This is an excerpt from Inside Towers Intelligence™, a quarterly market research report for the digital infrastructure industry. Subscribe here.

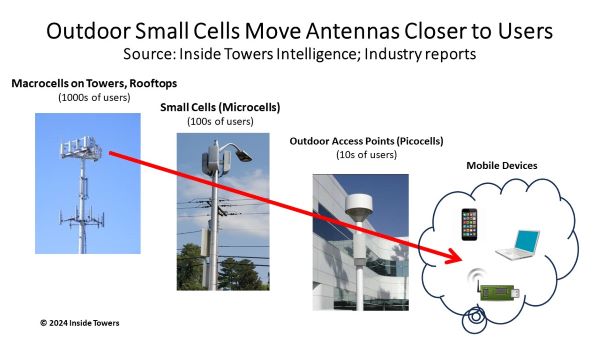

Small cells are just like macrocells, only smaller! They consist of radios and antennas on a pole powered by the local utility and have a fiber backhaul connection. Increasingly, small cells are used to add capacity to the mobile network in areas that macrocells alone cannot reach. Two key factors are driving mobile network capacity demand. First, the data consumption per mobile device is escalating, spurred by social media, interactive apps, video streaming, and increasingly, artificial intelligence applications. Secondly, the number of connected mobile devices is growing every year.

In any given market, the throughput capacity that the mobile network must support is calculated by multiplying the number of mobile devices in that market by the average data consumption per device. It turns out that the network throughput is also scaling at double-digit annual rates.

The Ericsson Mobility Report projects that average monthly mobile consumption per smartphone will jump from 20 Gb today to 50 Gb by 2027. In that same timeframe, the number of mobile devices is growing at a 31 percent CAGR.

More than raw data throughput, though, many applications are becoming more sensitive to latency, or delay. To reduce that latency, MNOs are moving antennas closer to smartphone users. This is how network densification is accomplished.

Our previous analysis concluded that once the first phase 5G wide area buildout with low-band spectrum on macrocells plateaued, then the MNOs would ramp up small cell deployments using both mid-band spectrum and millimeter wave frequencies to densify their networks as the anticipated mobile data demand escalates.

It turns out that both Verizon (NYSE: VZ) and AT&T (NYSE: T), having invested heavily in C-band and 3.45 GHz mid-band spectrum, each with 100 MHz wide channels, and T-Mobile (NASDAQ: TMUS) using 2.5 GHz, found that much of the increased capacity demand could be handled from macrocells. As a consequence, the projected high-volume small cell rollout slowed or certainly has been deferred.

Outdoor small cell installations in network applications are expected to stay muted through 2024 and into mid-2025, when network densification starts to pick up.

We estimate that annual U.S. outdoor small cell installations will grow from an aggregate of about 8,000 in 2023, to roughly 34,000 in 2027, representing a 44 percent CAGR. Total U.S. installed base is expected to grow from about 178,000 small cells today to close to 300,000 by the end of 2027.

These data represent the volume of outdoor small cells that the U.S. MNOs will install each year through their contractors or on their own, along with neutral host operators that deploy small cells in large venues.

Note that these figures do not include a smaller number of small cells that may be deployed in private networks or inside buildings for commercial landlords and property owners. We also do not count distributed antenna systems as small cells

‘Small Cells and Network Densification: What’s the Story?’ is a feature article in the Intelligence by Inside Towers 2024 Volume 2 issue, available now.

For more information and to subscribe, visit: https://insidetowers.com/intelligence/.

By John Celentano, Inside Towers Business Editor

Reader Interactions