TELUS (NYSE: TU), based in Vancouver, British Columbia, is advancing wireless and wireline network upgrades and expansions into 2021 and 2022. Positive results in 1Q21 are reflective of growing fixed broadband and mobile data demand with COVID-19 restrictions being lifted and as business and consumer telecom usage recovers across Canada.

TELUS sees a “unique strategic opportunity” to increase its capital expenditures in this environment as the way to drive new services for its customers while improving operating efficiencies and profit margins.

TELUS’ consolidated operating revenues in 1Q21 grew to $4 billion, up nearly 9 percent on a year-over-year basis. TELUS Technology Solutions (TTech), which encompasses its wireless and wireline operations, accounted for 87 percent of the total. Its TELUS International digitally-led customer experiences (DLCX) operation that supports digital transformations among domestic and international Enterprise and government agencies, made up the 13 percent balance.

Consolidated EBITDA for the quarter reached nearly $1.5 billion, up almost 4 percent YoY.

The company ended 1Q21 with over 16 million customers, up almost 6 percent YoY. TELUS’ 5G network covered more than 10.6 million Canadians, about 28 percent of the country’s population.

Wireline connections for Internet, TV, voice, and security lines grew to 5.3 million, up from 5 million lines in 1Q21. At the end of 1Q21, the TELUS’ PureFibre network in British Columbia, Alberta and eastern Quebec passed more than 2.5 million premises, reflecting an increase of approximately 240,000 fiber premises over the last twelve months.

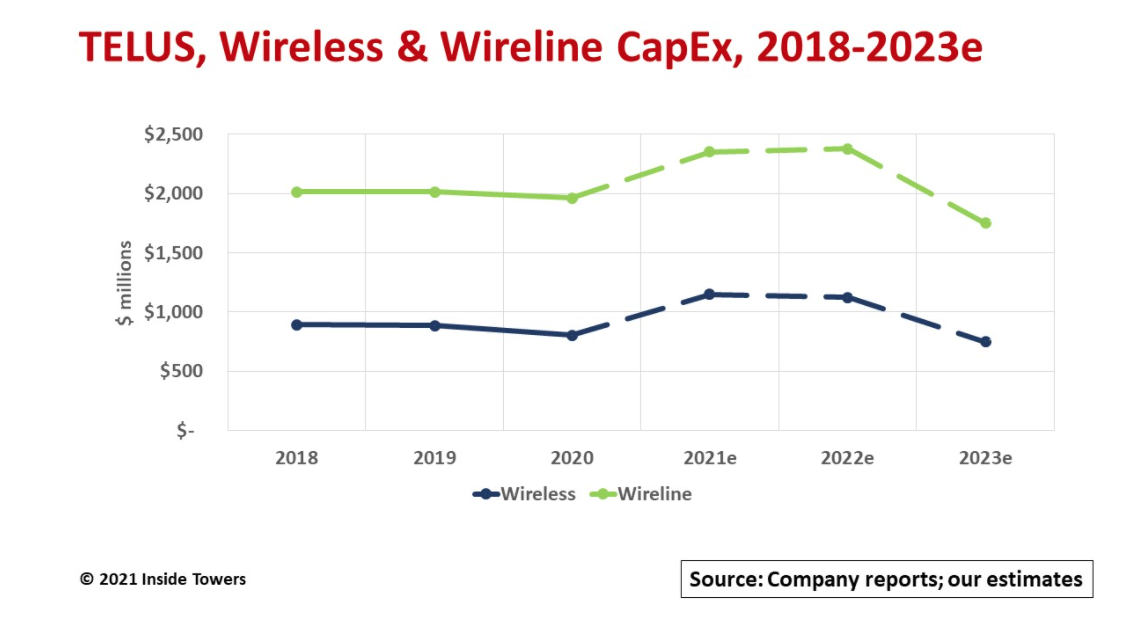

Capital expenditures for the quarter tallied $685 million, increasing 3 percent over $665 million in 1Q20. Wireline capex accounts for roughly 70 percent of TELUS’ total network investments with the balance for wireless.

TTech accounted for 97 percent of total capex in the quarter. TTech’s capital intensity, computed as the ratio of capex to service revenues, was 23 percent, indicating a high level of investment in network expansion and modernization.

At year-end 2020, the company indicated that it expected consolidated capex for 2021 and 2022 of $2.75 billion each year. With the positive 1Q21 results and a successful equity offering in March, TELUS will accelerate the expansion of its PureFibre network. The company expects to pass up to 225,000 additional urban and rural premises with fiber technology in the next two years.

At the same time, TELUS is enhancing the speed, coverage and quality of its 5G network on a nationwide basis both in its proprietary network in western Canada while coordinating with Bell Wireless on shared network facilities in eastern Canada. (See, Wireless Network Sharing, Canadian style)

Darren Entwistle, TELUS President and CEO comments, “These strategic investments represent $750 million of incremental annual capex over and above the $2.75 billion planned in each of 2021 and 2022 and buttressed by proceeds from our [$1.3 billion] equity offering undertaken to fund this important strategic opportunity.”

Entwistle indicates that by investing from a position of strength and leadership, these generational investments will bolster TELUS’ customer experience and competitive position.

During the quarter, TELUS received approval from Industry, Science and Economic Development Canada that regulates spectrum access, for the transfer of 3.5 GHz spectrum licenses the company acquired via commercial transactions.

These licenses augment TELUS’ current spectrum holdings and provide 50 MHz of bandwidth in the urban cores of Edmonton, Alberta, and Winnipeg, Manitoba along with Guelph/Kitchener, London, and Ottawa in Ontario as well as 50 MHz in East Kootenay and 25 MHz in Whistler, in British Columbia.

The company points out that these wireline and wireless investments are transformational and will drive customer growth and operating efficiencies. At the same time, TELUS plans to decommission all the legacy copper infrastructure in its fiber footprint by 2023.

These actions, in turn, are expected to drive positive revenue, EBITDA and cash flow benefits once the expedited build-out is completed.

TELUS expects this accelerated investment program to positively impact its business-to-business service offerings and create new 5G product ecosystems. The company further expects the fiber and 5G combination to accelerate its opportunities for digital health care and digital AgTech solutions, two critical sectors for TELUS.

The company cautioned, however, that bringing its broadband investments into 2021 and 2022 will result in sharp capex declines in subsequent years. From 2023 and beyond, TELUS expects its annual consolidated capex to decline to $2.5 billion or less with capital intensity below 15 percent, reflecting the slowdown in network expansion.

By John Celentano, Inside Towers Business Editor

Reader Interactions