Is AT&T (NYSE: T) the bellwether mobile network operator for a turnaround in the wireless infrastructure business? From the company’s 3Q23 results, there are positive signs. AT&T reported consolidated revenues of $30.9 billion in the quarter, up one percent on a year-over-year basis. Adjusted EBITDA grew five percent YoY to $11.2 billion. After cash payouts, AT&T ended the quarter with free cash flow of $5.2 billion, a jump of 35 percent from the year-ago period. Mobility is AT&T’s largest business unit accounting for 68 percent of total revenues. Mobility service revenues were $20.7 billion, up nearly four percent YoY, driven by subscriber growth and higher postpaid phone ARPU.

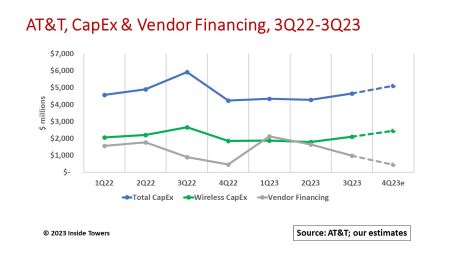

The aggregate capex in the quarter was $5.6 billion, down 18 percent from $6.8 billion in 3Q22. That number is a mix of capital investment of $4.6 billion and $980 million of vendor financing. The good news is that AT&T says its full-year 2023 capex will be on par with its 2022 expenditures which totaled $24.3 billion, including $4.3 billion in vendor financing. The company said it was reducing its reliance on vendor financing due to high interest rates. We estimate that AT&T will spend around $5.1 billion in 4Q23 to bring it up to roughly $23.5 billion for the year.

AT&T’s two strategic growth initiatives are in 5G and fiber. Wireless capex accounts for around 45 percent of the total capex, according to Inside Towers Intelligence. For the full year 2023, we estimate that AT&T will invest around $8.2 billion in its wireless network. That figure is down seven percent from $8.8 billion in 2022.

The company says it is on track to reach over 200 million people with mid-band 5G spectrum by the end of the year. In the quarter, postpaid phone net adds were 468,000 along with 26,000 prepaid phone net additions. AT&T’s total retail postpaid and prepaid subscribers reached 105.8 million, up three percent from 102.8 million in 3Q22.

AT&T says it is also on track to pass more than 30 million fiber locations by the end of 2025. The company had 296,000 broadband net adds in the quarter to reach 8 million fiber homes, a 16 percent YoY increase.

On a separate note, CEO John Stankey, when asked about the FCC’s Net Neutrality NPRM, made his views quite clear: “There’s no indication that in the ISP segment there’s any discrimination going on. We have an industry in aggregate, that supports no blocking, no paid prioritization, no throttling, contrary to what we see going on with some platform apps. The ISP industry is, I think, the last of customers’ concerns. No customers are complaining about what’s going on in that front. So why would we use taxpayer money and resources and political capital to chase a problem that doesn’t exist?”

Stankey went on to say, “Chasing an unnecessary partisan issue when we have potential bipartisan issues like a competitive spectrum policy for the United States, reauthoriz[ing] spectrum authority so that we can keep pace with places like China. [For] a growing economic environment and great innovation, how do we deal with the fact that we have a broken universal service process that is so important for those that can’t afford their services to make sure that it’s sustainable?. These are bipartisan issues that need to be dealt with and solved, and I think that’s where regulators should be spending their time.”

Stankey qualified his remarks saying that AT&T will work with the FCC on the issue and provide supporting information on the topic.

By John Celentano, Inside Towers Business Editor

Reader Interactions