Rogers Communications (NYSE: RCI) performed well in 3Q22 performance despite experiencing a massive network outage in July, and trying to complete its acquisition of Shaw Communications now under scrutiny by the Canadian Competition Tribunal, Inside Towers reported. For the quarter, wireless service revenues were $1.3 billion, up 3 percent on a year-over-year basis. Adjusted EBITDA was $811 million, a decline of 1 percent from $821 million in 3Q21. Note that both metrics were impacted by nearly $115 million in credits the company returned to wireless and cable customers as a result of the outage. Excluding the credits, wireless service revenues were up 9 percent while adjusted EBITDA grew 7 percent YoY.

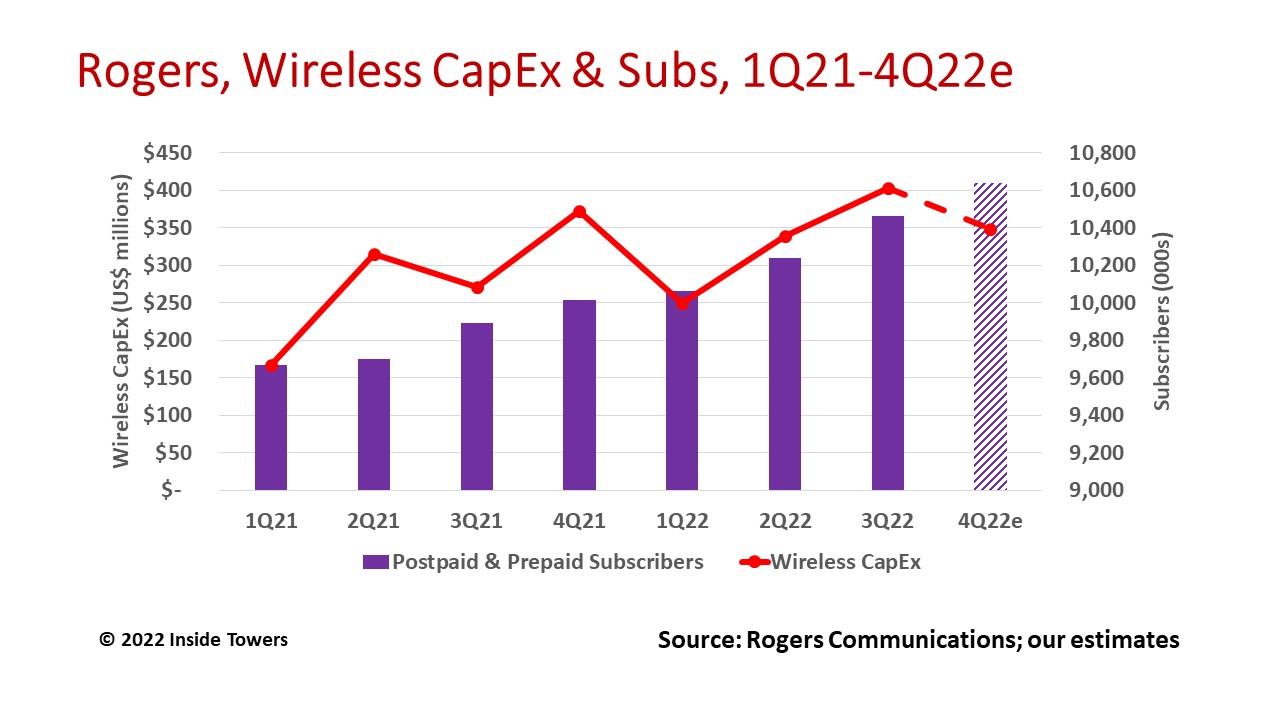

Rogers, headquartered in Toronto, Ontario, is a $10 billion telecommunications conglomerate comprising wireless, cable, and media operations. Wireless contributes over 60 percent of the total consolidated revenues. Rogers’ nationwide facilities-based wireless network covers 97 percent of Canada’s population and served 10.5 million postpaid and prepaid subscribers at the end of 3Q. Wireless accounted for $1.3 billion or 55 percent of service revenues and $811 million or 69 percent of total adjusted EBITDA for the quarter. Wireless capex was $403 million or 62 percent of the 3Q total. Through nine months ending September 30, Rogers invested in wireless nearly $1 billion or 74 percent of the $1.3 billion budgeted capex for 2022, up 32 percent compared to the same period in 2021.

Rogers says it is gaining market share in the growing and competitive Canadian wireless market by offering consumers choice. The company had 164,000 postpaid net subscriber additions in the quarter, and total mobile net adds of 221,000, up 30,000 from last year. Total net wireless additions year-to-date are 448,000, up 137 percent from the same period last year.

Tony Staffieri, Rogers President and CEO comments, “We invested aggressively in our networks and our customers’ experience to ensure we deliver the resilience and services our customers expect. We’re making excellent progress on our priority to drive better execution in 2022 and I’m proud of what our teams have delivered today.”

Wireless performance was up due to higher roaming revenue as global travel recovers, a larger postpaid and prepaid mobile phone subscriber base, and an overall increase in market activity. Demand for Rogers’ unlimited plans is increasing as Canadians return to work and school, immigration is accelerating, and more transitional subscribers such as foreign students and seasonal workers are using mobile services.

Rogers is investing in its wireless network for coverage, capacity, and resiliency. At the end of 3Q, the company deployed newly acquired high-capacity 3500 MHz mid-band 5G spectrum to over 35 percent of the population using both macrocells and small cells. 3500 MHz coverage will ramp up in 4Q and into 2023.

By contrast, management sees limited fixed wireless access opportunities compared to its Canadian competitors or U.S. counterparts. Rogers’ cable network already reaches all major markets in Canada, with a mix of hybrid fiber-coax and fiber-to-the-home technologies that the company believes gives it a competitive advantage in those markets. The company expects to use FWA mainly in rural areas where it does not operate cable.

Rogers confirmed its overall 2022 full-year outlook. Compared to 2021, the company expects total service revenues to grow 6-8 percent, Adjusted EBITDA to increase 8-10 percent and total capex of $2.2 billion. Management says it has not seen any material impact from inflation and other economic pressures and believes it can adapt to changes to the overall economic or business climate.

It anticipates 4Q wireless service revenue and adjusted EBITDA growth to both be in the mid-to-high single-digit range. To stay within budget, we expect a small drop-off in 4Q capex to around $350 million, although capital intensity remains high at roughly 24 percent. The company expects similar capex levels in 2023, with balanced investments in network infrastructure, network resilience, and customer service.

By John Celentano, Inside Towers Business Editor

Reader Interactions