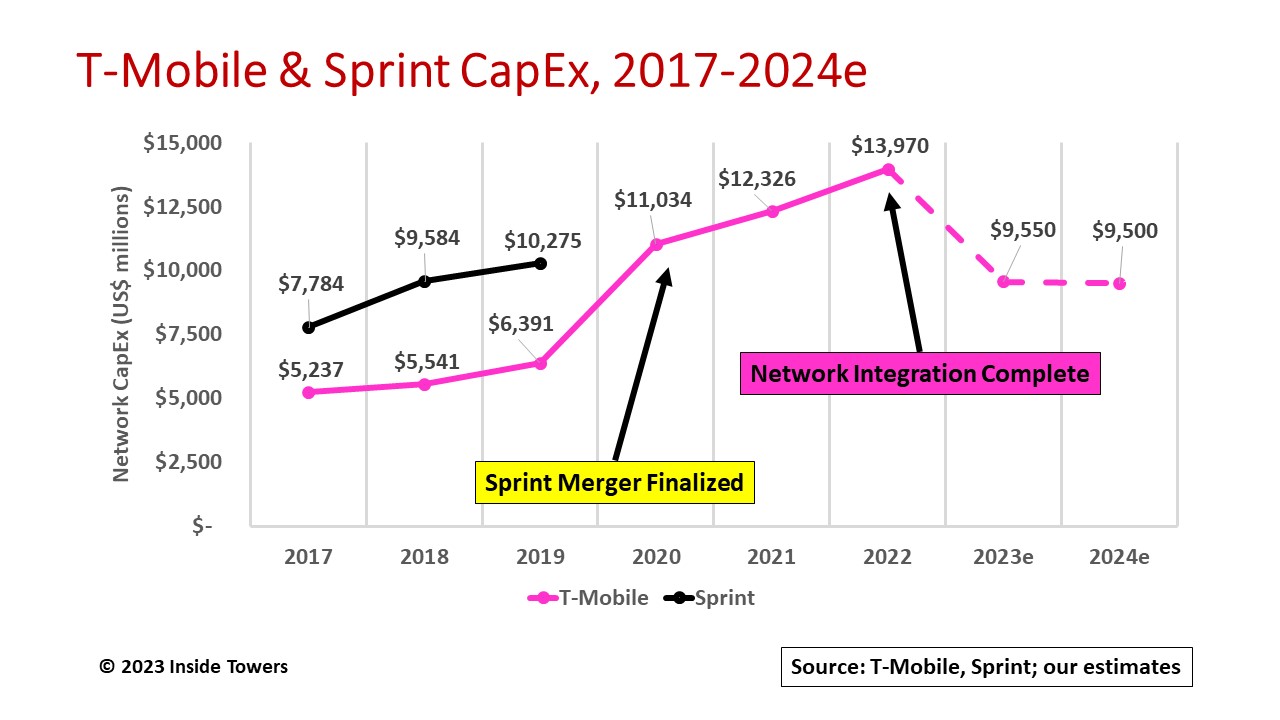

It’s been quite a ride for the Un-carrier. T-Mobile (NASDAQ: TMUS) says its 2022 performance was its best ever. Compared to 2021, full-year 2022 wireless service revenues were up 5 percent to $61.3 billion and core adjusted EBITDA increased 12 percent to $26.4 billion. Capital expenditures jumped 13 percent year-over-year to nearly $14 billion for its 5G buildout and integration of the Sprint network. The company says its network integration efforts are now complete and that 2022 represented its peak capex year.

Looking back, Sprint Corporation and T-Mobile US announced their agreement to merge on April 29, 2018. After a two-year regulatory and financial approvals process, the merger closed on April 1, 2020, with the combined entity operating as T-Mobile.

In 1Q20, just ahead of the merger, T-Mobile’s network comprised 67,000 macrocells and 26,000 small cells and distributed antenna systems. Once merged, the company’s amalgamated network assets totaled 109,000 macrocells and 69,000 small cell/DAS installations albeit with many redundant and overlapping sites that were to be decommissioned.

T-Mobile expected the network integration would take three years. But through an extended effort and cooperation with its equipment vendors and tower companies, T-Mobile completed that process by the end of 2022, in just two and a half years. The company aggressively decommissioned redundant or aged sites, reducing its network infrastructure to 79,000 macrocells and 41,000 small cells/DAS at year-end 2022.

Over that period, the company spent record capex levels, peaking at $14 billion in 2022. In the process, T-Mobile has achieved 98 percent population coverage with its 600 MHz low-band 5G Extended Range service and 265 million POPs with its 5G Ultra Capacity service using mid-band and millimeter wave spectrum. At year-end 2022, T-Mobile served 113.6 million postpaid and prepaid subscribers, compared to 68.5 million, before the merger.

With integration activities complete, the company is throttling back its capex to more normal operating levels. Its 2023 capex guidance is $9.4-9.7 billion and going forward, it expects to operate in the $9-10 billion per year range.

But T-Mobile has more work to do. It plans to cover 300 million POPs with Ultra Capacity by the end of 2023. Moreover, it continues to build out its mid-band spectrum holdings. Up to now, it has relied on 2.5 GHz and 1900 MHz for its Ultra Capacity service.

The company owns both C-band (3.7 GHz) and 3.45 GHz licenses that it garnered in FCC Auctions 107 and 110, respectively, Inside Towers reported. Deployments in those bands will take place mainly in 2024 and beyond, once satellite operators clear the portion of the C-band spectrum where T-Mobile has licenses. Similar to AT&T’s approach, the company will deploy dual-mode C-band/3.45 GHz radios as a way to reduce installation costs and tower climbs at cell sites.

T-Mobile was the runaway winner of 2.5 GHz Education Broadband Service/Broadband Radio Service licenses in Auction 108. It will systematically activate those licenses to augment its existing 2.5 GHz spectrum where it needs additional coverage. At the same time, T-Mobile recenty ordered from Crown Castle 35,000 new small cells to be deployed over the next several years, Inside Towers reported.

And let’s not forget T-Mobile’s success with fixed wireless access. The company outpaced telco and cable broadband competitors with a record two million FWA net adds in 2022 bringing its 5G Home Internet subscriber count to 2.6 million at year end. Because Home Internet shares the spectrum used for Ultra Capacity mobile services, the company at first indicated that its FWA penetration would plateau at 7-8 million subscribers.

Now, management thinks its addressable market is 50 million eligible households nationwide. In rural areas, where its mobile service is lightly loaded, the Home Internet service is attractive for customers that have few broadband options. With faster time-to-market, lower deployment costs than fiber and a monthly flat rate, its Home Internet service could garner higher take rates than the company suggests.

By John Celentano, Inside Towers Business Editor

Reader Interactions