DISH Network (NASDAQ: DISH) is preparing to launch its 5G facilities-based network while still learning how to run a wireless business. In its 2Q21 earnings release, the company shared that it has lost wireless subscribers even as it adds to its base of wireless users.

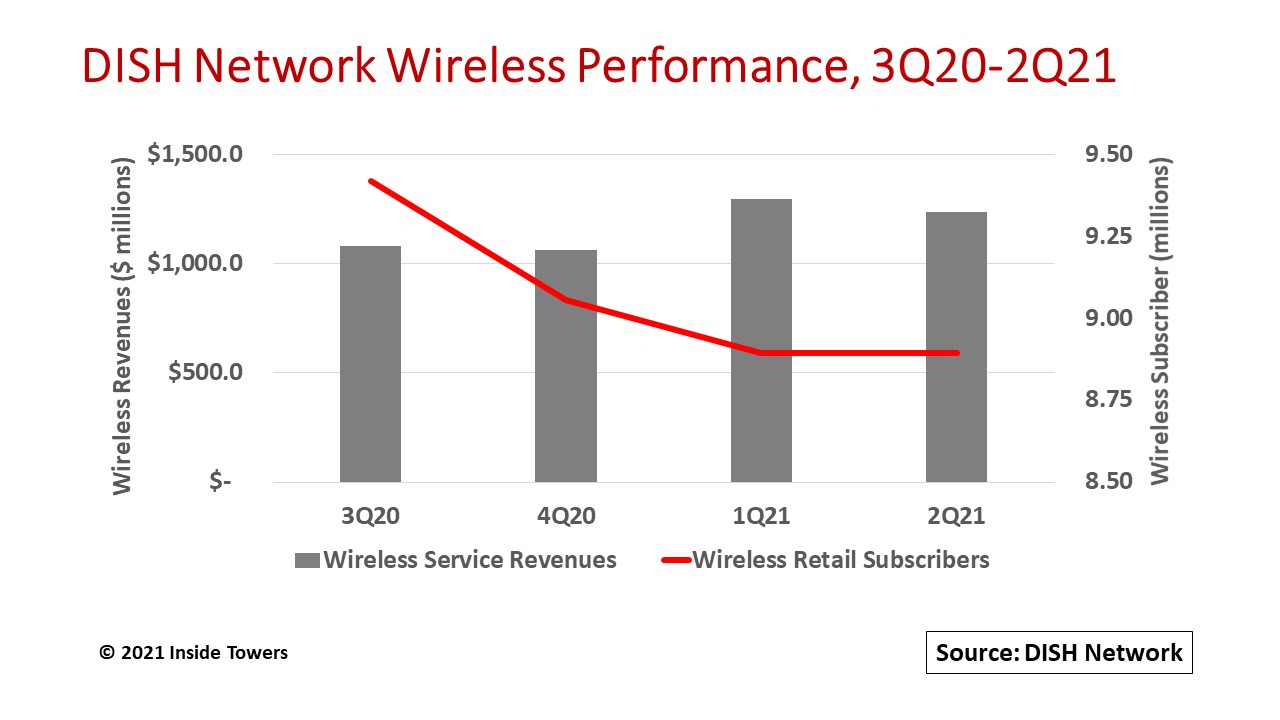

For the quarter, DISH acquired more than 200,000 wireless subscribers through an asset purchase agreement with Republic Wireless. At the same time, the company experienced a net decrease of 201,000 retail wireless subscribers. That followed a net decrease of 161,000 subscribers in 1Q21. The company closed 2Q21 with 8.9 million retail wireless subscribers.

Wireless service revenues were $1.2 billion, down sequentially over four percent from $1.3 billion in 1Q21. Service revenues were up 14 percent over $1.1 billion in 3Q20 when DISH first reported on its wireless retail service business.

That initial revenue influx came with DISH’s acquisition of the Boost Mobile prepaid wireless business from T-Mobile in accordance with the Department of Justice’s Final Judgment on the T-Mobile-Sprint merger.

Once that acquisition closed in July 2020, DISH Network officially entered into the retail wireless market, serving more than 9 million subscribers under the Boost Mobile brand with DISH acting as a MVNO on the T-Mobile Network.

DISH expanded its MVNO operations on August 1, 2020, with an asset purchase agreement with Tucows Inc. in which DISH purchased the assets of Ting Mobile, including over 250,000 Ting Mobile subscribers.

In another deal, completed on May 1, 2021, the company completed an asset purchase agreement with Republic Wireless including approximately 200,000 branded wireless subscribers.

The combination of the three acquisitions gave DISH a solid customer base and revenue stream foundation from which to leverage its wireless ambitions.

However, a dust up occurred in late 2020, when T-Mobile announced plans to retire its 3G CDMA network on January 1, 2022, claiming it will re-farm that spectrum for use in its own 5G buildout. That declaration threw a wrench into DISH’s wireless plans, since roughly half of DISH’s 9 million Boost Mobile customers use T-Mobile’s CDMA network, Inside Towers reported.

DISH expected to use that CDMA network until July 2023, while it built out its own network. Upset, DISH accused T-Mobile of anti-competitive behavior and sought relief elsewhere. In July, DISH signed a long-term strategic Network Services Agreement (NSA) with AT&T, making AT&T the primary network services partner for DISH’s MVNO customers.

Through this agreement, DISH will provide current and future customers of its retail wireless brands, including Boost Mobile, Ting Mobile and Republic Wireless, access coverage and connectivity on AT&T’s wireless network, in addition to the new DISH 5G network.

The agreement accelerates DISH’s expansion of its retail wireless distribution to rural markets where DISH provides satellite TV services. AT&T is also providing transport and roaming services as part of the agreement, to support DISH’s 5G network build which is expected to reach over 70 percent of the U.S. population by 2023.

DISH had been planning to get into the wireless business for some time, investing nearly $22 billion directly and through subsidiaries in spectrum in low-, mid- and high-band frequencies. The company holds a national population weighted average of 110 MHz of highly valued low- and mid-band spectrum including nearly 5,500 3.5 GHz CBRS Priority Access Licenses.

DISH believes it is well-positioned using that spectrum to deliver high-quality 5G services for consumers and Enterprise private networks alike.

DISH is committed to building the nation’s first facilities-based cloud-native, Open RAN 5G broadband network becoming the fourth national wireless carrier in the U.S.

Las Vegas will be DISH’s first commercial 5G market. Site installations are nearing completion and the company will conduct a 90-day market trial starting in September. Code-named Project Genesis, DISH is signing up volunteers to try the system and provide feedback on its connection and throughput performance.

At the same time, the company will use the trial to detect and eliminate system bugs that it acknowledges will inevitably crop up once the system is on the air, especially with such a software-intensive architecture. More importantly, DISH wants to prove it can build and operate the U.S.’s first cloud-native O-RAN 5G network.

By John Celentano, Inside Towers Business Editor

Reader Interactions