The big three U.S. mobile network operators – Verizon (NYSE: VZ), T-Mobile (NASDAQ: TMUS) and AT&T (NYSE: T) – in their 1Q22 earnings reports, gave the industry a positive indication of their planned network investments. The outlook through 2025 bodes well for a sustained high level of capital expenditures to modernize and expand their networks.

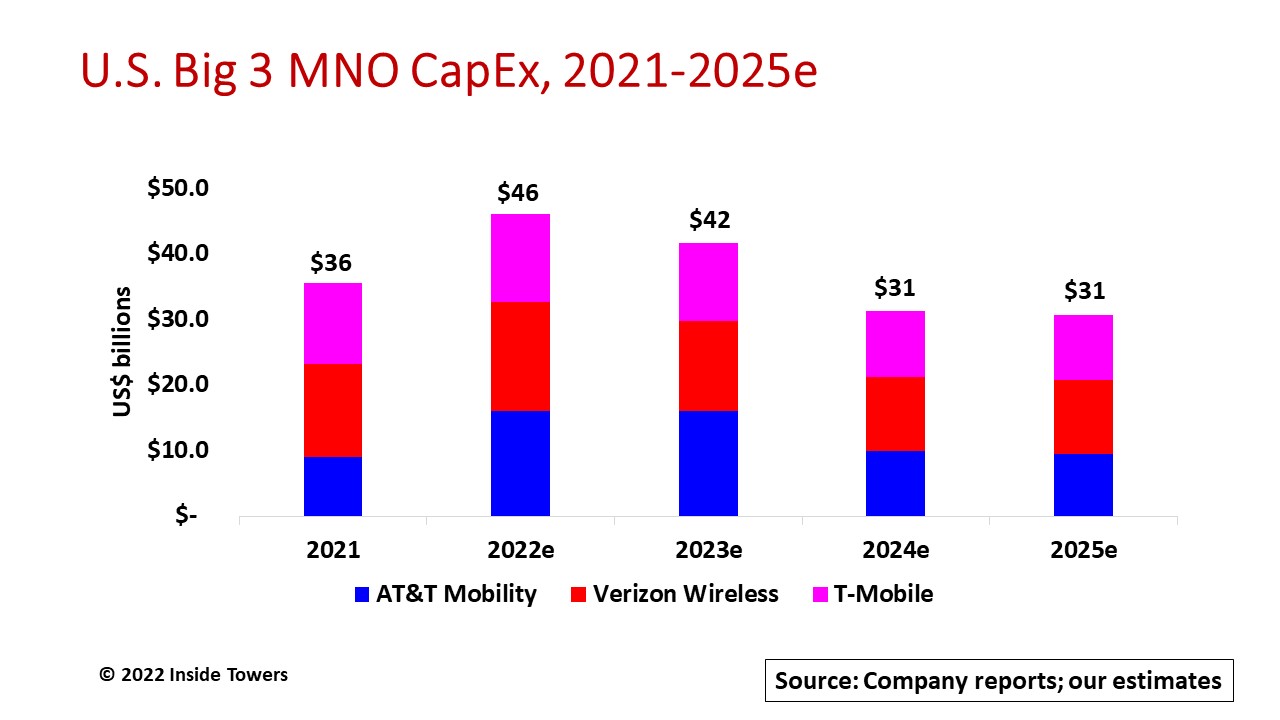

Based on guidance provided in their Investor Day presentations and in their earnings calls, it appears that full-year 2022 will be the peak year reaching $46 billion among these three MNOs, then tapering out through 2025. On top of the Big 3 tally for 2022, DISH Network (NASDAQ: DISH) expects to invest about $2 billion, UScellular (NYSE: USM) planned spending is in the $750-800 million range, and the regional wireless carriers will invest around $300-500 million.

Note that these figures are entirely for wireless infrastructure comprising radio access network and core equipment and software, and fiber and microwave backhaul systems. These figures include mainly what Verizon dubs as business as usual (BAU) capex. On top of BAU capex, both Verizon and AT&T have provided incremental estimates of roughly $10 billion through 2023 for mid-spectrum (C-band and 3.45 GHz) deployments.

It is important to understand that both AT&T and Verizon report their wireless and wireline capex as a consolidated figure. The data presented here represents wireless-only capex estimates and excludes wireline broadband fiber deployments.

As Inside Towers reported, Verizon was the big winner in Auction 107 for upper mid-band spectrum in the 3.7-3.98 GHz range. The company committed $10 billion to deploy C-band across its network over the 2021-2023 period on top of its estimated annual wireless BAU capex of $10-11 billion.

Satellite companies currently occupying the portion of C-band that was auctioned for commercial cellular use must clear that spectrum by clearing deadlines in two phases: Phase I by December 5, 2021, for the top 46 PEAs and Phase II by December 5, 2023, for the balance of the total 406 PEAs nationwide. Spectrum clearing for Phase I was completed by the deadline but licenses in those markets were not activated until mid-January 2022, once the FCC and FAA resolved 5G interference concerns, extensively covered by Inside Towers.

Verizon invested $2.1 billion in C-band capex in 2021, readying for the Phase I deployment. The company plans to spend another $5.5 billion in 2022, with the remaining $2.5 billion in 2023. In its 1Q22 earnings calls, Verizon pointed out that 30 more PEAs have been cleared ahead of the Phase II schedule, allowing the company to expand its C-band coverage sooner than expected.

As a pure wireless play, T-Mobile continues to expand its 5G Extended Range with 600 MHz and 5G Ultra Capacity at 2.5 GHz. The company spent $12.3 billion in 2021, and raised its guidance for 2022 to the $13.2-13.5 billion range as it sustains its buildout and rationalizes its 5G macro cell sites with 4G LTE sites acquired in the Sprint merger. T-Mobile bought C-band spectrum in Auction 107 but will not be able to deploy these before the Phase II deadline for the licenses it acquired. The company has baked in the cost of C-band deployments into its forward-looking capex guidance that it expects will level out to around $10 billion a year in 2024 and 2025.

AT&T’s wireless BAU capex averages $9-10 billion a year. The company has budgeted an incremental $5 billion a year in 2022 and 2023 for its mid-spectrum buildouts. AT&T was the second biggest winner in the C-band auction and took the top spot in Auction 110 for 3.45 GHz. It spent about $1 billion in 2021 to prepare for C-band Phase I deployments.

Notably, in the aftermath of Auction 110, the company announced that it would deploy both C-band and 3.45 GHz radios together in one tower climb to save installation time and costs. AT&T installed minimal C-band sites for Phase I. Once dual-band radios are available in volume in the second half of 2022, that activity will get underway in earnest through the end of 2022 and into 2023, with capex levels returning to steady-state levels in 2024 and 2025.

By John Celentano, Inside Towers Business Editor

Reader Interactions