For more in-depth industry insights, subscribe to Inside Towers Intelligence

To look at recent stock prices of infrastructure companies – towers, fiber, data centers – one might think that these companies are badly underperforming. On the contrary, the leading infrastructure companies and their mobile network operator customers reported solid financial gains for 1Q22 and even raised their full-year 2022 guidance of key operating metrics.

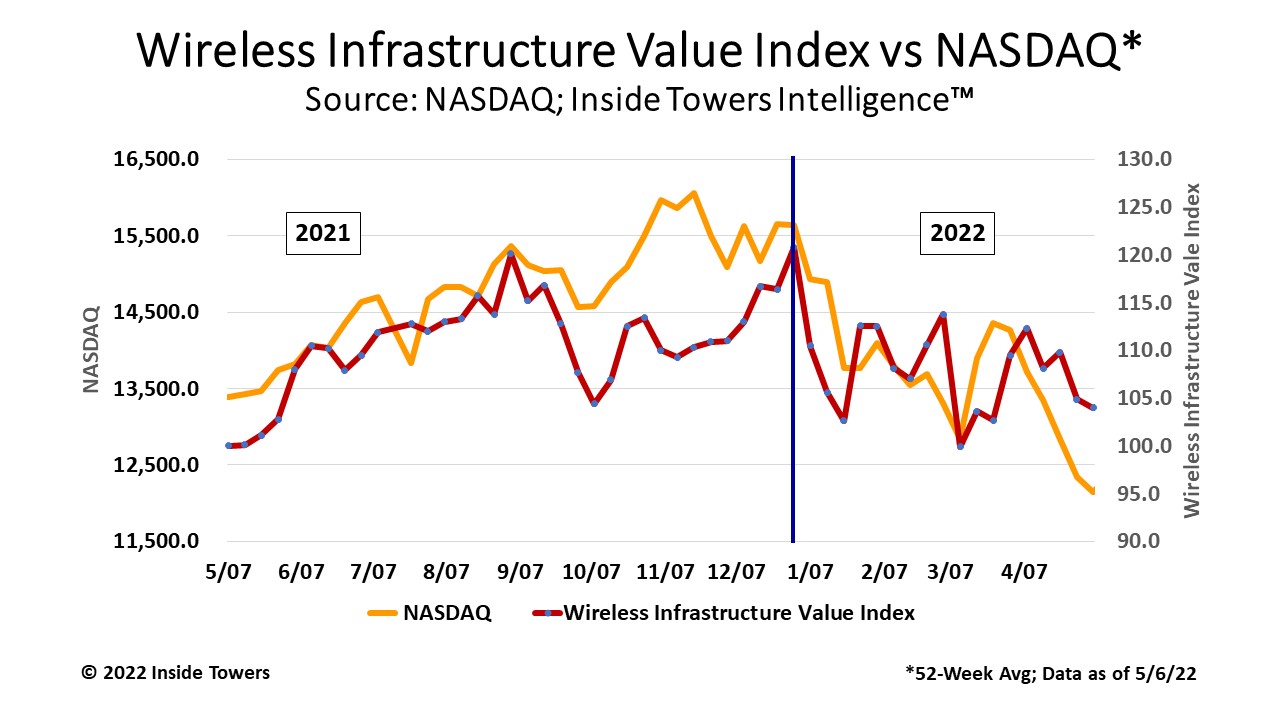

The chart compares our proprietary Wireless Infrastructure Value Index to the NASDAQ composite index over a 52-week period dating back to May 7, 2021. The Value Index comprises 12 leading infrastructure companies: three tower companies (American Tower, Crown Castle, SBA Communications), five data center companies (Equinix, Digital Realty Trust, Iron Mountain, Switch, Cyxtera Technologies), two fiber companies (Lumen Technologies, Uniti Group) and two diversified infrastructure companies (Brookfield Infrastructure Partners, DigitalBridge Group).

The Big 3 towercos along with Equinix and Digital Realty data centers account for about 85 percent of the Value Index total market capitalization. American Tower leads all infrastructure companies with a market cap of nearly $103 billion. Equinix, the leading data center company, has a market cap of $57 billion.

Comparatively, the NASDAQ comprises 3,000 companies. Technology companies account for over half of the NASDAQ listings led by Apple, Microsoft, Amazon, Facebook, Alphabet (Google), Intel and Cisco. T-Mobile, Verizon, and DISH Network are listed on the NASDAQ whereas AT&T is NYSE-listed.

From early May through the end of 2021, the Value Index grew at a positive weekly compounded rate of 0.5 percent, slightly better than the NASDAQ’s rate of 0.4 percent. Throughout most of the year, investor confidence was buoyed by positive economic signs of low unemployment and rising wages as the pandemic subsided, and people and businesses slowly returned to pre-COVID activities.

Both indices hit a road bump in late 3Q21 as concerns about increasing inflation and interest rates crept into national and global economic conversations. Those concerns were eased somewhat through the end of the year as central banks signaled steps to moderate inflationary trends.

The NASDAQ peaked at 16,057.4 in mid-November then leveled out through December 31, ending at 15,654.0. That figure was up 17 percent from 13,389.4 on May 7. Similarly, the Value Index increased steadily throughout the year, save for the dip in early October, but ended the year on a high note of 120.8 on December 31, representing a 21 percent increase over the same period.

Since the beginning of 2022, however, both indices have nosedived, again due to major concerns about inflation, interest rates, supply chain delays, and the war in Ukraine. From January 1, 2022, to date, the Value Index has declined at a compound weekly rate of 0.8 percent while the NASDAQ dropped even more at 1.4 percent per week.

What can infrastructure equipment suppliers and contractors expect in this environment?

Note that stock price gyrations are not an indicator of the health of the wireless infrastructure business. In fact, these declines are contrary to the positive overall health of the wireless industry.

As Inside Towers reported, planned capital expenditures among the mobile network operators are up significantly in 2022 compared to 2021. Capex allocations are for accelerated 5G deployments and new mid-band spectrum activation, particularly C-band, along with fiber and data center build outs. This outsized level of network investment is being driven by escalating demand for high-speed, low latency services from consumers and businesses alike.

In this light, all U.S. MNOs raised their full-year 2022 capex guidance to an estimated aggregate of nearly $50 billion, up 39 percent from the $36 billion spent in 2021. Wireless capex is expected to peak in 2022, with network investments staying above historical levels through 2025.

As an investor in the tech and wireless sectors, your best option is to ride out the storm. However, as a supplier of infrastructure equipment and systems and field services to the MNOs and their prime contractors, you are going to be busy!

By John Celentano, Inside Towers Business Editor

Reader Interactions