Remember the awesome spectacle of a Space Shuttle launch? With its engines roaring, spewing flames and smoke, the Shuttle rose majestically into the sky. A few minutes into the flight, ground controllers radioed the Shuttle Commander, “OK to power up!” as the Shuttle rocketed out of Earth’s atmosphere.

Back here on Earth, T-Mobile (NASDAQ: TMUS) is performing a bit like the Shuttle. It is powering up.

From its emergence as the new T-Mobile on April 1, TMUS’ 3Q20 performance shows that it is accelerating both its network growth and financial metrics.

Wireless service revenues grew to $14.1 billion, an increase of 7 percent from $13.2 billion in 2Q20. For the nine months ending September 20, TMUS reported consolidated wireless service revenues of $36.2 billion, up 41 percent from $25.7 billion for the period in 2019.

The company broke through the 100 million branded connections threshold for the first time. It ended 3Q20 with 100.36 million postpaid and prepaid customers, up 2 percent from 98.3 million at the end of 2Q20. TMUS leads the prepaid market with 20.63 million customers.

By comparison, Verizon had 120.32 million postpaid and prepaid customers at the end of 3Q20 while AT&T’s end of quarter total was 94.07 million. AT&T counts another 75.97 million connected IoT devices and vehicles to its tally.

TMUS’s network upgrade and expansion is running ahead of schedule.

At the end of 3Q20, the company deployed its low-band 600 MHz 5G in 8,300 cities and towns across the country covering 270 million people. The company expects that coverage to reach 280 million people by year-end 2020 and grow to 300 million POPs by the end of 2021. TMUS claims its low-band 5G network operates 2.5 times faster than 4G LTE.

At the same time, TMUS has turned up its mid-band 2.5 GHz 5G network in over 400 cities and towns covering 30 million POPs. The company is projecting mid-band 5G deployments to more than 1,000 municipalities covering 100 million POPs by year-end 2020. TMUS expects to achieve nationwide coverage by year-end 2021 and deliver connection speeds up to 7.5 times faster than 4G LTE.

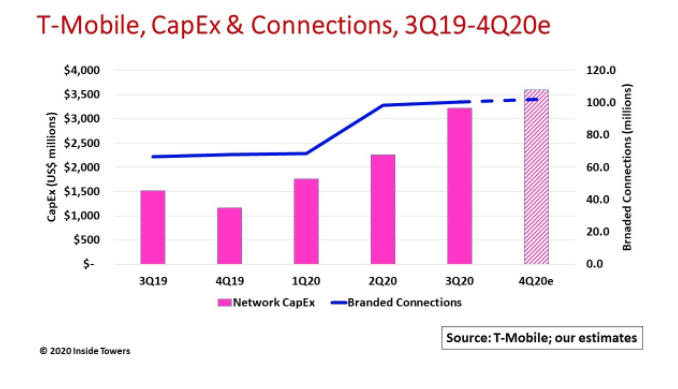

The company’s capital expenditures reflect the powered-up network build.

TMUS invested $3.2 billion in 3Q20 compared to $2.3 billion in 2Q20 and $1.5 billion spent in 3Q19, a 112 percent year-to-year jump. Capital intensity for 3Q20 was 23 percent, indicating a remarkably high level of network expansion. Based on year-to-date results, TMUS raised its capex guidance for 2H20 to $6.7-6.9 billion suggesting that the 4Q20 level will be around $3.6 billion.

TMUS’s combined T-Mobile and Sprint 4G LTE and 5G networks currently comprise 108,000 macrocell sites along with another 68,000 small cell and distributed antenna locations. The company is striving to reduce that number to around 82,000-83,000 sites over the next several years. TMUS expects to retain 12,000-13,000 Sprint sites but decommission nearly 35,000 sites. TMUS said it will add new sites as needed for coverage and capacity.

Only 15 percent of Sprint’s postpaid traffic is currently on the new TMUS network. The company pointed out that 85 percent of Sprint postpaid customers have handsets that are compatible with the TMUS network today. These Sprint customers are being ported steadily over to the TMUS network.

The company acknowledged that it is testing what it calls its Home Internet service, a fixed wireless access broadband offering targeted to unserved or underserved markets. The FWA service operates over 4G LTE and connects to a wireless Internet gateway that is installed at residences and businesses.

TMUS gave no indication of where and when the Home Internet service will be available other than it is assessing the technical and commercial feasibility of the service. However, the company sees its recently-introduced TVision over-the-top streaming service as an important offering to attract customers to its Home Internet package.

The company’s T-Mobile for Business organization is making headway with Enterprise and government accounts. In these markets, TMUS sees a great opportunity for in-building wireless applications. The company is evaluating various IBW solutions including DAS and small cells that will utilize TMUS’ millimeter wave spectrum.

by John Celentano, Inside Towers Business Editor

Reader Interactions