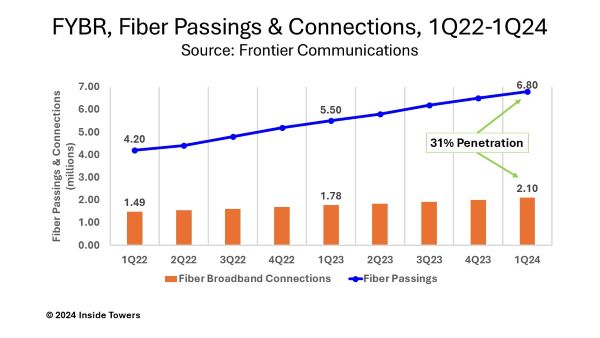

Frontier Communications (NASDAQ: FYBR) is sustaining its fiber buildout pace. Under its fiber initiative dubbed Building Gigabit America, the company added 322,000 fiber passings in 1Q24 and says it is on track to achieve its goal of 1.3 million passings for 2024. At the end of the quarter, the company reported 6.8 million fiber passings out of its total base of 15.4 million copper and fiber passings across its 25-state operating area. Of the total passings, Frontier had 2.1 million fiber broadband connections, representing a 31 percent penetration.

Frontier considers itself a “pure play” fiber company offering only fiber transport and access services while foregoing ancillary businesses like wireless or data centers. The company’s capital expenditures are for building and maintaining its fiber network infrastructure. Capex for the quarter was $1 billion, down 11 percent on a year-over-year basis. The company says that its cash capex is front-end loaded this year, as it had anticipated, largely due to the timing of working capital related to the build. In the company’s 1Q24 earnings call, Scott Beasley, Frontier EVP and CFO said, “We expect to see capital investment decline for the remaining three quarters of the year, and we remain on track for our 2024 capital investment to be lower than 2023.”

Frontier is striving to keep its capex per passing in the $1,000-1,100 range. With increased penetration and growing ARPU, the company believes it can still achieve significant returns on that investment even if deployment costs were higher.

The company expects to deploy the same number of fiber passings in 2024 as it did in 2023, at the lower cost per passing level. Frontier says that it is achieving low cost per passing because it is still working through a significant amount of site pre-work (engineering, permitting) and fiber cable and equipment inventory that was built-up in 2022 and 2023, and is not incurring additional capital costs.

The company expects to maintain a run-rate of 300,000-350,000 passings per quarter to meet its goal of at least 10 million fiber passings by the end of 2025.

Frontier added 88,000 net fiber broadband customers in the quarter, to reach the 2.1 million consumer and businesses fiber broadband connections. That figure is up 18 percent YoY.

At the same time, consumer fiber broadband ARPU grew six percent YoY to $65.18. ARPU growth was a result of: introducing faster speed tiers, price adjustments, and selling more value-added services. Frontier says that in 1Q24, over 60 percent of its new customers took speeds of 1 Gig or faster, and nearly 50 percent of customers purchased at least one value-added service.

Revenue in 1Q24 was nearly $1.5 billion, up two percent YoY. Adjusted EBITDA of $547 million was up 5 percent YoY, driven by 12 percent growth from fiber products even as Adjusted EBITDA from copper products declined two percent YoY. Frontier says that fiber broadband customers now represent 70 percent of its total broadband customer base and fiber now accounts for more than 50 percent of revenue and 60 percent of Adjusted EBITDA.

The company provided full-year 2024 guidance for Adjusted EBITDA of $2.20-2.25 billion versus $2.1 billion in 2023, and accelerating to mid-single digit growth YoY; 1.3 million fiber locations passed; and cash capex of $3.0-3.2 billion, compared to $3.2 billion in 2023.

By John Celentano, Inside Towers Business Editor

Reader Interactions