In its recent Analyst Day conference, Verizon (NYSE: VZ) shared its current progress with 5G and new spectrum deployments, and its expected network investments through 2025.

Basically, the company is saying that its primary revenue growth drivers are in place and that over the next several years as it finishes key aspects of its network expansion, it expects to operate at a lower capital intensity than current levels.

Does that mean lower capex? If so, what does that mean for the infrastructure suppliers and contractors?

Keep in mind that the company is guiding to a lower capital intensity, not necessarily lower capex. Verizon does not break out its wireless and wireline capex allocations. Nonetheless, we estimate that Verizon spends $8-10 billion a year in upgrading and maintaining its wireless network, with what the company refers to as ‘business as usual’ (BAU) annual capex.

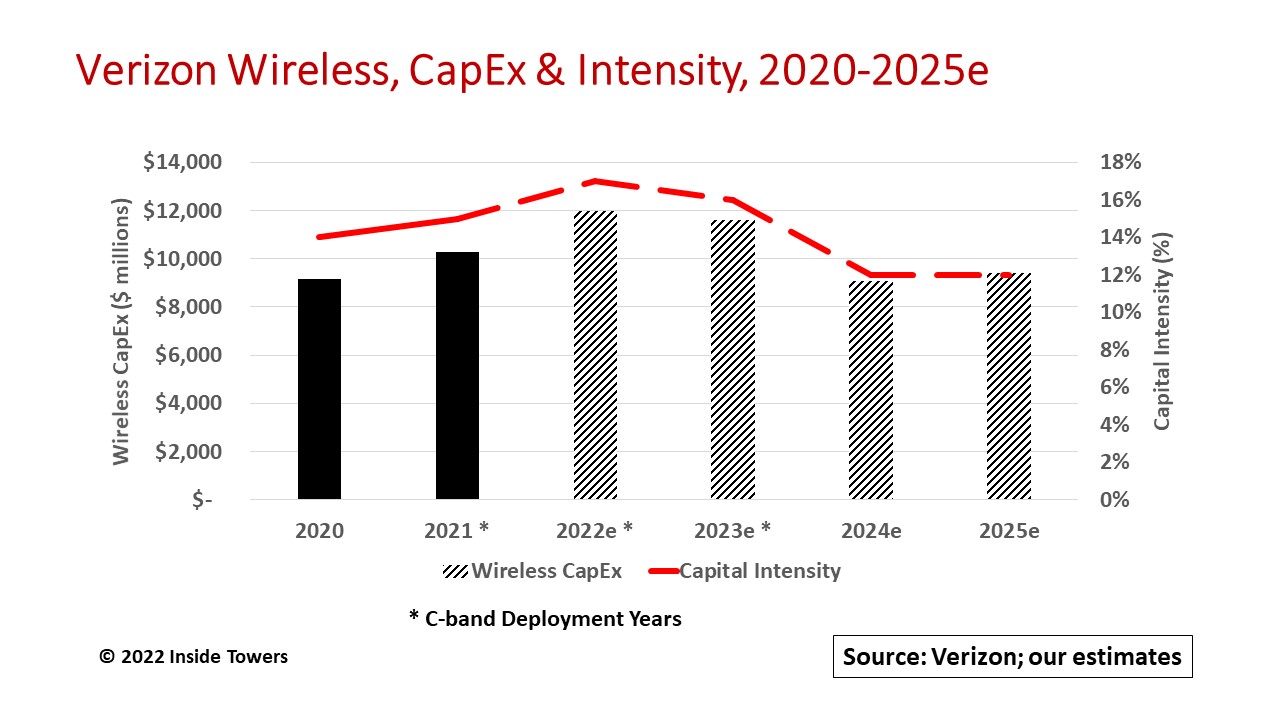

In this instance, capital intensity is defined as wireless capital expenditures divided by wireless service revenues. As a benchmark, capital intensity ratios above 15 percent indicate a growth mode, while figures below 15 percent represent slower network growth, in more of a maintenance mode.

In 2020, Verizon spent about $9.2 billion in capex as it rolled out its 5G Nationwide service using mainly low-band 850 MHz and sharing LTE 700 MHz spectrum, and 5G Ultra-Wideband using millimeter wave on small cells in select parts of the country.

Verizon garnered the lion’s share of C-band mid-band licenses in FCC Auction 107 and gained the firepower it lacked to build out 5G Ultra-Wideband across the country.

A prerequisite to deploying C-band licenses involved clearing that portion of the band used by satellite feeds for TV and radio broadcast services. Phase I deployment was scheduled for December 9, 2021, for A-block licenses held by Verizon along with AT&T’s interim A-block assignments in the top 46 markets.

As Inside Towers reported extensively, the Phase I rollout was delayed while the FCC and the FAA bickered about potential C-band frequency interference with aircraft radar altimeters. The remaining A-, B- and C-block licenses held by all the auction winners will be activated after December 9, 2023.

In the aftermath of Auction 107, Verizon committed to spend $10 billion on top of its BAU capex to build out its C-band licenses between 2021 and 2023. In 2021, it spent roughly $2.1 billion on C-band deployments and will cover around 100 million people by early 2022. Total wireless capex in 2021 was an estimated $10.3 billion at a capital intensity of 15 percent. Wireless service revenues grew to $68.4 billion in 2021.

Verizon will spend the bulk of its C-band capex, about $5.5 billion in 2022, and expects to cover 175 million POPs by year-end 2022. This brings total wireless capex for 2022 to about $12.1 billion at a capital intensity of 17 percent on service revenue growth of about 2.9 percent to $71 billion.

The company will spend the $2.5 billion C-band capex balance in 2023, with the expectation of covering over 250 million people by the end of 2024. Total 2023 wireless capex will be about $11.8 billion at a 16 percent capital intensity with service revenues growing at a 3 percent year-over-year to roughly $74 billion.

At that point, the deployment activity downshifts. The bulk of the C-band cell sites will have been installed on towers. Verizon says it will continue at a lower capital intensity of around 12 percent or less as it densifies its mobility network with small cells and ramps up small cell installations for fixed wireless access applications using both C-band and millimeter wave.

Verizon will invest an estimated $9.2 and $9.6 billion in 2024 and 2025, respectively, on service revenue growth of 4 percent in 2024 and beyond that reflects a cumulative uptake of 5G mobility services, nationwide broadband with FWA and enhanced network-as-a-service functionality such as mobile edge computing and B2B for Enterprise.

All in all, the outlook for the wireless infrastructure business is bullish and remains unchanged.

By John Celentano, Inside Towers Business Editor

Reader Interactions