Crown Castle (NYSE: CCI) is confident of its growth in the aftermath of an upbeat 1Q21 in which its major carrier customers scaled up their 5G deployments. Consequently, CCI raised its full-year 2021 guidance.

In 1Q21, site leasing revenues grew 5 percent on a year-over-year basis to nearly $1.4 billion compared to $1.3 billion in 1Q20. The Towers segment accounted for $895 million or two-thirds of the total, growing 3 percent YoY. The Fiber segment contributed the $474 million balance, increasing 7 percent YoY with 70 percent from fiber leases and the 30 percent balance from small cells.

Adjusted EBITDA for 1Q21 was $897 million, up 10 percent from $814 million in 1Q20. Adjusted Funds From Operations (AFFO) came in at $738 million, a jump of nearly 25 percent over $593 million in 1Q20.

Two recent agreements are fueling that growth which the company says it can sustain for years ahead.

In November, CCI signed a 15-year agreement with DISH Network (NASDAQ: DISH) to lease DISH space on up to 20,000 towers nationwide in support of DISH’s virtualized 5G network buildout. As part of the agreement, DISH will receive certain fiber transport services and optionally can utilize CCI’s pre-construction services. CCI was the first infrastructure partnership DISH announced.

In April, Verizon (NYSE: VZ) inked a 10-year Master Lease Agreement extension with CCI to accelerate VZ’s deployment of C-band equipment as VZ launches its 5G Ultra-Wideband and 5G Home fixed wireless broadband service on this newly acquired spectrum. The deal also streamlines processes and procedures to allow Verizon engineering teams to expedite C-band deployments. This deal follows VZ’s previous commitment to CCI for 15,000 small cells.

With these new commitments on top of existing MLAs with both AT&T (NYSE: T) and T-Mobile (NASDAQ: TMUS), CCI raised its full-year guidance for site leasing revenues to $5.7 billion, up 7 percent from $5.3 billion. Revised guidance includes 2021 growth projections for both Adjusted EBITDA and AFFO, at 10 percent and 14 percent, respectively.

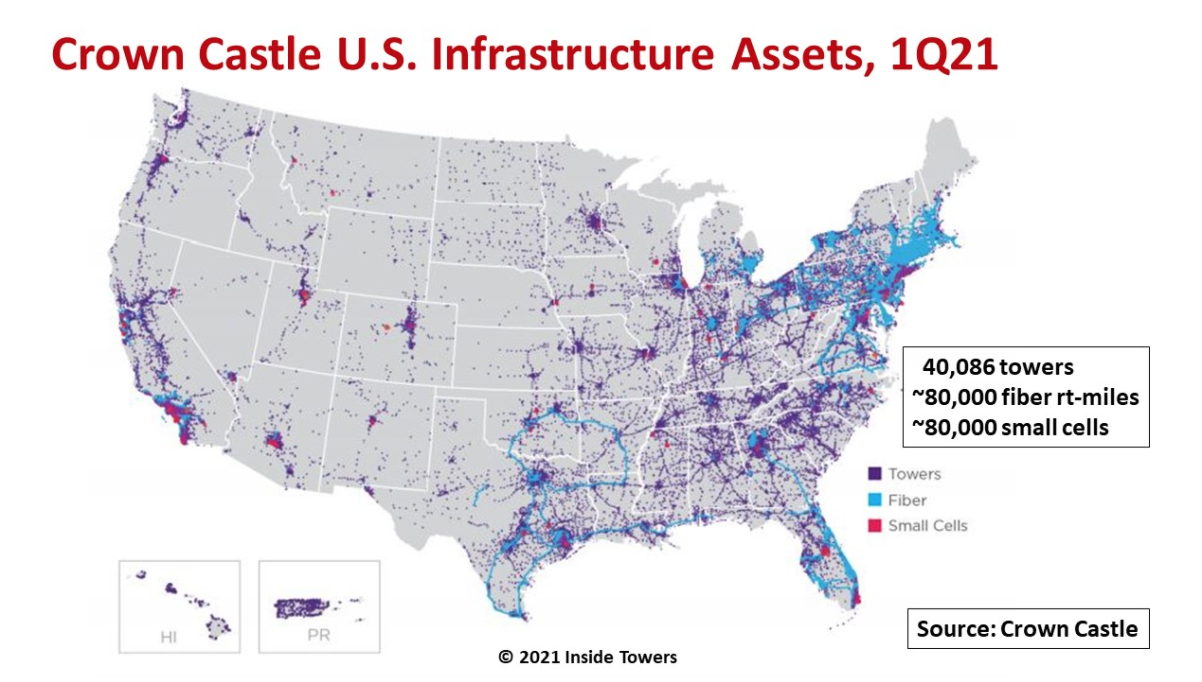

CCI’s wireless infrastructure assets are extensive. As of the end of 1Q21, it owned 40,086 towers in the mainland U.S., Hawaii, and Puerto Rico, with 71 percent of those towers in the top 100 markets. That tally is second only to American Tower (NYSE: AMT) which has over 41,000 towers in the U.S.

CCI points out that the company has amassed, mainly through acquisition, about 80,000 fiber route-miles, comprising high-capacity, dense metro fiber routes in the top metro areas where a high proportion of mobile data traffic originates and terminates. Installed on those fiber routes are close to 80,000 small cells, on-air and under construction, for wireless carriers. CCI expects to have roughly 50,000 on-air small cells by year-end 2021.

The company believes it has the right mix of infrastructure assets in the right locations to support its carrier tenants’ 5G rollouts at scale. It can serve the national carriers in a range of applications involving wide area macrocells on towers and small cell nodes close to customers all on fiber routes that tie into core networks and data centers.

Unlike its public tower company counterparts, AMT and SBA Communications (NASDAQ: SBAC) both of which have extensive international operations, CCI’s strategic focus is only on the U.S. market. “[It] represents the best market for wireless infrastructure ownership since it has the most attractive growth profile and the lowest risk,” states Jay Brown, CCI CEO.

In its 1Q21 reports, CCI gave the first indication of potential revenue churn if TMUS decommissions existing Sprint sites. Though negligible in the quarter, CCI expects the first meaningful Sprint churn in 2023, and less than $20 million through 2028, after which bulk churn may be realized. The company will update the Sprint churn data periodically.

“We are investing in new small cell and fiber assets that our customers need for their wireless networks, which we believe increases our ability to capitalize on the 5G growth trends in the U.S.,” emphasizes Brown. “We are developing new capabilities and offerings that will leverage our existing assets to drive innovation and we believe will further extend our growth opportunity, such as CBRS and edge computing.”

Brown expects CCI to deliver the highest tower revenue growth rate among U.S. public towercos in 2021. “Our customers are affirming the value we bring with our comprehensive portfolio of shared wireless infrastructure assets by entering into long-term agreements to access those assets.”

By John Celentano, Inside Towers Business Editor

Reader Interactions