequently, wireless service revenues were flat to up only slightly in the same period and capex dropped six percent in Q3. Activist shareholders forced AT&T to agree to stick to its basics and not get too far out of its lane.

Verizon Wireless (VZW) held steady its network investment activity, spending $2.0-2.5 billion each quarter. Coming into the Q4 stretch, VZW’s subscriber and service revenue growth are essentially flat even as VZW claims a leading position in 4G and a fast 5G deployment ramp in both mobile and fixed wireless access applications.

If their respective $8-10 billion annual guidance holds, Tier 1 carriers will finish 2019 neck-and-neck with each running at a strong $2.5 to 3.0 billion pace.

John Celentano is Inside Towers’ Contributing Analyst. He can be reached at jcelentano1@gmail.com

by John Celentano for Inside Towers

November 11, 2019

Reader Interactions