Despite the prevailing macroeconomic environment, T-Mobile (NASDAQ: TMUS) reported across-the-board growth for 2Q22. With positive results, TMUS upped its full-year 2022 guidance for all its operating metrics.

The company highlighted that rather than just competing for a share of the overall wireless subscriber addressable market, the company is going after the “switchers.” These are subscribers who are switching from their current wireless carriers for various reasons – high prices, unreliable network performance, or poor customer service. TMUS is attracting such individuals and businesses with value offers and services bundling without increasing rates, contrary to what AT&T and Verizon have done.

TMUS’ strategy seems to be working. During 2Q22, the company added 380,000 postpaid net accounts and 1.7 million postpaid net customer additions. At the end of the quarter, TMUS had 110 million retail postpaid and prepaid subscribers, up 5 percent year-over-year and second only to Verizon Wireless.

Moreover, the company is making gains with its newest service, 5G Home Internet fixed wireless access, adding 560,000 new customers in the quarter. The company’s FWA now serves more than 1.5 million subscribers since the service was introduced just over a year ago. Here, TMUS is targeting mainly homes and businesses in urban and suburban areas who are dissatisfied with their cable internet service, and in rural areas that lack adequate broadband service.

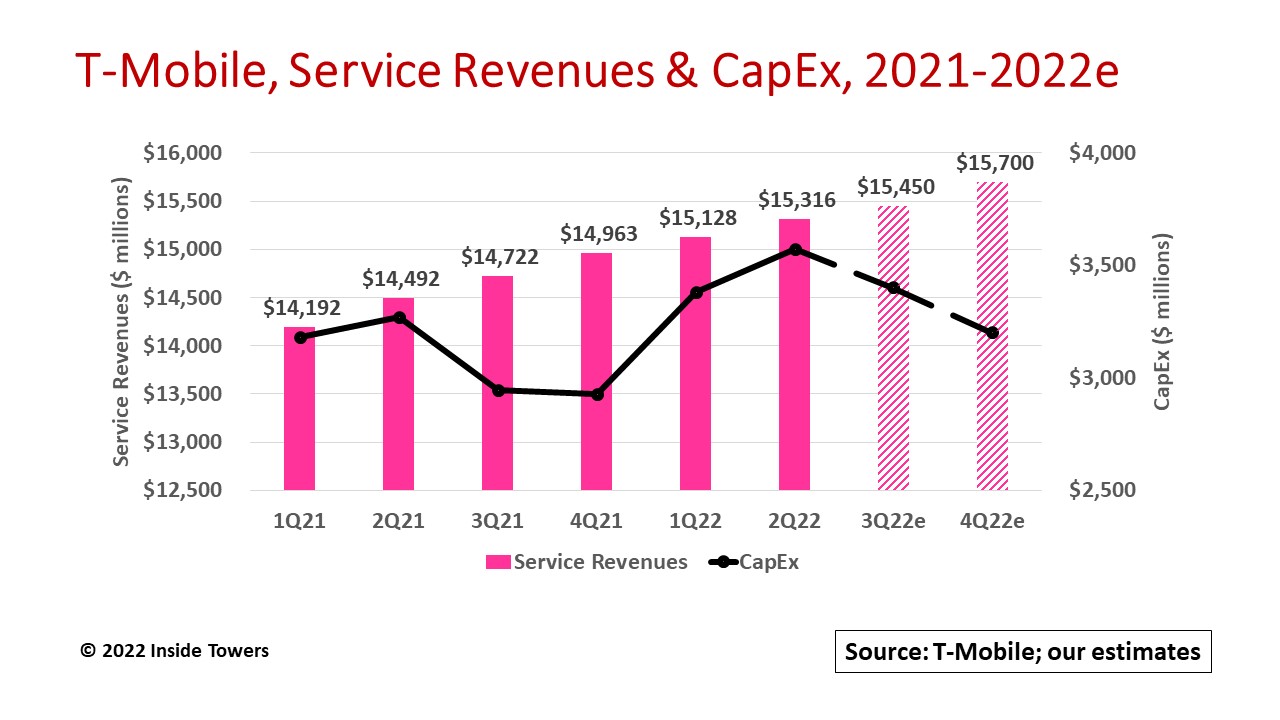

TMUS’ service revenues of $15.3 billion grew 6 percent YoY, bolstered by postpaid service revenue growth and more subscribers taking higher priced unlimited plans. Core Adjusted EBITDA was $6.6 billion, up 10 percent from a year ago.

Capital expenditures in the quarter came in at $3.6 billion, up 9 percent YoY. Capex through the first half of the year was nearly $7 billion, up 8 percent compared to $6.5 billion in 1H21, indicative of the accelerated build-out of its nationwide 5G network.

Despite the upward gains, the company incurred a net loss of $108 million in the quarter that translated into a $0.90 loss per share due to merger-related costs and other special expense items.

TMUS is operating at full speed with its 5G network build. At the end of the quarter, its Extended Range 5G that operates with 30 MHz in 600 MHz low-band spectrum covered 320 million people, or 97 percent of the American population. Its Ultra Capacity 5G that utilizes 110 MHz of 2.5 GHz mid-band spectrum now covers 235 million people and approximately 87 percent of TMUS customers. The company’s 5G Home Internet is operating from small cells at 2.5 GHz now and likely millimeter wave in the future.

TMUS points out that 50 percent of postpaid customers are now using a 5G phone, and 5G devices account for 55 percent of all network traffic which it says is a testament to having the first standalone 5G network in the country. The company is in the process of shutting down the legacy Sprint 4G LTE network and expects to substantially complete that decommissioning activity by the end of 3Q22.

Here’s the outlook for the remainder of the year. The company now expects postpaid net customer additions to be 6.0-6.3 million, up from prior guidance of 5.3-5.8 million. We estimate these additions will drive service revenue growth at one percent or better each quarter. Core Adjusted EBITDA is now expected to be in the $26.0-26.3 billion range. Merger-related costs are expected to be $4.7-5.0 billion before taxes but will impact net income, net cash from operations and free cash flow.

Full-year capex will be in the $13.5-13.7 billion range, up $250 million at the midpoint as TMUS accelerates its nationwide 5G network build-out. Quarterly capex levels likely will decline as the Sprint network decommissioning activity winds down in 2H22.

Neville Ray, T-Mobile President, Technology, says that through July, field crews were rolling out mid-band radio upgrades in over 1,000 sites a week. “It’s not just about footprint, it’s about capacity and the spectrum story and today we have over 110 megahertz of dedicated mid-band spectrum on average across that mid-band footprint and over 30 megahertz of extended range 5G spectrum,” comments Ray. “So, 140 megahertz of dedicated 5G spectrum and it’s that capability of coverage, plus 5G depth and spectrum that allows us to push into these 5G broadband stories and this growth.”

By John Celentano, Inside Towers Business Editor

Reader Interactions