Verizon (NYSE: VZ) reported solid 3Q21 results and upgraded its guidance for full-year 2021.

On a consolidated basis, VZ reported total revenues of $32.9 billion, up more than four percent on a year over year basis. Adjusted EBITDA came in at $12.3 billion, increasing over three percent YoY.

“We had a strong third quarter, delivering on our strategy and growing in multiple areas,” comments Verizon Chairman and CEO Hans Vestberg. “Our disciplined strategy execution demonstrated growth in 5G adoption, broadband subscribers and business applications. We are increasing our 2021 guidance, and we continue to expand our 4G LTE and 5G network leadership. We fully expect to have a strong finish to the year as we accelerate deployment of 5G to our customers across the country.”

Wireless service revenues for the quarter topped $17 billion for the first time. Wireless accounts for over 60 percent of VZ’s consolidated service revenues. This figure was up one percent from $16.9 billion in 2Q21 and up four percent over the $16.4 billion reached in 3Q20. The company expects wireless service revenues to grow by four percent for full-year 2021.

Total postpaid and prepaid retail connections grew to an industry-leading 122 million, on the strength of 695,000 net additions in the quarter. Total connections grew less than one percent sequentially but were up close to two percent YoY. Note that prepaid connections account for just over three percent of the total connections. That proportion will change significantly with the addition of close to 20 million prepaid accounts that come with the TracFone Wireless acquisition that VZ hopes to close by the end of the year.

The company continues to build out its broadband connection availability. Its broadband availability now encompasses fiber-to-the-home under its FiOS brand, and fixed wireless access (FWA) in both 4G LTE and 5G millimeter wave. The company indicates that it is on track to reach 30,000 small cell deployments of all types by year-end 2021.

At the end of 3Q21, VZ reported that broadband services were available to a total of 28 million homes. Of the total, 11.6 million homes are covered by FWA including two million households covered with mmW. The company expects to reach more than 15 million homes passed with FWA by year-end. The majority of these are in Tier 1 markets where VZ furnishes its customers with a 4G LTE router that is compatible with C-band frequencies once they become available. FiOS passes the balance of 16.4 million households, up three percent from 15.9 million homes-passed in 3Q20.

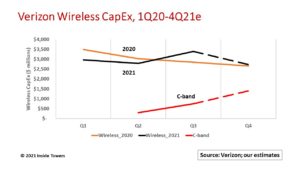

The company reported consolidated capital expenditures of $13.9 billion through nine months ending September 30. This amount represents over three quarters of the company’s full-year guidance of $17.5-18.5 billion that encompasses wireline, wireless and corporate capex.

We estimate that year-to-date wireless capex tallied over $9 billion through the end of 3Q21. We expect VZ will invest a total of $11-12 billion for full-year 2021 in its wireless networks to maintain and upgrade the RAN and Core for its established 4G LTE network, to deploy its new 5G Nationwide and 5G Ultra-wideband mmW service and C-band site builds. Wireless capital intensity, that is, the ratio of capex to service revenues, for the first nine months has averaged 18 percent, indicating VZ’s high level of network expansion. The company will focus on C-band deployments through 4Q21 and into 1Q22.

VZ previously announced an incremental $10 billion of capex from 2021 to 2023, of which $2-3 billion is expected in 2021. The company indicates that it has spent over $1 billion through the end of 3Q21. It emphasized that it has radio equipment and supporting materials on order and in the supply chain worth over $1 billion through the end of 2021, in line with its $2-3 billion guidance range. Moreover, VZ does not expect any supply chain disruptions, pointing out that it has worked closely with its major vendors for the past several years to secure delivery commitments.

The first wave of C-band deployments will take place in the top 46 partial economic areas (PEAs) where VZ holds 60-100 MHz of 3.7 GHz spectrum. Incumbent satellite operators are expected to clear this first tranche of C-band spectrum by December 2021. VZ plans to have 100 million POPs covered by 1Q22. C-band spectrum in the remaining 360 PEAs will be cleared for all license holders by December 2023.

By John Celentano, Inside Towers Business Editor

Reader Interactions