Since the breakup of AT&T Bell System in 1984, a vertically integrated communications service provider model has been dismantled through deregulation, competition, and technology. Gone are the days when CSPs designed and made everything from local and long-distance networks, network equipment, and even telephones.

Today, the big question is: Why do carriers even need to own their networks?

Consider the U.S. mobile network operators. All of their RF equipment and most of the smartphones they offer already are made by foreign manufacturers (see, U.S. 5G OEMs are MIA!). These MNOs still own spectrum, designing and running their own networks while using contractors to build the network.

MNOs are showing a willingness to “lease versus own” more parts of their networks. The main driver is the substantial capital expenditure needed to build and operate large-scale networks especially as wireless service revenues remain flat.

Initially owning towers, MNOs recognized these structures were not revenue generators. They sold those assets to specialized tower companies, renting back only the tower space they occupied.

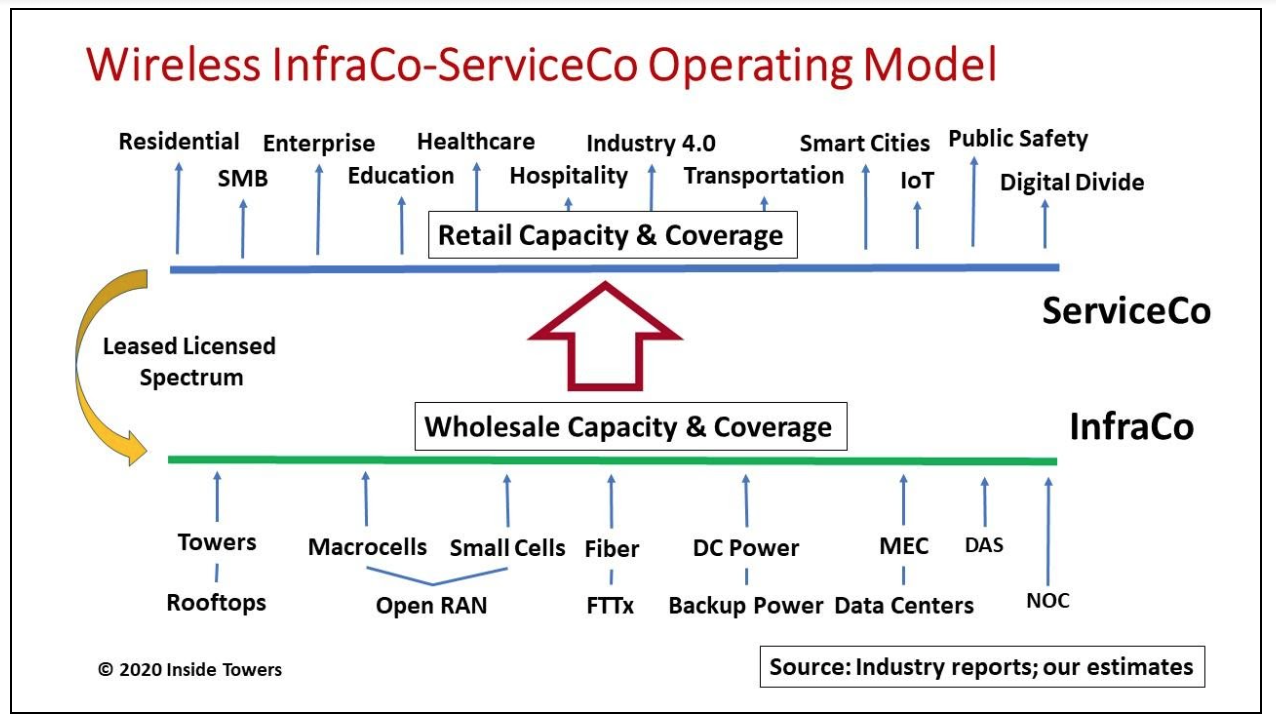

Now, the leading towercos worldwide are morphing into full-service infrastructure companies. (see, The Rise of Wireless Infrastructure Companies). These infracos gradually are assuming responsibility for key parts of their MNO customers’ networks. Such moves offload significant capex and operating expenses for the MNO while creating new revenue streams for the infraco.

Infracos offer a range of infrastructure elements.

Fiber used mainly for backhaul from cell sites to the network core will likely reach into mid-haul and fronthaul applications. Furthermore, fiber connects thousands of outdoor small cells that MNOs use to densify their networks in high population areas.

Both Crown Castle (NYSE: CCI) and Colony Capital (NYSE: CLNY) are examples of infracos that use fiber and small cells strategically to complement their tower businesses. American Tower (NYSE: AMT) augments its tower business by acting as a neutral host for in-building wireless applications using distributed antenna systems.

Some infracos offer backup power at towers with diesel, and wind or solar generators. AMT and SBA Communications (NASDAQ: SBAC) act as energy service companies in parts of their Latin American and African operations where the electrical grid is unreliable. An earlier idea of an infraco-supplied centralized DC power plant with batteries at U.S. towers should be reconsidered.

AMT, CCI and SBAC are offering mobile edge computing at cell sites for high-speed data, low latency applications. Beyond MEC, some infracos such as CLNY operate their own data centers to support their MNO tenants.

Certainly, network infrastructure sharing already is in practice in global markets and fits the infraco model (see, Wireless Network Sharing, Canadian Style). Network sharing mitigates the high capex needed for a dedicated wide area network while extending a MNO’s capacity and coverage beyond its main operating area.

The looming challenge for infracos is owning the RF equipment. Today, the radios represent the biggest capex allocation and are the purview of select suppliers that sell their proprietary designs.

With Open RAN, the notion of Network as a Service becomes feasible. Infracos could install their own software-programmable COTS radios and MIMO antennas at their sites, then lease that equipment so MNOs can program those radios for specific coverage and capacity applications.

With infracos running the network, the MNOs are free to compete where it really matters – servicing the end customers. Rather than waging futile network wars (my network is bigger and faster than your’s), MNOs should compete solely on service. This way, they become true servicecos offering voice, data, and video packages tailored and priced for the end user whether residential, Enterprise or a host of vertical market applications.

Done right, servicecos could spin off, then lease back all or parts of their network to one or more infracos to build, operate, and maintain a state-of the art network. Servicecos would still own spectrum that they can lease to infracos. Network investment shifts from capex to opex.

In this new operating model, servicecos buy coverage and capacity from the infraco at wholesale rates, then sell custom service packages at retail rates.

Equipment vendors would redirect their sales efforts to these infracos. The servicecos would continue working closely with the infracos, as they do today, to plan and deploy infrastructure where and when it’s needed.

Even regional MNOs would benefit from such an approach, relieving them of the high capex needed to keep their networks on par with the national carriers.

By John Celentano, Inside Towers Business Editor

Reader Interactions