For more information about the “FWA vs. FTTH Debate,”

subscribe to Intelligence by Inside Towers

The demand for broadband connectivity continues at a high level. Internet service providers can choose from several technology tools in the proverbial toolkit to deliver that connectivity. Each technology has its place depending on the density of the market served, capable download and upload speeds, time-to-market, and costs, both for initial deployment and life cycle. The total cost of ownership can vary significantly depending on the technology.

Fiber-to-the-home seems to work best in densely populated environments where it can provide high-capacity connections for large numbers of passings per mile. Facilities-based fixed wireless access (as opposed to carrier-based spectrum sharing FWA) has a better fit in thinly populated rural areas for reaching fewer customers over long distances. In between is a gray area where technological choice can go either way. Consider a rural scenario of 750 households spread across 25 square miles, roughly 30 households per square mile, over hilly terrain. This example is representative of many underserved or unserved areas that the BEAD program is intended to address.

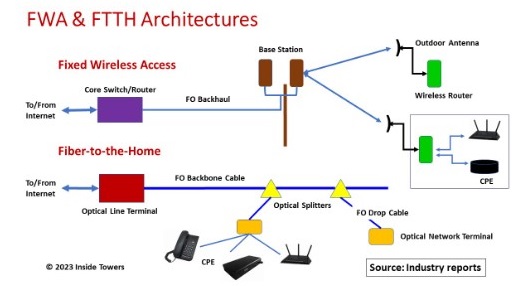

FTTH has two cost components: cost per home-passed, and cost per home-connected. Cost per home-passed includes the optical line terminal at some central location, the backbone fiber route, either aerial or buried, and optical splitters. Cost per home-connected includes an aerial fiber drop and an optical network terminal located at the customer premises. Download and upload signals travel between the OLT and multiple ONTs over the fiber route. ONTs provide broadband connections to devices at the premises.

Facilities-based FWA consists of a multi-sector base station on an existing or new tower transmitting to outdoor antennas at multiple customer locations in a line of sight, and sometimes, in a non-line of sight basis. Outdoor antennas connect to a wireless router/modem inside the premises.

Data provided to Inside Towers by the Fiber Broadband Association show that the cost per home-passed is estimated at $7,000 for buried cable in Tier 2 and Tier 3 markets and can be higher in rural areas. For this scenario, we assume $10,000 per home passed. FBA suggests cost per home-connected in rural settings is around $2,000. So upfront capital expenditures to connect all 750 homes with FTTH is: ($10,000+$2,000) X 750 = $9,000,000.

By comparison, data from Tarana Wireless with its Gigabit 1 (G1) next generation fixed wireless access platform that can deliver mutl-hundred megabit download speeds show the G1 platform can connect to 750 homes using base stations, each with four sectors, on three towers. Total capex includes 12 sectors and construction of two new towers at $100,000 each. Assume fiber backhaul and core switching/routing is leased. Cost per home-passed effectively works out to $475. Cost per home-connected, including outdoor antenna, is $600. Thus, FWA initial capex is: ($1,075) X 750 = $806,250. In this example, the initial cost to deploy FWA is under 10 percent that of FTTH.

Over a 30-year operational life, assume the FTTH fiber drop and ONT is replaced every 15 years, and the FWA system is completely upgraded every 10 years including tower maintenance.

The life cycle cost of FTTH is: ($2,000 X 750 X 2) = $3,000,000 compared to the FWA system which is: ($1,075 X 750 X 3) = $2,418,750. That’s 81 percent of the FTTH lifetime cost.

With the initial deployment and a 30-year operational life investment, TCO for FTTH are $12,000,000 compared to $3,255,000 for FWA, or 27 percent of the FTTH capex. For an ISP, this represents material savings that can increase its return on investment or be reinvested into other infrastructure projects.

By John Celentano, Inside Towers Business Editor

Reader Interactions