IHS Towers, the operating company of London-based IHS Holding Limited (NYSE: IHS), is in high gear. The company reported 1Q23 results that increased by double-digit rates compared to 1Q22. Revenues were $603 million, up 35 percent year-over-year from $446 million in 1Q22. Adjusted EBITDA grew 37 percent YoY to $335 million, cash from operations was up 51 percent to $252 million and recurring levered free cash flow (RLFCF) jumped 72 percent to $150 million. Capex for the quarter was $153 million compared to $117 million in 1Q22, a 30 percent increase.

IHS Towers ended the quarter with 39,104 total towers across its operations in 11 countries on three continents. Nigeria is its largest market with 16,372 towers or 43 percent of the total. Sub Saharan African markets, including South Africa, Côte d’Ivoire, Cameroon, Zambia and Rwanda, accounted for 13,889 towers. Africa makes up 78 percent of IHS Towers’ portfolio. Latin America has 7,305 towers, with 7,023 in Brazil with the rest in Colombia and Peru. The Middle East and North Africa market contributes another 1,538 towers in Kuwait with a pending partnership in Egypt.

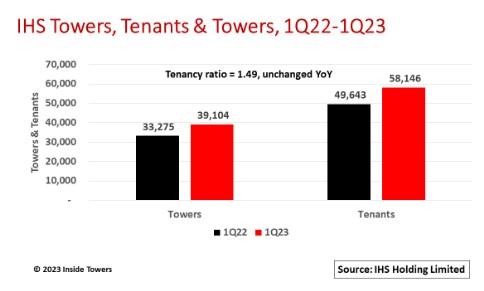

The portfolio is up 5,849 towers from 33,275 in 1Q22, through a combination of new builds and acquisitions in Brazil and South Africa in 2022, Inside Towers reported. However, the 1Q23 tally is down from 39,652 at the end of 2022, mainly because of churn on existing sites which includes 727 towers in Nigeria on which the company was not recognizing revenue from its smallest customer. Total tenants were 58,146, up 17 percent YoY from 49,643 in 1Q22. The number of tenants per tower remained unchanged at 1.49

Lease amendments were the big revenue driver for the company. IHS reported that lease amendments grew to 33,038 in the quarter, up 16 percent from 28,517 at the end of 1Q22. That growth reflects the 4G upgrade and 5G buildout activity among IHS’s MNO customers across all of its operating regions.

Lease escalators contributed to revenue growth as well. As is typical with tower leases in North America, escalators are fixed, say, 3 percent annually. However, in IHS Towers’ markets, lease escalators are tied to local inflation rates. In the current macroeconomic environment, high inflation and favorable currency exchange rates are adding to IHS’ revenues. In addition, the company is also able to pass through to its customers energy costs related to diesel fuel for backup generators.

The company maintained its guidance for the full year 2023, expecting midpoint revenue of $2.2 billion with 23 percent organic revenue YoY growth, Adjusted EBITDA of $1.21 billion and RLFCF of $460 million.

IHS is budgeting capex of $630 million, with $90-100 million for Project Green, part of the company’s Carbon Reduction Roadmap. The company has a build-to-suit program of around 1,200 towers, with roughly 150 sites planned in Nigeria and approximately 750 towers in Brazil, with the balance spread across other countries.

By John Celentano, Inside Towers Business Editor

Reader Interactions