AT&T (NYSE: T) reported second quarter 2024 consolidated revenue of $29.8 billion down less than one percent year-over-year from $29.9 billion in 2Q23. At the same time, the company delivered Adjusted EBITDA of $11.3 billion, up nearly 3 percent YoY. Wireless accounts for 69 percent of the total revenue, with Business and Consumer Wireline contributing 27 percent and Latin America and Corporate making up the balance. Overall capital expenditure in the quarter was $4.9 billion, down 17 percent YoY. While AT&T continued investing money from cash flow in its wireless and wireline networks, it has drastically cut its vendor financing by $1.1 billion from what it spent in 2Q23.

Wireless service revenue for the quarter increased by over three percent to $16.3 billion, while equipment revenue declined eight percent to $4.2 billion. AT&T Mobility continues to grow its base. The company had 419,000 postpaid phone net adds in Q2. Total wireless subscriber net adds declined due to a significant drop in prepaid phone additions even as postpaid net adds grew 28 percent YoY. The company ended the quarter with a total of 115.5 million wireless subscribers, up three percent YoY.

Business Wireline segment revenue dropped nearly 10 percent YoY to almost $4.8 billion. Consumer wireline sales were up three percent to $3.4 billion.

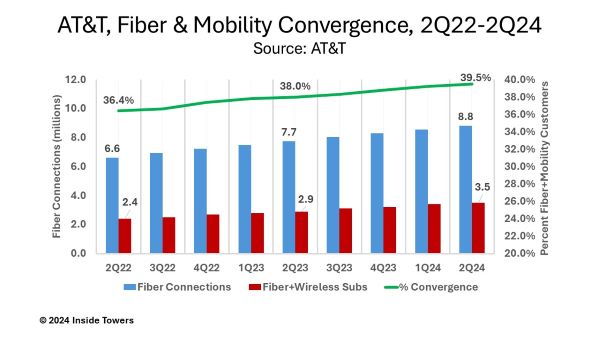

The Consumer Wireline segment showed positive results from its fiber build out. The company reported a total of 27.8 million consumer and business fiber passings at the end of the quarter. That figure is up nine percent YoY. AT&T said it still expects to reach or surpass 30 million fiber passings by the end of 2025, and could go beyond that either organically or through joint ventures such as GigaPower, Inside Towers reported. Total fiber broadband connections grew 14 percent YoY to 8.8 million on the strength of 239,000 net adds in the quarter.

The company pointed out that it is working to convert its fiber broadband customers to become AT&T Mobility customers if they are not already. At the end of 2Q24, the company claimed that of total fiber connections, it had 3.8 million customers that were also AT&T Mobility subscribers.

The company sees this as a strategic advantage. “Today, nearly four of every 10 AT&T Fiber households also choose AT&T wireless service,” comments John Stankey, AT&T CEO. “As the nation’s largest consumer fiber builder, we see this as an opportunity to continue to grow subscribers and revenues, while deepening customer relationships.”

AT&T’s Internet Air fixed wireless access product, which is counted as a part of the Consumer Wireline segment, had 139,000 net adds in the quarter to reach a total of 342,000 subscribers. The company is still treating FWA as a strategic option for selected applications versus pitching the service to the broader consumer and business markets.

For the full year 2024, AT&T reiterated its earlier guidance to include: wireless service revenue to increase in the 3 percent range, while broadband sales are expected to rise more than 7 percent; Adjusted EBITDA is expected to grow by three percent: capital investment is targeted for $21 billion to $22 billion; and free cash flow is targeted for $17 billion to $18 billion.

By John Celentano, Inside Towers Business Editor

Reader Interactions