T-Mobile US (NASDAQ: TMUS) seems to be firing on all cylinders. The company reported solid gains, even exceeding some expectations, in its key operating metrics for both 4Q21 and full-year 2021. And its outlook for 2022 suggests that momentum will carry forward.

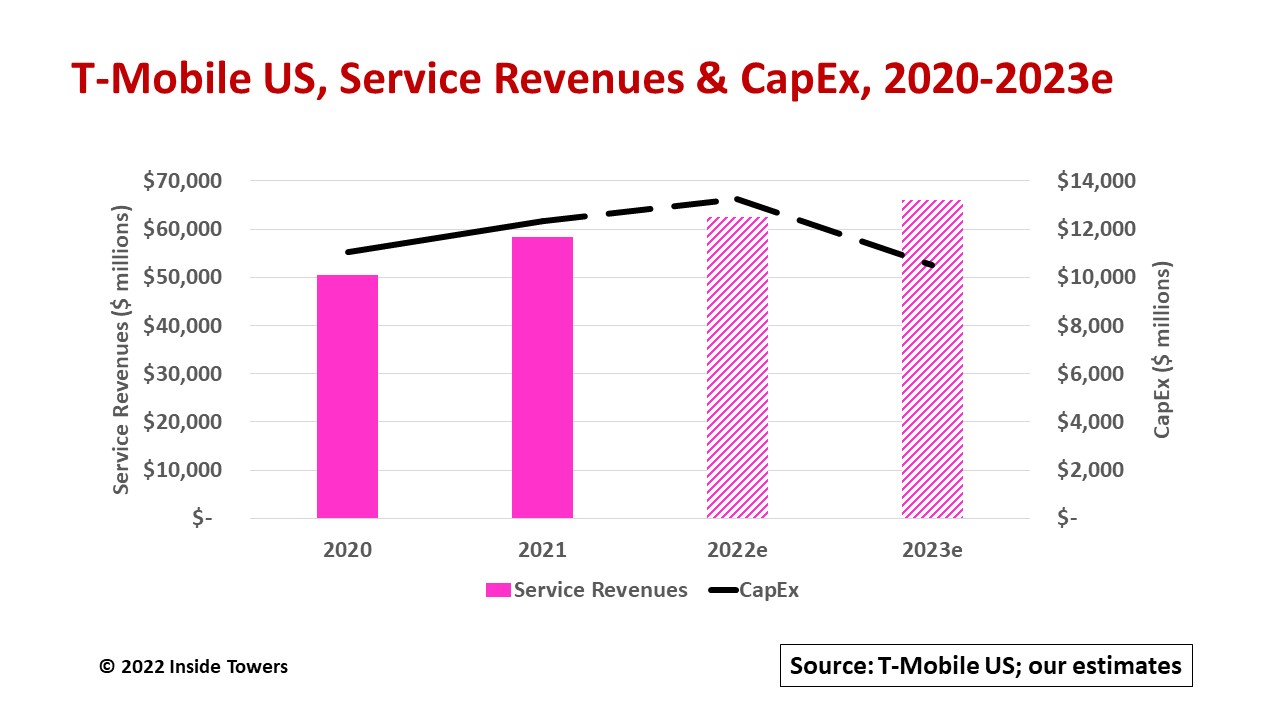

Wireless service revenues for the year reached $58.4 billion, a new high level that is up 16 percent on a year-over-year-basis from $50.4 billion in 2020. Core adjusted EBITDA was $23.6 billion. Free cash flow came in at $13.9 billion, growing by more than 60 percent YoY.

Service revenue growth for the next several years is anticipated in the 5-10 percent a year range as the company adds new customers both from porting over large numbers from the Sprint customer base and attracting new customers.

The company had 5.5 million postpaid net additions for the year bringing the total retail postpaid and prepaid customer base to nearly 109 million, second only to Verizon. It expects to garner another 5.0-5.5 million postpaid net adds in 2022.

Fixed wireless access, 5G Home Internet in TMUS parlance, is a growth area especially where the company has excess 5G network capacity in suburban and rural markets. Though starting out as a field trial in early 2021, TMUS added 542,000 fixed wireless customers throughout the year, bringing the total to 646,000 by year-end.

Capital expenditures for 2021 were $12.3 billion, up 12 percent YoY, as the company pushed its 5G network expansion across the country. Extended Range 5G that operates at 600 MHz now covers 310 million people or 94 percent of the population. Its Ultra Capacity 5G that utilizes 2.5 GHz reached 210 million POPs, exceeding its year-end 2021 goal of 200 million POPs.

Capex guidance is $13.0-13.5 billion for 2022, that involves building out Ultra Capacity 5G to cover 300 million POPs. On top of that, TMUS is pulling into 2022 Sprint network integrations activities that were scheduled for 2023.

Equipment for TMUS’ C-band and newly acquired 3.45 GHz spectrum will be deployed at a measured pace throughout 2022 and 2023. The rollout mainly will be completed by the December 5, 2023 deadline for C-band activation in those select markets where TMUS holds licenses for these mid-band spectra. Capex for C-band and 3.45 GHz buildouts is baked into the 2022 guidance.

At the end of 2021, TMUS’ combined network consisted of 102,000 4G LTE and 5G macro cell sites. Once the integration of high-valued sites and decommissioning of redundant and legacy sites is complete, the network will be operating around 85,000 macro cell sites, predominantly on American Tower and Crown Castle towers under new master lease agreements with both tower companies.

The merged network also has 41,000 small cell and distributed antenna system (DAS) installations. These sites will be rationalized as to which ones stay and which ones go. TMUS recently renewed its site leasing agreement with Crown Castle to include an additional 35,000 small cells over the 2023-2028 period (See, Crown Castle’s Big Small Cell Play).

The company points out that 2022 will be the high water mark for capex. It expects its 2023 network investments will be down substantially from its current guidance for 2022.

We estimate 2023 capex will be in the $10-11 billion range, down by 20 percent from 2022, given that most of the 5G nationwide buildout along with the Sprint network integration activity will be complete. Moreover, the TMUS and Sprint 3G CDMA networks will be discontinued in 2022, further reducing any capex absorption in subsequent years.

By John Celentano, Inside Towers Business Editor

Reader Interactions