By John Celentano, Inside Towers Business Editor

For more in-depth insights on this, and related topics, subscribe to Inside Towers Intelligence. The second market analysis report of the Intelligence series will be published next week.

Predictions of wireless infrastructure demand slowdowns have been greatly exaggerated. Certainly, the tower business worldwide is enjoying quite a run, the best in many years.

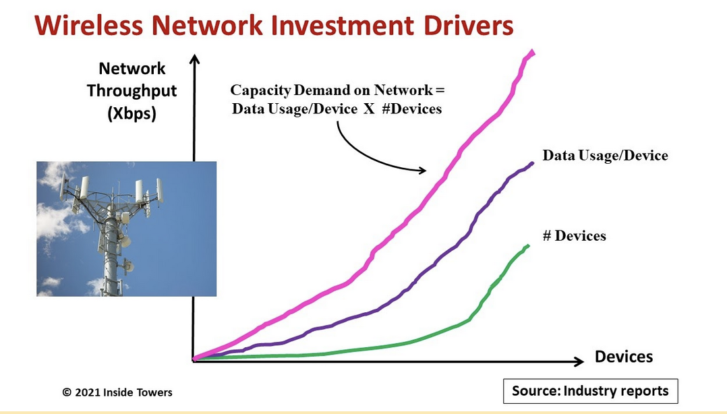

The latest research from the Ericsson Mobility Report and the Cisco Annual Internet Report, shows that any slowdown is not likely to occur for at least the next five years. A plethora of new mobile devices and greater mobile data consumption per device are driving wireless traffic volumes not seen before.

The Need for [Tower] Space

With increased traffic comes the need for more active and passive wireless network infrastructure to carry that traffic. The tower sector is benefiting from a confluence of growth drivers as the world comes out of the pandemic. 5G technology is providing high-speed data connections up to 1 Gbps, low latency in single-digit milliseconds and high reliability for mission critical applications. This means more demand for antenna space on towers and other support structures in more places.

Current high-level demand is reflected in the confident outlook among leading infrastructure companies. To wit, the U.S. Big three tower companies, American Tower, Crown Castle and SBA Communications, in their 2Q21 earnings calls, raised their full-year 2021 guidance. They now expect site leasing revenues to increase by 7-8 percent over the 2020 levels, nearly double the growth rates of recent years.

Increased Connectivity

Ericsson projects global 5G mobile subscriptions will exceed 580 million by the end of 2021, at a run-rate of about one million new 5G mobile subscriptions every day. By year-end 2026, 5G subscriptions will reach approximately 3.5 billion with roughly 60 percent population coverage. Most of that coverage will be achieved using low-band and mid-band frequencies transmitted from macro cell sites on towers.

Mobile Data Drivers

Ericsson’s analysis shows that global mobile data traffic exceeded 49 exabyte (Eb) per month at the end of 2020 and is projected to grow by almost five times to 237 Eb per month in 2026. Note that one exabyte of data is 1 billion gigabytes (Gb).

On the device level, smartphones currently carry 95 percent of this traffic and are consuming more data than ever. Globally, the average usage-per-smartphone now exceeds 10 Gb per month and is expected to reach 35 Gb per month by the end of 2026. More than 300 5G smartphone models have already been announced or launched commercially.

Fixed Wireless Access

COVID-19 brought to light the importance of, and the need for, reliable, high-speed broadband connectivity. Ericsson shows that 90 percent of mobile network operators that are launching 5G mobile services also will offer 4G/5G fixed wireless access service even in markets with high fiber penetration.

There were over 60 million FWA connections at year-end 2020 and is forecast to grow more than threefold through 2026, reaching nearly 200 million. Out of these, 5G will account for around 40 percent of total FWA connections. FWA data traffic represented around 15 percent of global mobile network data traffic by the end of 2020. This volume is projected to grow seven times to reach 64 Eb in 2026, accounting for more than 20 percent of total global mobile network data traffic.

Massive IoT on the Rise

Massive IoT technology, NB-IoT and Cat-M, is forecasted to increase by roughly 80 percent during 2021, to nearly 330 million connections. By 2026, NB-IoT and Cat-M technologies are expected to account for 46 percent of all cellular IoT connections.

Regional 5G Adoption

The pace of 5G adoption varies widely by region. Europe is off to a slower start and has lagged the 5G deployment pace set in China, the U.S., Korea, Japan and the Gulf Cooperation Council (GCC) that includes Saudi Arabia, United Arab Emirates, Qatar, Oman, Bahrain and Kuwait. North East Asia (China and Japan) is expected to account for the largest share of global 5G subscriptions reaching an estimated 1.4 billion or 40 percent by 2026. In North American and GCC markets, 5G is expected to have the highest penetration with 84 percent and 73 percent, respectively, of their regions’ total mobile subscriptions.

Fredrik Jejdling, Ericsson Executive Vice President and Head of Business Area Networks says the report shows “… that we are in the next phase of 5G, with accelerating roll-outs and coverage expansion in pioneer markets such as China, the USA and South Korea. Now is the time for advanced use cases to start materializing and deliver on the promise of 5G. Businesses and societies are also preparing for a post-pandemic world, with 5G-powered digitalization playing a critical role.”

Reader Interactions